There’s Bad News for Retirees on Social Security. Here’s the Latest

Millions of older Americans depend on Social Security to cover their retirement expenses. But the fear is that the program won’t be around in the future due to financial issues lawmakers have long struggled to fix. The good news is that Social Security is not in danger of going away entirely. The program gets […] The post There’s Bad News for Retirees on Social Security. Here’s the Latest appeared first on 24/7 Wall St..

Key Points

-

The Social Security Trustees just released their annual report.

-

It found that the program’s trust funds are expected to run dry a year earlier than in previous estimates.

-

Benefit cuts could happen sooner in light of that, which really puts the pressure on lawmakers.

-

Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; get started by clicking here.(Sponsor)

Millions of older Americans depend on Social Security to cover their retirement expenses. But the fear is that the program won’t be around in the future due to financial issues lawmakers have long struggled to fix.

The good news is that Social Security is not in danger of going away entirely. The program gets most of its revenue from payroll tax collection, so as long as that practice continues, Social Security can exist and pay benefits.

The problem is that Social Security expects its main revenue stream to decline in the coming years as baby boomers retire in droves. Social Security can use the money in its trust funds to keep up with scheduled benefits — that is, until that money runs out.

Now, the Social Security Trustees have an update on the timing of that. And it’s not a positive one.

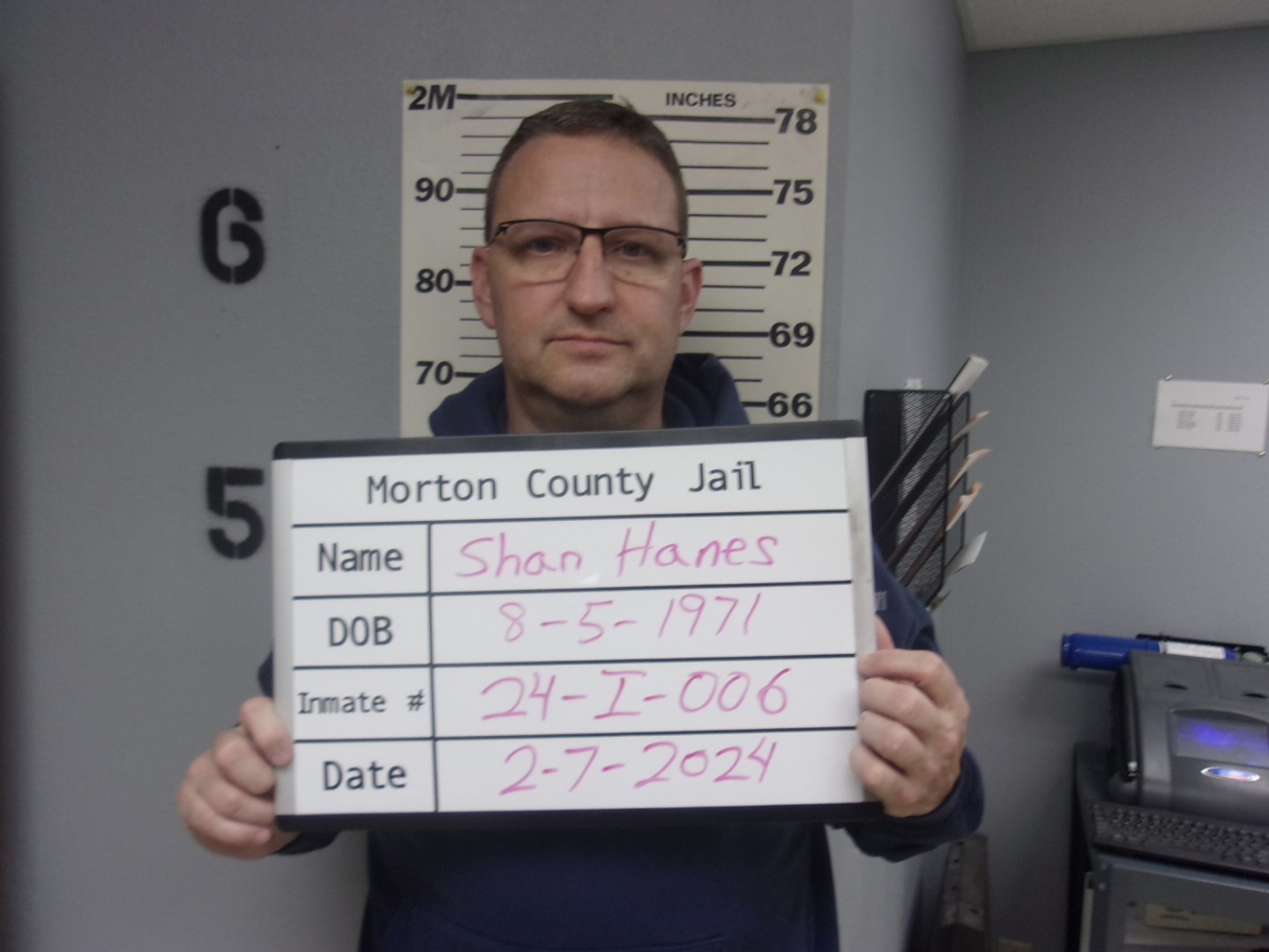

Benefit cuts could come sooner than expected

The most recent Social Security Trustees report said that the program’s combined trust funds — the Old-Age and Survivors Insurance Trust Fund and the Disability Insurance Trust Fund — will only have enough money to keep up with scheduled benefits through 2034. That’s not great news.

Last year, the Social Security Trustees expected the program’s combined trust funds to be depleted in 2035. With the timeline pushed up by a year, the situation just got even more dire.

The reality is that many older Americans would effectively be plunged into poverty without their complete Social Security checks. And a lot of current workers may be in for a financial shock if they’re unable to collect their complete benefits in retirement.

The Social Security Trustees’ most recent estimate says that unless a solution is reached, beneficiaries could be looking at a 19% cut in less than a decade. Given that many older Americans are struggling to cover their basic costs as it is, it’s clear that something needs to be done.

Lawmakers need to step up

At this point, lawmakers cannot afford to wait to address the issue of Social Security cuts. There’s a ticking clock, and some of the solutions that may be viable to prevent cuts need time to be phased in.

One potential solution, for example, is to push back full retirement age (FRA) from 67 to a later age for some members of the workforce (namely, younger ones). For that to happen, though, lawmakers would need to set thresholds determining who the change applies to and phase it in slowly. They can’t afford to wait until 2034 to first shake things up.

Another option, of course, is to raise taxes — something most people would agree is far from ideal. Workers currently contribute 6.2% of their paychecks to Social Security, up to a certain cap, and their employers pay an equal share. Those who are self-employed, however, must cover both the employee and employer portion of that tax bill.

This change, too, is something that would likely need to be phased in over time. For this reason, lawmakers need to start prioritizing Social Security. If they don’t, and they allow benefits to shrink, it could spark a widespread poverty crisis among retirees no one is prepared for.

The post There’s Bad News for Retirees on Social Security. Here’s the Latest appeared first on 24/7 Wall St..