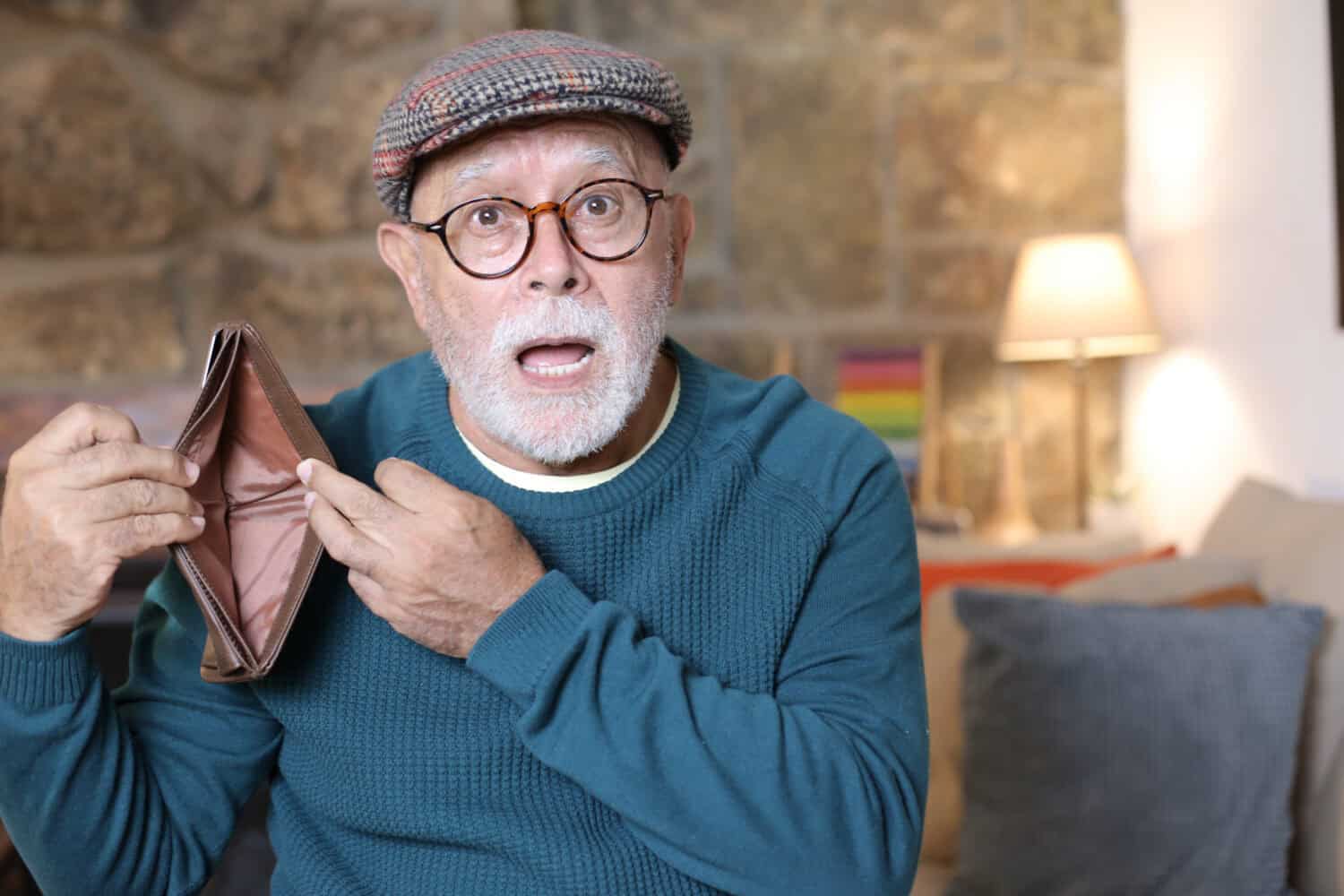

I’m 50 with a net worth of $5 million. Should I retire early in case the next few years destroy the economy?

A 50-year-old Reddit user with around $4.6 million in investments was planning to retire at age 52 but is wondering if he should pull the plug now. He lives a comfortable middle-class life earning around $300K per year, has three kids, and has a pretty high-stress job but one he enjoys. His big reason for […] The post I’m 50 with a net worth of $5 million. Should I retire early in case the next few years destroy the economy? appeared first on 24/7 Wall St..

Key Points

-

A Reddit user who planned to retire in two years is considering retiring early because of concerns about the economy.

-

He’s afraid the Trump Administration will be a shock to the system and his investments won’t recover.

-

In reality, making long-term decisions based on short-term concerns isn’t a good approach as no one can predict the future.

-

4 million Americans are set to retire this year. If you want to join them, click here now to see if you’re behind, or ahead. It only takes a minute. (Sponsor)

A 50-year-old Reddit user with around $4.6 million in investments was planning to retire at age 52 but is wondering if he should pull the plug now. He lives a comfortable middle-class life earning around $300K per year, has three kids, and has a pretty high-stress job but one he enjoys.

His big reason for pushing up his retirement date, besides a desire to slow down, is that he’s afraid that political moves made by DOGE and the new administration are going to be a shock to the system and could affect his investments in a way that they won’t recover by the time he reaches his original target age of 52.

So, should he stop working, cash out, and retire now to avoid exposure to the political upheaval or should he stay the course and stick to his original plans?

Trying to make guesses about the economy isn’t the best way to organize your investments

The Redditor may be right to be concerned about the impact the Trump Administration is going to have on the economy over the short term — or he may be entirely wrong. The reality is that there has never been an administration quite like this one, and it’s unclear at this point what the courts are going to allow, how lasting and sweeping the changes will be, and what the economy is going to do in response.

While this is a time of major change, it’s also important to realize that no one is ever going to really know what the economy is going to do. No one could have predicted the COVID-19 pandemic, for example, or been able to accurately guess the impact that it would have on the market in the years that followed. That’s because the future is always full of uncertainty.

Given the fact that timing the market and predicting the timing of recessions is virtually impossible, no one — this Redditor included — should be making major financial decisions like changing their retirement date as a result of short-term economic fears. Instead, the appropriate approach is to maintain the right asset allocation given your timeline and expose yourself to a mix of different assets that you’d be happy to hold long-term in case you need to wait out a crash.

Since the OP is just two years away from his original retirement date, a good portion of his portfolio should already be invested in relatively conservative assets as he’s going to need to start drawing money from his accounts soon. This should mean there’s no reason for him to make big changes based on predictions of short-term economic moves because he should already have some money in safer investments that won’t lead to big losses if the economy goes south.

Does retiring early make sense?

Now, if his sole reason to retire early is because of potential economic upheaval, that makes very little sense. If he’s worried about the business going bad and his $300K salary disappearing, then the last thing he should do is retire since leaving the workforce would ensure he no longer gets that money.

Instead, he might as well continue to collect his pay as long as he can until his planned retirement age and he should continue to invest in an appropriate mix of assets so he’ll be prepared with enough money even if his feared economic downturn does occur. Giving up a huge salary when you’re anticipating financial upheaval seems like exactly the wrong move.

Of course, if he really is just burned out and wants to quit, that’s a different conversation. In that case, he’d want to look at what income his assets could generate at a safe withdrawal rate and if he discovers he can afford to quit now, then he should do so and start reaping the benefits that his dedicated investing provides.

Retiring early because you have enough money and are tired of working makes good sense, but retiring ahead of schedule out of fear of an uncertain economic future most likely does not since there are other ways to plan for instability besides giving up the very income you’re so afraid of losing.

The post I’m 50 with a net worth of $5 million. Should I retire early in case the next few years destroy the economy? appeared first on 24/7 Wall St..