I’m halfway to my $5 million target and burning out – do I chase a better job or risk losing momentum on retirement?

When I was in my 20s, my finance job was very stressful. But it wasn’t just that I found myself unhappy during my working hours. Rather, the stress extended to my post-work hours. I was often too drained to go out with friends after work. And on weekends, all I wanted to do was […] The post I’m halfway to my $5 million target and burning out – do I chase a better job or risk losing momentum on retirement? appeared first on 24/7 Wall St..

Key Points

-

It’s easy to fall into the trap of sticking with a stressful job, especially if it pays well.

-

It’s important to strike a balance between earning decently and not getting burned out.

-

It could pay to adjust your savings goals for the sake of your mental health.

-

Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; get started by clicking here here.(Sponsor)

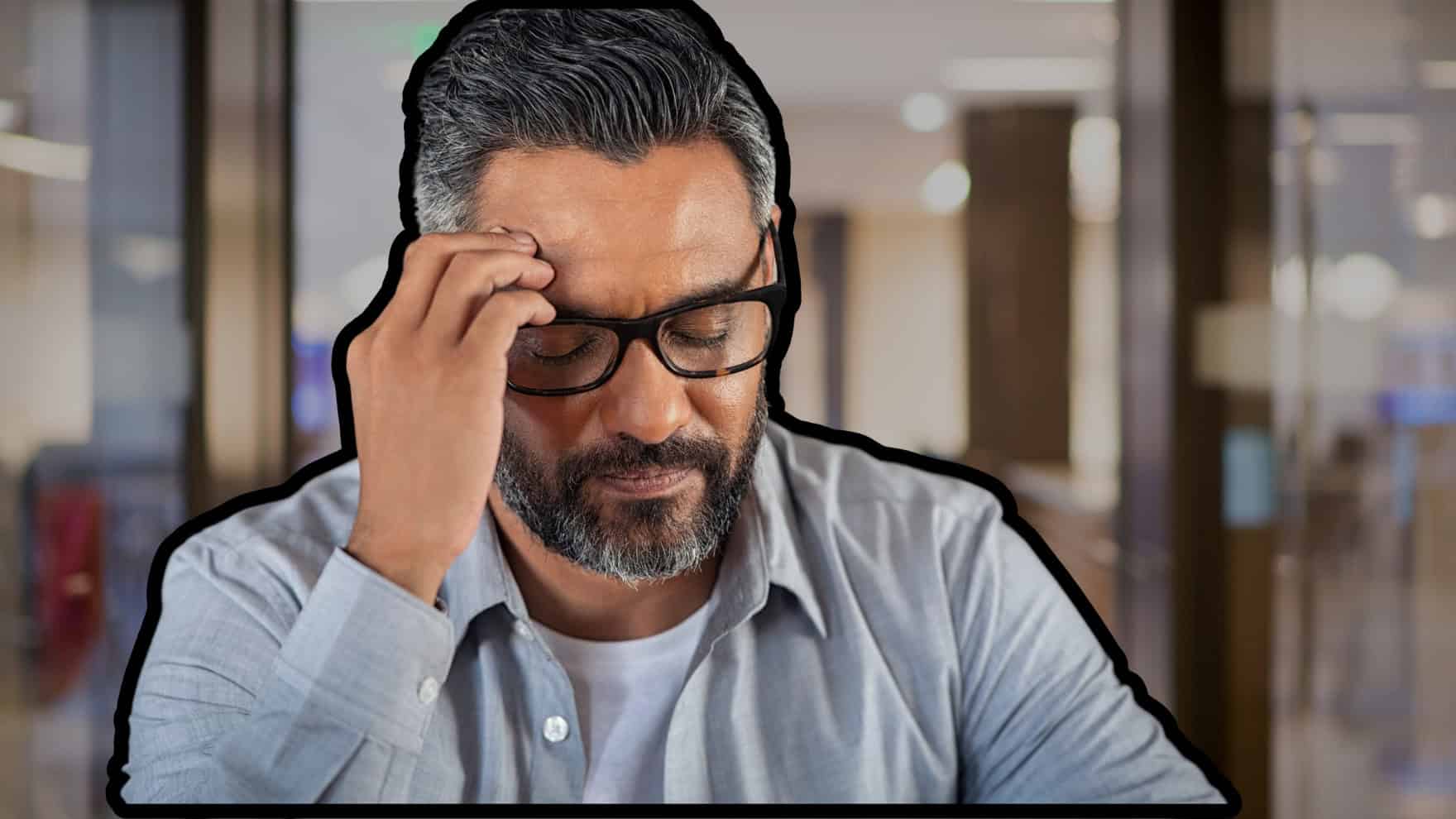

When I was in my 20s, my finance job was very stressful. But it wasn’t just that I found myself unhappy during my working hours. Rather, the stress extended to my post-work hours.

I was often too drained to go out with friends after work. And on weekends, all I wanted to do was stay home and recover from my stressful week. Given my age, it wasn’t exactly a healthy routine, and I knew that I eventually had to put a stop to it.

So I did. I quit my finance job once I reached a point where my savings were decent.

Had I stayed at that job and in that industry, I’d perhaps have more money than what I have today. But I don’t regret my decision one bit.

In this Reddit post, we have a 32-year-old tech worker with no kids who lives in an expensive city. They’re about halfway to their $5 million retirement savings target, but they’re burned out at work and aren’t sure what to do.

I can definitely relate to this poster’s situation. But I think they need to take a page out of my playbook.

It’s important to strike a balance

It’s one thing to experience occasional stress at work. That happens to the best of us. But there are some things the poster has written that have me concerned, like this statement:

“The stress and burnout are messing with my health and making it difficult to focus at work. I’m not sleeping well, I’m getting sick more often, and I feel a heavy sense of dread on evenings and weekends thinking about work. I think I’m depressed, which I feel is unfair to my partner as well.”

This tells me that the poster’s stress goes beyond what’s typical. And my concern is that if the poster continues at this job, they could end up putting their physical and mental health at risk. That’s not worth any amount of money. So I would tell the poster to do something similar to what I did — set an end date.

Once I reached the point of knowing I had to leave my job, I didn’t resign right away. Instead, I stuck it out a few more months so I could bank some extra cash and figure out my next steps.

But just knowing that I had an end date in mind made me feel so much better. There was finally a light at the end of the tunnel. And I think the poster here might feel the same.

Sometimes, goals need to be adjusted

Of course, this begs the question: Will the poster be able to make it to their $5 million retirement savings goal if they take a lower-paying job that’s less stressful? My answer is, I don’t know.

There’s a good chance that if they’re halfway to their goal by 32, they have plenty of opportunity to double their money. But if they’re hoping to retire super early, that may not happen. Or, they may have to do it on less.

It looks like either way, the poster might have to make some type of adjustment to their savings goal or retirement plan to allow them to exit their current job. But I think it’s worth it for the sake of their mental health.

I also think the poster should sit down with a financial advisor and talk through their plans and concerns. An advisor might help them realize that their plans are doable even with a lower paycheck.

Or, maybe not. But there still comes a point when I think health has to take priority.

The post I’m halfway to my $5 million target and burning out – do I chase a better job or risk losing momentum on retirement? appeared first on 24/7 Wall St..