Is Social Security Out of Money? This Is What You Need to Know

There are many older Americans today who get the bulk of their income from Social Security. And you may end up needing that money to help cover your expenses once you retire, too. In this Reddit post, we have someone in their 30s who’s clearly very worried about Social Security. They’ve heard the rumors […] The post Is Social Security Out of Money? This Is What You Need to Know appeared first on 24/7 Wall St..

Key Points

-

There’s concern that Social Security is going bankrupt and won’t be able to pay benefits.

-

While Social Security cuts are a possibility, the program is not going bankrupt.

-

It’s best to plan for Social Security cuts and save money for retirement so you’re protected in case they happen.

-

Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; get started by clicking here.(Sponsor)

There are many older Americans today who get the bulk of their income from Social Security. And you may end up needing that money to help cover your expenses once you retire, too.

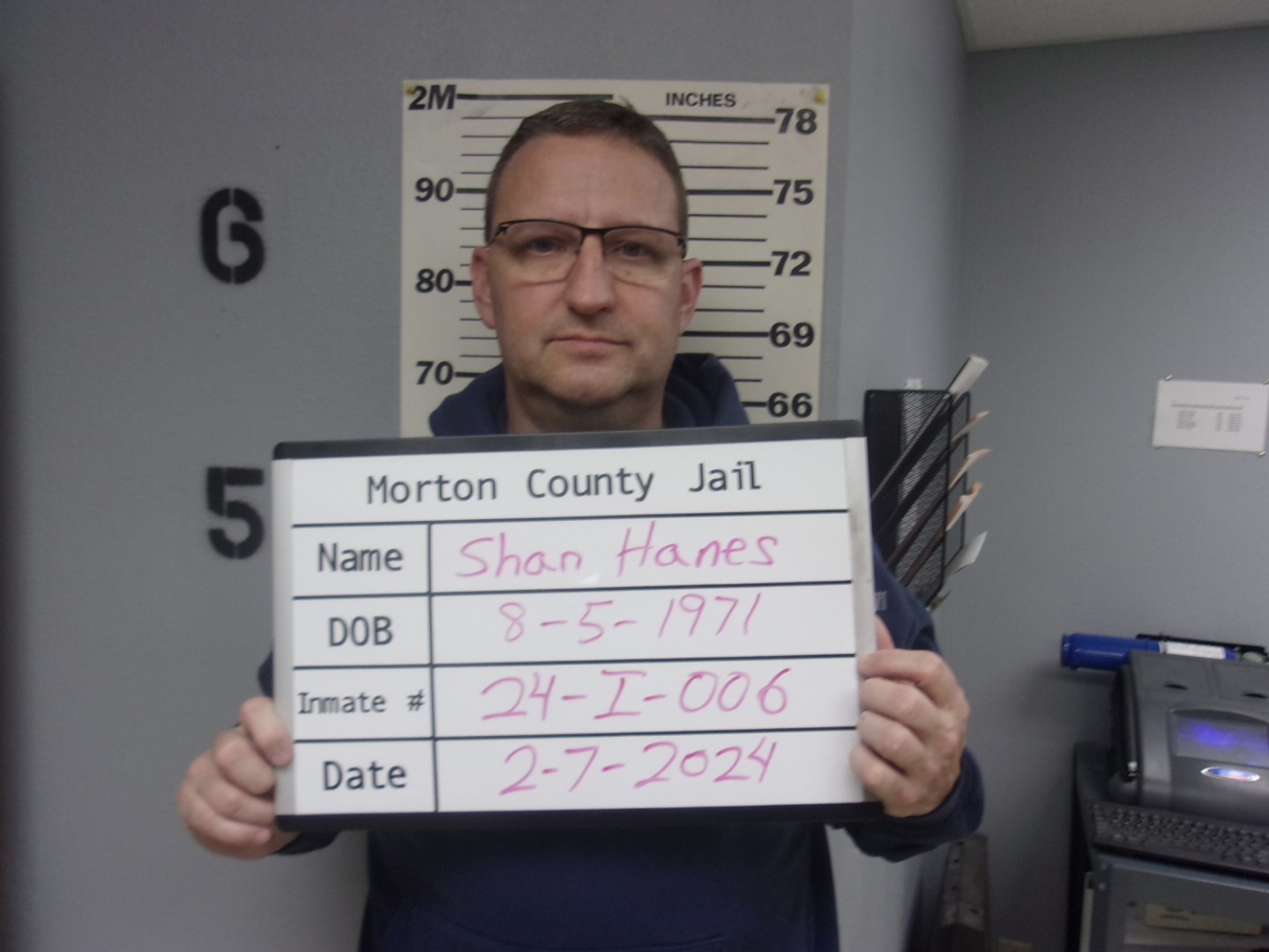

In this Reddit post, we have someone in their 30s who’s clearly very worried about Social Security. They’ve heard the rumors that the program is running out of money and wonder whether they’ll be able to get benefits in 30 years.

The good news is that Social Security is not on the verge of bankruptcy like some people might think it is. This means that the poster should expect to collect Social Security in retirement. However, the program is facing some financial challenges that could result in benefit cuts.

The real scoop on Social Security

While people in their 30s today don’t have to worry about Social Security disappearing completely, the reality is that the program may have to cut benefits in the future. That’s not guaranteed to happen, but it’s possible.

The reason Social Security is in bad shape is that it gets most of its funding from payroll taxes. As the workforce shrinks due to the anticipated mass retirement of baby boomers, Social Security’s main revenue stream is expected to decline.

Social Security can use the money it has reserved in its trust funds to keep up with benefits as payroll tax revenue slows down. However, once those funds run out of money, Social Security may be looking at benefit cuts unless lawmakers figure out a way to prevent them.

For this reason, the poster above is right to be worried. However, there’s a big difference between Social Security cutting benefits and Social Security not paying benefits at all.

Since Social Security can still get access to payroll tax funds, it should be able to continue paying benefits to some degree. It just may be a smaller degree than what people want or deserve.

How to plan for Social Security cuts

The poster above may be worried about Social Security, but they’re doing one smart thing to prepare for potential cuts. The poster is saving money regularly and says that together with their spouse, they’re socking away over $3,000 a month for retirement in various accounts.

If you’re worried about Social Security (which, unfortunately, you should be), then it pays to do the same. The good news is that if you’re in your 30s like the poster, you have plenty of time to save for retirement to make up for a potential reduction in benefits.

You may not be able to save over $3,000 a month like the poster, since that requires you to live well below your means. It also probably requires you to have a large salary. The poster doesn’t state what they earn, but we can assume it’s a pretty generous wage for them to be saving at that level.

Even if you save $300 a month, though, if you do so over a 30-year period of time and invest your money wisely, you could end up with a nice retirement nest egg to supplement your Social Security. That way, if benefit cuts end up happening, you won’t be left completely in the lurch.

The post Is Social Security Out of Money? This Is What You Need to Know appeared first on 24/7 Wall St..