Is This the One Stock to Buy to Profit From the AI Revolution?

Stocks For the Next Generation of AI Millionaires The artificial intelligence (AI) revolution is reshaping industries, from healthcare to automotive, with algorithms driving unprecedented efficiency and innovation. The global AI market, valued at $638 billion in 2025, is projected to reach $3.68 trillion by 2034, expanding at a 19% compound annual growth rate. Early beneficiaries […] The post Is This the One Stock to Buy to Profit From the AI Revolution? appeared first on 24/7 Wall St..

The AI market is set to skyrocket to $3.68 trillion by 2034, fueling massive gains for early leaders exploiting the technology.

However, high valuations of prominent AI stocks spark concerns about sustainability, shifting focus to stocks that could be long-term profit centers for investors.

Nvidia made early investors rich, but there is a new class of ‘Next Nvidia Stocks’ that could be even better. Click here to learn more.

Key Points in This Article:

Stocks For the Next Generation of AI Millionaires

The artificial intelligence (AI) revolution is reshaping industries, from healthcare to automotive, with algorithms driving unprecedented efficiency and innovation. The global AI market, valued at $638 billion in 2025, is projected to reach $3.68 trillion by 2034, expanding at a 19% compound annual growth rate.

Early beneficiaries like Nvidia (NASDAQ:NVDA) and Palantir Technologies (NASDAQ:PLTR) have reaped massive gains, with their stocks soaring as investors bet on AI’s transformative power. Nvidia’s graphics processing units (GPU) power AI training, while Palantir’s data analytics platforms drive enterprise adoption.

These stocks have become household names, riding the wave of AI’s proliferation across cloud computing, autonomous vehicles, and generative AI. Yet, their high valuations — Nvidia’s forward P/E at 30x and Palantir’s at 222x — raise concerns about sustainability. As AI demand surges, the infrastructure enabling it may offer steadier, long-term gains.

That suggests there is a less-hyped stock that is better positioned to profit from AI’s enduring growth. It is one that can deliver both stability and upside in this dynamic market.

A Better Stock to Ride the AI Revolution Wave

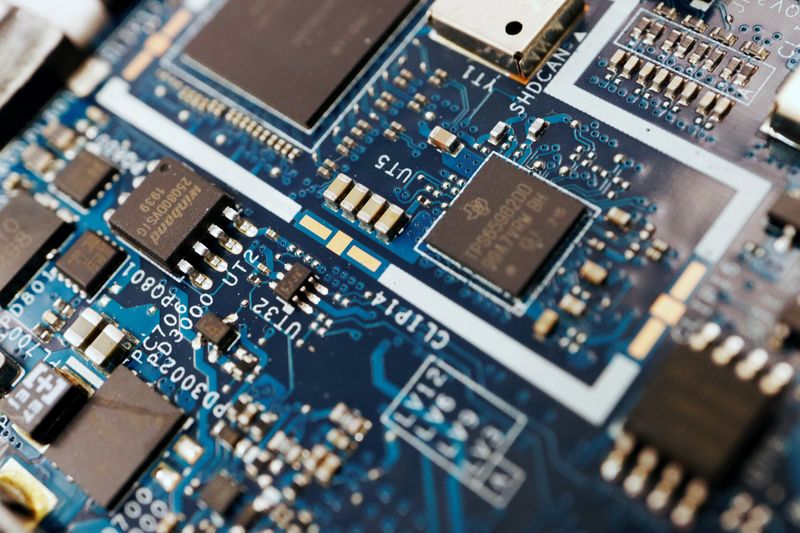

Taiwan Semiconductor Manufacturing (NYSE:TSM) stands out as the ultimate AI stock to buy for long-term capital appreciation, underpinned by its critical role as the world’s leading chip foundry.

With a $1.1 trillion market cap, TSM produces over 60% of the world’s semiconductors and 90% of advanced chips. It powers AI applications from Nvidia’s GPUs to Apple’s neural engines. First-quarter revenue rose 35.3% to $25.5 billion, with AI-related high-performance computing (HPC) more than offsetting the seasonal decline of smartphone demand. Advanced technologies, which TSM defines as its 7-nanometer and more advanced technology product, accounted for 73% of total wafer revenue. It positions TSM as the backbone of the AI ecosystem.

Analysts forecast 26.6% revenue growth for 2025, driven by AI chip demand. They have also assigned a $226 per share one-year consensus price target, implying 8% upside from its current level.

TSM’s diversified client base — including Nvidia, Advanced Micro Devices (NASDAQ:AMD), Apple (NASDAQ:AAPL), and Qualcomm (NASDAQ:QCOM) — help mitigate any customer concentration risk. That sets it apart from pure-play AI firms.

The chip foundry’s $10 billion in Q1 free cash flow funds massive capital expenditures, which are projected to be between $38 billion to $42 billion this year, with 70% targeting advanced process technologies.

Trading at a forward P/E of 17x and a price-to-sales ratio of under 10x, TSM offers value with growth. Its 1.3% dividend yield — a dividend it has increased for the past decade at an 18% CAGR — adds income stability. Ultimately, TSM is the premier AI pick-and-shovel play

TSM Has Manageable Risk

While an investment in TSM stock carries high reward potential, it does face some risks. Those include geopolitical tensions — sabre-rattling from China and President Trump’s tariff scheme — which could disrupt production. However, its global fab diversification, with factories in Arizona and Japan, reduces this threat.

The tariffs could raise costs, as Trump’s policies potentially add 10% to chip prices. Competition from Samsung and Intel (NASDAQ:INTC) also looms, but TSM’s 61% gross margin and technological lead should keep it ahead. Unlike Nvidia’s reliance on AI hype or Palantir’s speculative valuation, TSM’s broad exposure to smartphones, IoT, and automotive chips helps ensure its durability if AI growth slows.

Final Take: TSM’s Profit Potential

Taiwan Semiconductor Manufacturing is the premier stock for investors to buy to harness AI’s wealth-building potential as it offers a compelling blend of growth and value.

The foundry’s dominant market share position and the expected growth of its business cement its role as the linchpin of AI chip production. For those eyeing AI’s multi-decade boom, TSM’s unmatched scale and reasonable valuation make it the definitive stock to capture sustainable, high-growth profits.

The post Is This the One Stock to Buy to Profit From the AI Revolution? appeared first on 24/7 Wall St..