Jamie Dimon sends candid message on economy, stocks

The leader of the biggest bank offered up new insights.

Recession or no recession? That's the million-dollar question on the minds of most people and businesses lately.

On the one hand, unemployment is still near historic lows, and average wage growth is clocking in higher than inflation, supporting spending. On the other hand, inflation risks, signs of a weakening jobs market, and the uncertainty of tariffs are taking a toll on consumer sentiment.

What happens next to the economy is critical to what happens next to the stock market. And recently, the stock market hasn't liked what it's heard.

Related: Legendary fund manager sends blunt 9-word message on stock market tumble

The S&P 500 has tumbled 9% year-to-date, while the technology-laden Nasdaq Composite has retreated over 13%. Much of the decline has happened in the past month, accelerated by President Trump's Liberation Day tariff announcements, which levied import taxes ranging from 10% to 40% or much more in the case of China.

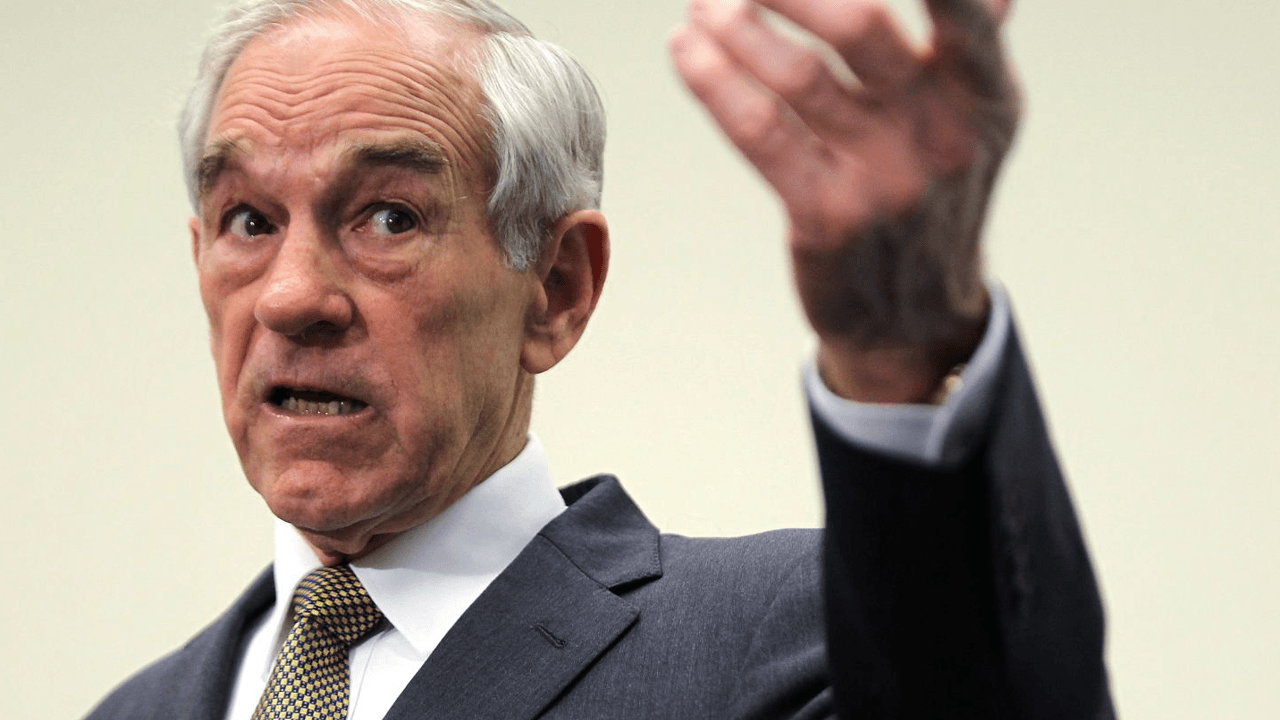

The market jitters amid a lack of economic clarity aren't lost on JP Morgan Chase CEO Jamie Dimon. A long-time banking veteran, Dimon is one of America's most influential business leaders.

On Friday, Dimon offered his latest thoughts on the U.S. economy and markets. Given his position atop the nation's biggest bank, which likely affords him access to the mindset of CEOs across the spectrum, his insights are worth considering.

Is a market recession on the horizon?

The arguments against a recession still hold true, but cracks are appearing.

Those anticipating we'll side-step recession point to a solid jobs market. That's certainly still true. The unemployment rate is 4.2%, and that's still relatively low historically.

Related: Billionaire Jeffrey Gundlach sends blunt warning on stocks, bonds

Also, real average weekly wages, which adjust income for inflation, are positive, suggesting the average worker is still growing income more quickly than inflation—bullish for spending. In March, changes in real average hourly earnings and no change in the average workweek meant real average weekly earnings rose 1.6% from one year ago, according to the Bureau of Labor Statistics.

There are also many unfilled jobs. There are 7.6 million open jobs in February, according to the most recent Job Openings and Labor Turnover Survey, or JOLTS.

And so far, we haven't seen much change in retail spending activity. Retail and food services sales between November and February rose 3.8% from the previous year.

However, that data is backward-looking, and, in some cases, it's already worsening.

For example, the 4.2% unemployment rate is up from 3.5% as recently as 2023, and there were 8.4 million open jobs in February 2024, far more than there are now.

Layoffs are also rising. Employers announced 497,052 lay-offs in the first quarter, the biggest first quarter figure since 2009, and up 93% from Q1, 2024, according to Challenger, Gray, & Christmas.

The hard data doesn't show it yet, but soft data, such as consumer sentiment, suggests shoppers are likelier to keep wallets in pockets and fingers off the 'buy' button.

The Conference Board's Expectations Index was 65 in March, well below the 80 level considered to be a recessionary red flag.

"Consumers’ expectations were especially gloomy, with pessimism about future business conditions deepening and confidence about future employment prospects falling to a 12-year low," said Stephanie Guichard, Senior Economist, Global Indicators at The Conference Board.

Jamie Dimon pegs odds of recession, weighs in on stocks

In JP Morgan Chase's quarterly earnings conference call on April 11, Jamie Dimon was asked for his opinion on the current likelihood of a recession hitting the U.S. in 2025.

Related: Jamie Dimon sends curt 6-word response to tariff war

"What I would say is our excellent economist, Michael Feroli; I called him this morning specifically to ask him how they're looking at their forecast today," said Dimon. "They think it's about 50-50 for recession."

A coin flip isn't overly encouraging. And what Dimon's hearing from his network of business leaders isn't very reassuring.

"A lot of people are not doing things because of this," said Dimon. "They're going to wait and see. And that's M&A, M&A with middle market companies, that's people's hiring plans and stuff like that."

A wait-and-see mindset isn't great for economic activity, and pausing hiring plans could mean that the risk of unemployment rising is greater than before recent tariffs increased the risk of inflation and a dip in GDP.

More Economic Analysis:

- Wall Street overhauls S&P 500 price targets as tariff selloff accelerates

- Inflation would like a word, please

- Stocks could bounce, but big bank earnings hold the cards

A lack of clarity may become more evident soon. As more companies report their first-quarter earnings results and offer up outlooks for the rest of the year, Dimon thinks many will use the opportunity to remove guidance.

"You're going to hear a thousand companies report, and they're going to tell you what their guidance is," said Dimon. "My guess is, a lot will remove it."

Wall Street will likely rethink its earnings outlooks if companies pull their guidance, ratcheting them lower.

"We’ve stated our concern for 2025 earnings per share expectations several times now and the growing likelihood that the consensus EPS forecast for the S&P 500 would be revised lower," said portfolio manager Chris Versace in a TheStreet Pro post. "Joining us in that thinking is JPMorgan’s Jamie Dimon, who said he expects estimates for corporate earnings to fall amid the uncertainty created by Pres. Donald Trump’s trade negotiations."

Any widespread dip in earnings outlooks could cause the S&P 500's price-to-earnings ratio to climb, erasing recent progress in bringing the P/E ratio back to historical averages.

"The analyst community has already reduced its earnings estimates for the S&P by 5%," said Dimon. "So, it's now up 5% as opposed to up 10%. My guess is that'll be 0% and negative 5% probably the next month."

The S&P 500's forward P/E ratio is 19.0, below the 5-year average of 19.9, but above the 10-year average of 18.3, according to FactSet. It was above 22 in February before the stock market sell-off.

If a recession materializes, it will likely cause stocks to fall, but Dimon doesn't see that as all bad for JP Morgan's stock.

He says that regardless of a bad or mild recession, "Earnings won't be great, and the stock will go down, which I look at as an opportunity to buy back more stock."

Related: Veteran fund manager unveils eye-popping S&P 500 forecast