3 Strong Buy Stocks Yielding at Least 9% That Have Huge Upside Potential

Grabbing shares of these three quality companies that pay at least a 9% dividend makes sense for investors looking for passive income. The post 3 Strong Buy Stocks Yielding at Least 9% That Have Huge Upside Potential appeared first on 24/7 Wall St..

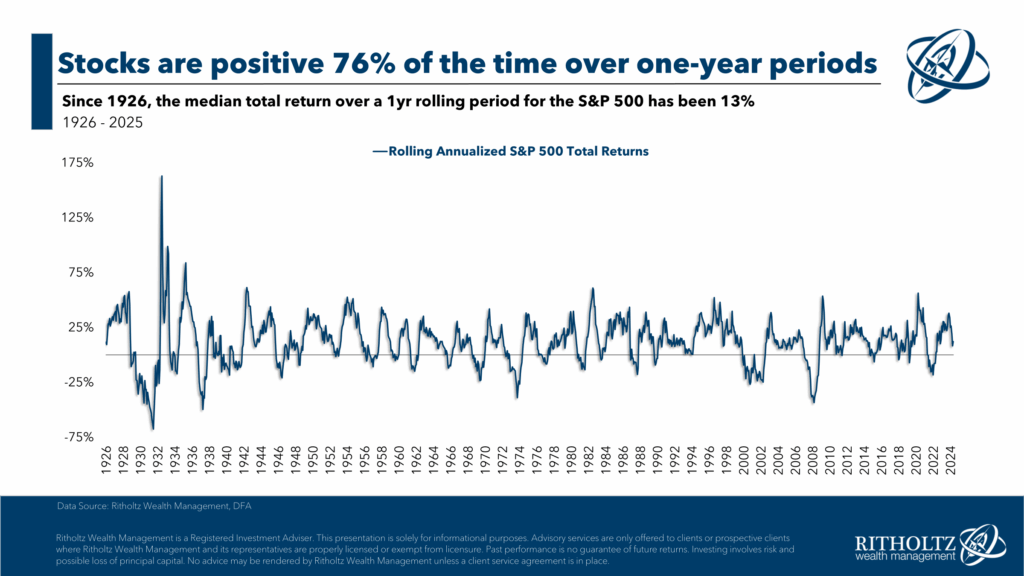

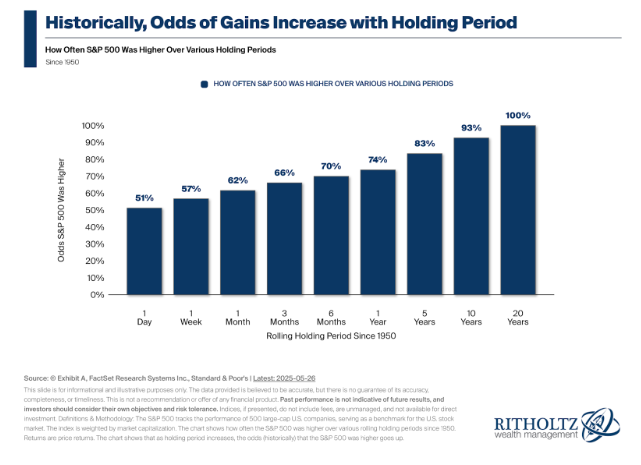

Investors love dividend stocks, especially high-yield varieties, because they offer a significant income stream and have substantial total return potential. Total return includes interest, capital gains, dividends, and distributions realized over time. In other words, the total return on an investment or a portfolio consists of income and stock appreciation. For example, if you buy a stock at $20 that pays a 3% dividend and rises to $22 in a year, your total return is 13%. That is, 10% for the increase in stock price and 3% for the dividends paid. The higher the dividend a company pays, the greater the odds are for total return success.

24/7 Wall St. Key Points:

-

Despite hopes for a cut in interest rates, the odds of a summer move lower have diminished.

-

After the monster rally off the early April lows, investors need to be careful.

-

Quality stocks paying 9% or higher dividends can generate solid passive income streams.

-

Do you need to generate more passive income from your stock holdings? Schedule a meeting with a financial advisor near you for a complete portfolio review. Click here to get started. (Sponsored)

Since 1926, dividends have contributed approximately 32% of the total return for the S&P 500, while capital appreciation has contributed 68%. Therefore, sustainable dividend income and capital appreciation potential are essential for total return expectations. A study by Hartford Funds, in collaboration with Ned Davis Research, found that dividend stocks delivered an annualized return of 9.18% over the 50 years from 1973 to 2023. Over the same timeline, this was more than double the 3.95% annualized return for those who did not pay.

We screened our 24/7 Wall St. high-yield dividend stocks research database looking for quality companies that pay at least a 9% dividend. Three standouts in their respective sectors hit our screens, and all make sense for those looking for passive income and with a somewhat higher risk tolerance. Top Wall Street firms we cover rate all these stocks at Buy.

Why do we cover high-yield dividend stocks?

High-yield dividend stocks offer investors a reliable source of passive income. Passive income is characterized by its ability to generate revenue without requiring the earner’s continuous active effort, making it a desirable financial strategy for those seeking to diversify their income streams or achieve financial independence.

Lyondell Basell

This top chemical giant has been hammered over the past year, and despite already paying a massive dividend, it just raised its payout yet again. LyondellBasell N.V. (NYSE: LYB) is a chemical company creating solutions for everyday sustainable living.

Its segments include:

- Olefins and Polyolefins-Americas (O&P-Americas)

- Olefins and Polyolefins-Europe, Asia, International (O&P-EAI)

- Intermediates and Derivatives (I&D)

- Advanced Polymer Solutions (APS)

- Refining and Technology

The O&P-Americas and O&P-EAI segments produce and market olefins and co-products, polyethylene, and polypropylene.

The I&D segment produces and markets propylene oxide (PO) and its derivatives, as well as oxyfuels and related products, and intermediate chemicals, including styrene monomer (SM) and acetyls.

The APS segment produces and markets compounds and solutions, including polypropylene compounds, engineered plastics, masterbatches, engineered composites, colors, and powders.

The Refining segment refines heavy, high-sulfur crude oil and other crude oils of various types, while the Technology segment develops and licenses chemical and polyolefin process technologies.

Wells Fargo has an Overweight rating and an $85 target price.

Hercules Capital

This company is the lender of choice for many innovative entrepreneurs and their VC partners. Hercules Capital Inc. (NYSE: HTGC) is a specialty finance company that focuses on providing financing solutions to venture capital-backed and institutional-backed companies across various technology and life sciences industries.

It is structured as an internally managed, non-diversified, closed-end investment company.

Its business objectives are to increase its net income, net investment income, and net asset value through investments in primarily structured debt or senior secured debt instruments of venture capital-backed and institutional-backed companies across various technology-related industries, at attractive yields.

It invests in a range of companies active in the technology industry sub-sectors characterized by products or services that require advanced technologies, including:

- Computer software and hardware

- Networking systems

- Semiconductors

- Telecommunications equipment and media

- Semiconductor capital equipment

- Information technology infrastructure

Wells Fargo has assigned an Overweight rating, accompanied by a $19 target price.

Starwood Property Trust

Run by real estate legend Barry Sternlicht, Starwood Property Trust (NYSE: STWD) is a high-quality real estate investment trust offering a reliable, ultra-high-yield dividend.

The company’s segments include:

- Commercial and Residential Lending

- Infrastructure Lending

- Property

- Investing and Servicing

The Commercial and Residential Lending segment is engaged in:

- Originating, acquiring, financing, and managing commercial first mortgages

- Non-agency residential mortgages

- Subordinated mortgages

- Mezzanine loans

- Preferred equity

- Commercial mortgage-backed securities

- Residential mortgage-backed securities

- Real estate and real estate-related debt investments in the United States, Europe, and Australia

The Infrastructure Lending Segment is engaged in originating, acquiring, financing, and managing infrastructure debt investments.

The Property Segment is engaged in acquiring and managing equity interests in stabilized commercial real estate properties.

The Investing and Servicing segment includes a servicing business in the United States, an investment business, and a mortgage loan business.

J.P. Morgan has an Overweight rating for the stock with a $19.50 price objective.

Need $16,500 per Year in Passive Income? Invest $25,000 in These 4 Ultra-High-Yield Stocks

The post 3 Strong Buy Stocks Yielding at Least 9% That Have Huge Upside Potential appeared first on 24/7 Wall St..