Labubu maker's stock falls after major restock, stern warning from China

Here's what could be next for Labubu lovers.

The monster-faced collectible known as Labubu has gone from a niche collectible to a worldwide craze, but the heat is finally cooling.

Labubu is a pointy-eared elf-monster designed by Hong Kong illustrator Kasing Lung. It rose to fame as part of Pop Mart’s “The Monsters” series, with collectors drawn to its blend of mischievous charm and exclusivity.

Also driving demand are social media influencers and celebrity endorsements. Celebrities including Rihanna and BlackPink’s Lisa have been spotted carrying Labubu.

In China, a standard Labubu plush figurine retails for about 99 yuan (under $14), though it often remains out of stock. In the U.S., the same item is priced at $27.99. The pricing difference is partly driven by elevated import tariffs.

Rare editions can fetch hundreds of dollars on secondhand markets. On eBay, the hidden version of a Labubu plush is priced between $500 and $1,000.

Labubu maker Pop Mart is a Chinese toy company listed on the Hong Kong Stock Exchange, with a current market capitalization of HK$321.77 billion (about US$41 billion).

Behind Pop Mart’s cult following is its blind box business model, where buyers purchase sealed packages without knowing which figure they’ll receive. Each series typically includes one or two “hidden” or limited-edition designs far rarer than the standard figures, driving repeated purchases and fueling a booming resale market.

But now, the frenzy may have reached a tipping point.

China sends warnings on blind box sales

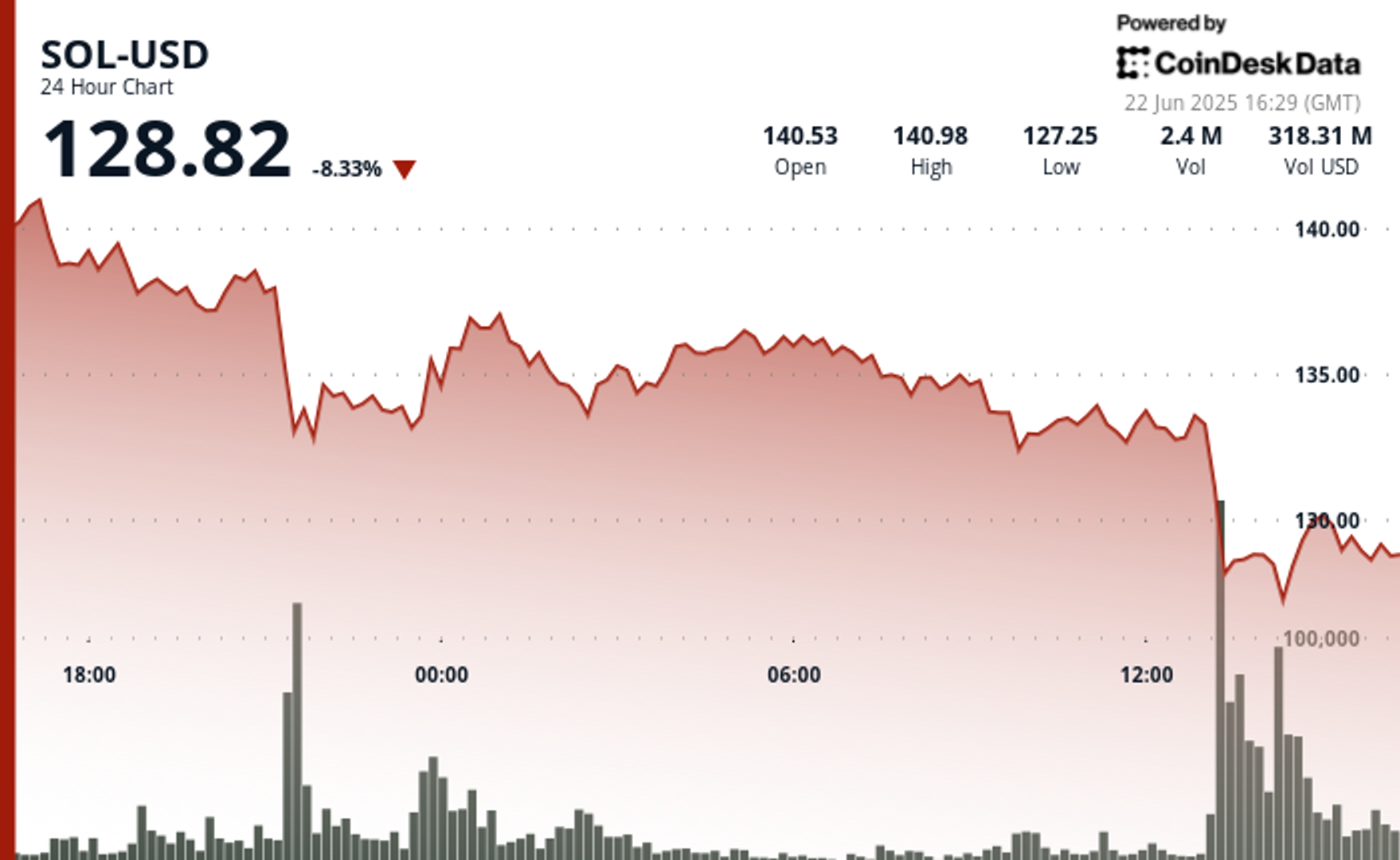

Shares of Pop Mart International (HK: 9992) have tumbled more than 12% over the past five trading days, following a warning from Chinese state media over “blind box” sales.

On June 20, China’s state-run newspaper People’s Daily criticized the “blind box” phenomenon, advocating for stricter regulation and age limits. The commentary did not mention Pop Mart by name and focused more on children and teens spending heavily on those blind boxes and cards.

Related: How Labubu became luxury's answer to Beanie Babies

Chinese customs shared on social media that they recently blocked multiple shipments of counterfeit Labubu products.

Pop Mart has already faced increasing compliance pressure. Since 2022, regulators have required vendors to disclose the odds of receiving “secret” figures and to offer return options. Children under eight are banned from buying blind boxes, and online resales face more scrutiny from platforms.

Meanwhile, Labubu prices on secondhand platforms have started to decline as hype cools and supply rises.

On June 18, Pop Mart in China launched the largest online pre-sale to date for Labubu 3.0, the third generation of Labubu plush blind box launched globally in April.

After weeks of "sold out" status across major platforms, the release drew massive demand, briefly overwhelming the company’s domestic servers. According to local Chinese media, an estimated 4 to 5 million sets were sold during the pre-sale.

The large-scale restock triggered an immediate collapse in resale prices in China. On RedNote, or Xiaohongshu, China's major social media and e-commerce platform, some resellers are now offering a presale set of Labubu 3.0 (which contains six blind boxes) for just $100.

No major restock has occurred overseas, where demand remains high and inventory is limited.

Analysts sound alarm on Pop Mart’s stock

Despite the recent pullback, Pop Mart shares are still up more than 160% in 2025, reflecting investors’ optimism about the company’s international growth and product innovation.

The company has launched flagship stores in cities such as New York and London and partnered with local artists to diversify its IP portfolio.

Related: Analyst unveils surprising Nvidia stock price target after nearing record high

Analyst tone on Pop Mart has turned more cautious after its sharp rally this year. Jefferies analyst Anne Ling believes that the Chinese government "remains supportive of China’s IP development, but wants to protect minors and iron out irregularities."

“In the short term, there will be pressure on share prices for the entire pop toy segment, especially those that have outperformed year-to-date,” Ling wrote, according to Bloomberg.

More Retail Stocks:

- Beloved American toy company sends harsh message to workers

- Lululemon’s new line faces heat over ‘misleading’ label

- Analysts reboot Nike stock price targets ahead of earnings

Morgan Stanley on June 18 removed Pop Mart from its China/Hong Kong focus list, CNBC reported.

The firm had cautioned earlier that the market had fully priced in recent growth.

“In view of its lofty valuation, we do not expect this level of outperformance to continue in the next few quarters,” the firm said in a June 10 research report.