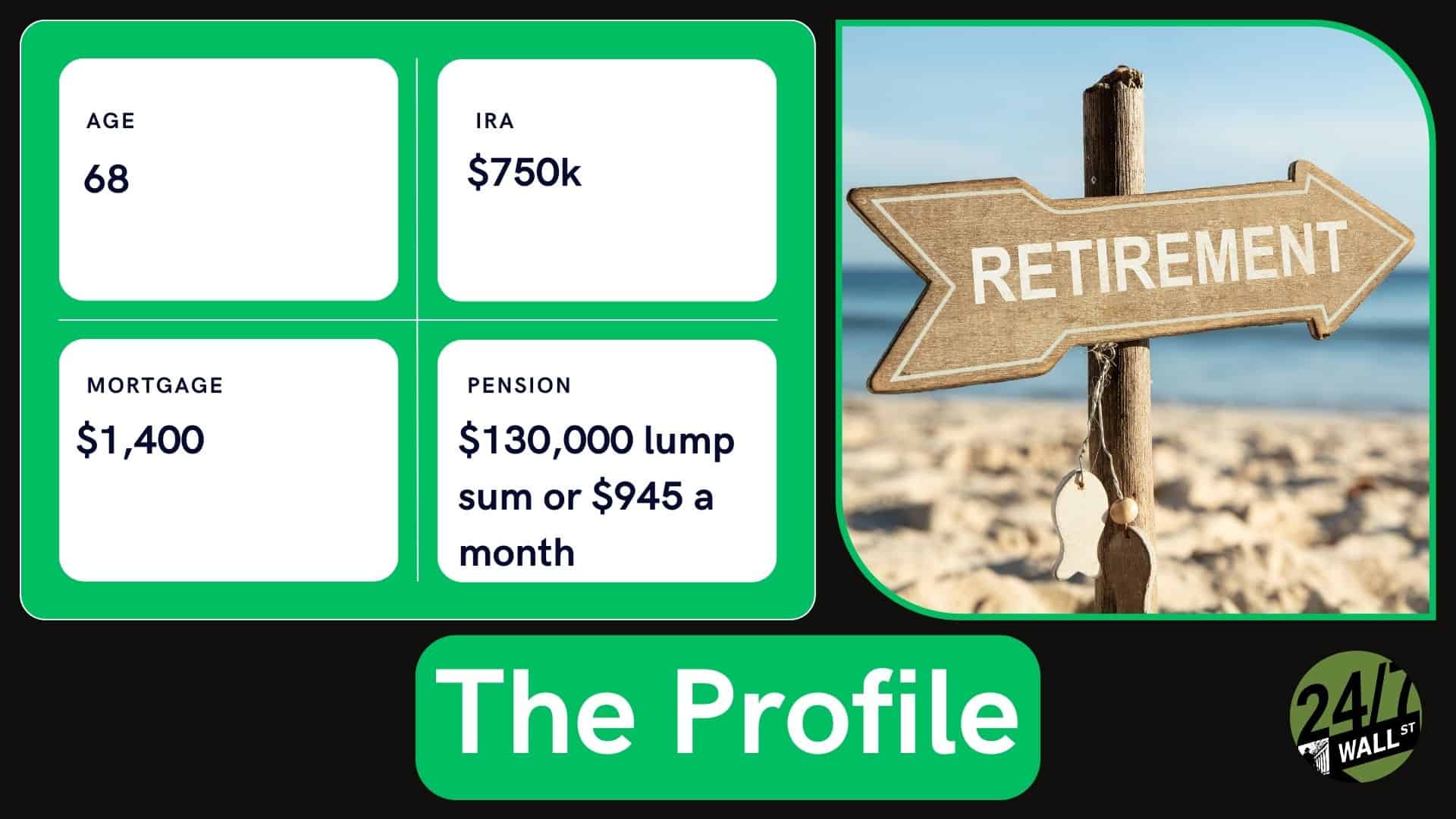

I’m 68 and Don’t Know If It’s Better to Take a $130K Lump Sum or $945 Monthly Pension in Retirement

Pensions provide additional income that can help you in retirement, but most of these plans force retirees to make a big choice: receive a lump sum right now or monthly payouts for the rest of your life. A 68-year-old finds himself in that predicament. He recently posted in the Retirement Reddit group about whether he […] The post I’m 68 and Don’t Know If It’s Better to Take a $130K Lump Sum or $945 Monthly Pension in Retirement appeared first on 24/7 Wall St..

Pensions provide additional income that can help you in retirement, but most of these plans force retirees to make a big choice: receive a lump sum right now or monthly payouts for the rest of your life.

A 68-year-old finds himself in that predicament. He recently posted in the Retirement Reddit group about whether he should take a $130k lump sum or receive $945/mo for the rest of his life. It’s good to speak with a financial advisor if you can, but I’ll share some thoughts as well.

Key Points

-

A Redditor is deciding between a $130k lump sum or $945/mo payments for the rest of his life.

-

The $945/mo payouts are less risky, but a lump sum wisely invested in the stock market can lead to much higher returns and a better inheritance.

-

Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; get started by clicking here here.(Sponsor)

The Tax Bill

Taxes are an important factor to consider since the money you receive from a pension is treated as ordinary income. That means a $130k lump sum will result in a big tax hit on the first year, assuming he doesn’t roll it into a traditional IRA.

The tax burden is less, with $945/mo payouts. The windfall provision would have increased the taxation on the retiree’s Social Security benefits, but this provision was recently repealed in January 2025.

He receives $3,500/mo in Social Security. This payout, combined with the pension, would result in $4,445 per month. Social Security and the monthly pension payments can help him cover basic expenses like car insurance, utilities, and food.

He Doesn’t Have Any Dependents

The Redditor is divorced and has a college-age child. His ex isn’t entitled to any of his Social Security, retirement accounts, or pension. Furthermore, he has already set aside money for his child, which won’t impact his finances.

It’s easier for the Redditor to live on a low budget, and $945 monthly payments can make it easier for the Redditor to consistently afford everything. He wants to travel a bit, so receiving a lump sum creates the risk of burning through the money too early.

Another benefit of the monthly pension payments is that he may feel more comfortable with keeping his IRA funds in the stock market. Receiving the lump sum may cause him to make more defensive investments since he doesn’t have an additional $945 coming in each month.

Why the Lump Sum Can Be the Better Choice

Although fixed monthly payments combined with Social Security can set him up for life, he could be leaving money on the table. Although the $130k would result in a big tax bill, this lump sum gives the Redditor more flexibility right now, especially if he can already live off his Social Security payments and some IRA withdrawals.

It’s very reasonable to assume that the Redditor ends up with $100k after taxes, assuming he rolls it into a Roth IRA or takes the cash. He’s likely to end up with a little more than that, especially if he lives in a state with low or no income taxes.

If he doesn’t grow the $100k, it can cover $945 monthly payouts for approximately nine years. However, he will get more mileage out of the $100k if he invests it into conservative investments that produce a 5% annualized return. Furthermore, he may be able to make a large contribution to his retirement account and minimize how much he has to pay in taxes.

The main advantage of a lump sum is that you get your money right now. The Redditor said that he is in full health, but if a medical bill comes his way, it may be better to have the lump sum. Furthermore, the $945/mo payments stop when the Redditor passes away, and they can’t be passed onto someone else. However, if the Redditor receives a lump sum, all ofthose funds can be passed onto an heir.

When Do Monthly Payouts Out Earn the Lump Sum?

Ignoring taxes, you would have to receive $945/mo payments for approximately 11.5 years before they surpass your lump sum. However, inflation is a major caveat, which means it will take even longer for your monthly payouts to exceed the lump sum.

You can end up with more purchasing power if you take out the lump sum right away instead of hoping that you live long enough to catch up with the monthly payouts.

However, investing is another key detail that can make it almost impossible for the monthly payouts to keep up with the lump sum. If the Redditor can put the lump sum into a mutual fund with some risk, like the Vanguard Total Stock Market Index Fund Admiral Shares (MUTF: VTSAX), they can outperform the pension.

Pension fund managers are usually very conservative and barely keep up with inflation. However, a fund like VTSAX has delivered an annualized 11.7% return over the past decade. Getting that type of an annualized return with the lump sum would make this option much better than monthly payouts. However, it depends on the Redditor’s risk tolerance.

The post I’m 68 and Don’t Know If It’s Better to Take a $130K Lump Sum or $945 Monthly Pension in Retirement appeared first on 24/7 Wall St..