Key driver of U.S. stocks powers through tariff uncertainty

Stocks are looking to extend their post-tariff recovery on the back of at least one accepted form of U.S. exceptionalism.

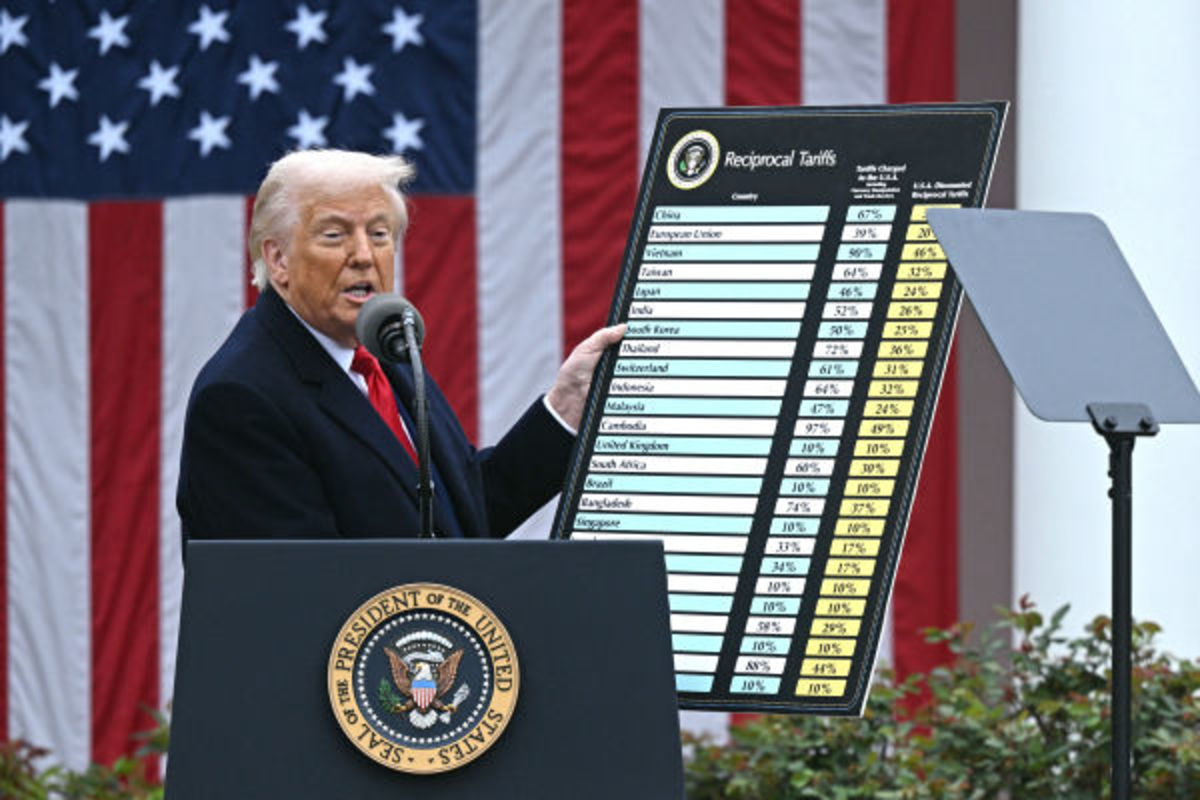

World leaders might not be able to predict President Donald Trump's next move on tariffs, and many have hinted that dealing with the U.S. on policies related to trade, security and immigration has become increasingly unreliable.

Global investors, on the other hand, know one thing remains certain amid the political turmoil: U.S. companies will always find a way to make money.

Just two weeks ago, the S&P 500 was deep in the throes of the worst performance in the first 100 days of a new president since the Nixon era, the economy was at risk of sliding into an abrupt recession, and investors were fleeing even the safest of U.S. assets.

But while some analysts were debating the "sell America' trade, and European stocks were outperforming their American peers by the largest margin in decades, S&P 500 companies were quietly adding to their impressive profit gains.

With around three-quarters of the benchmark's constituents reporting first-quarter earnings so far, collective profits are set to rise 13.6% from a year earlier to $533.1 billion. That's a $12 billion improvement from earlier forecasts, powered by big gains in health care, tech and utilities, and comes amid a 0.3% contraction for the broader domestic economy.

Megacap tech companies, meanwhile, have largely reiterated their plans to spend billions on investments in artificial intelligence, even amid threats of new levies on semiconductor imports and restrictions on sales to China. Capital spending on AI is on pace to hit a staggering $325 billion this year alone.

The impressive earnings haul and buoyant tech outlook have helped the S&P 500 rally 14% from its early April trough, the lowest levels of the year, and lifted the benchmark back above its April 2 close. That's when Trump unveiled what he called Liberation Day tariffs on nearly every one of America's global trading partners, apart from Russia.

Markets are searching for direction

It's also left markets searching for direction now that the pretariff close has been reclaimed, first-quarter earnings season is largely behind us, and two Federal Reserve rate decisions and a host of potential trade deals are looming on the horizon.

"The speed of this rally has been exceptional," said Jay Woods, chief global strategist at Freedom Capital Markets. "However, to call it the real thing there is some major overhead resistance to get through before giving the bulls back the reins."

Company bosses are cautious, with just over half the S&P 500 companies that have issued full-year profit guidance coming in below Wall Street forecasts. Recession references, meanwhile, are running at the highest levels since 2023, according to Bloomberg data.

Related: Fed inflation gauge sets up stagflation risks as tariff policies bite

"As investors look towards the coming months, it’s clear this earnings season has provided reasons for cautious optimism, yet also highlighted areas of concern," said Jacob Falkencrone, global head of investment strategy at Saxo Bank.

"The strength in corporate profits, particularly in sectors resilient to economic uncertainty, is encouraging," he added. "However, caution remains necessary as tariffs, cautious corporate guidance, and mixed economic signals continue to create uncertainty."

Earnings growth is in focus

But many are also optimistic that a resilient job market can drive consumer spending and a deal-motivated president will soothe tariff concern in coming months.

Wall Street, however, has pared its 2025 earnings growth forecast sharply since the start of the year, and it now sees collective profits rising 8.9%, compared with its early January consensus of around 14%.

Still, a host of factors could see that figure improve sharply over the summer and beyond, potentially powering a solid second-half rally for the S&P 500.

Related: U.S. recession risk leaps as GDP shrinks for the first time since 2022

Financial conditions, a term used to describe a collection of factors affecting consumer and corporate demand, have eased considerably over the past five months.

Global oil prices are trading near their lowest in four years, and sharper production increases from the OPEC cartel are likely to pressure them further.

Meanwhile, Treasury bond yields have tumbled, potentially stoking cheaper mortgage rates and borrowing costs, and the U.S. dollar is down more than 8% this year, adding extra value to the overseas profits of S&P 500 companies.

The Fed is also expected to begin lowering its benchmark lending rate later this summer, with CME Group's FedWatch pricing in three consecutive quarter-point reductions starting in July.

That would add to the easing of financial conditions, which could help the U.S. economy avoid recession while adding an extra boost to stock performance.

Help might be on the way

And any dial-back of the president's tariff strategy -- be it through carveouts for various sectors, a comprehensive trade deal with China, or a tax cut extension from Congress -- would provide even further support for U.S. stocks heading into the autumn.

"Despite a current effective rate that is around 17%, consensus has centered on a 10% universal tariff," a level that Lisa Shalett, chief investment officer and head of the Global Investment Office at Morgan Stanley Wealth Management, called "damaging" but "digestible."

"Although it may take months for trade deals to be signed, investors seem prepared to look through tariffs with great hopes for resolution this summer of a debt ceiling/budget reconciliation bill and stimulative tax bill," she said.

More Economic Analysis:

- Fed inflation gauge sets up stagflation risks as tariff policies bite

- U.S. recession risk leaps as GDP shrinks

- Like it or not, the bond market rules all

JP Morgan strategists on Monday estimated that a rally to 6,000 points for the S&P 500 was more likely than a slide to 5,000 points over the near term as "markets overshoot with earnings season stronger than expected (and) trade war headlines are likely to continue to come out positively."

Tom Lee of Fundstrat is also bullish, telling CNBC Monday that corporate-earnings performance is likely to be the key driver for stocks to retest their early-year highs.

"Companies have proven themselves to o manage through shocks and I don't think investors give them enough credit for that," he said. "That happened with Covid; companies survived a bullwhip effect on the economy, a surge in inflation and the fastest Fed rate hikes on record.

"So I think this tariff shock, while it is shocking, earnings will probably outperform expectations," he said.