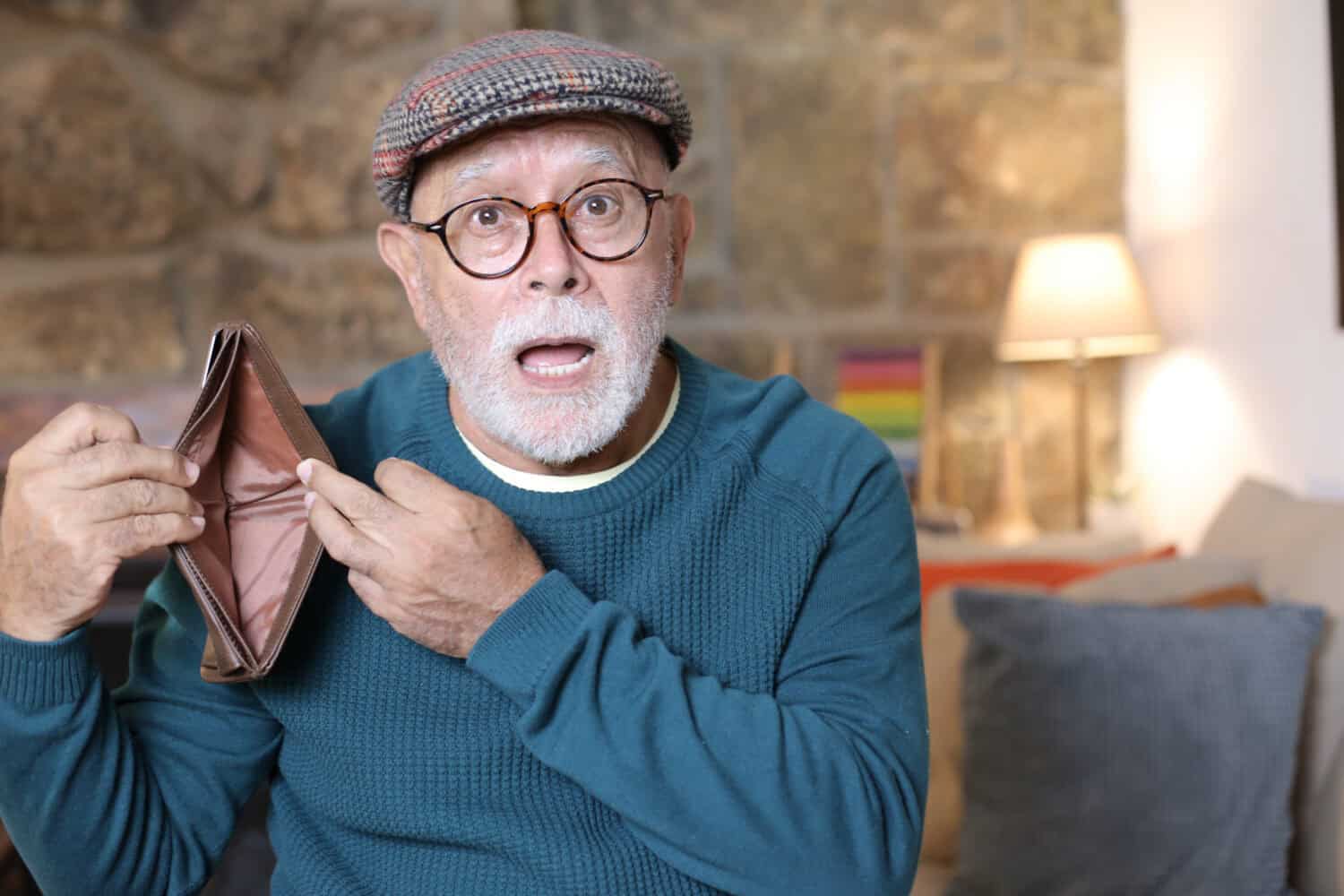

I’m 55 And Have Nothing Saved for Retirement… Help!

If you’re 55 with little or no retirement savings, you’re not alone. A lot of people find themselves reassessing their financial picture later in life, especially with the cost of living climbing and job markets shifting. The good news? You still have time. The key is staying proactive and making smart moves—starting now. Step One: […] The post I’m 55 And Have Nothing Saved for Retirement… Help! appeared first on 24/7 Wall St..

If you’re 55 with little or no retirement savings, you’re not alone. A lot of people find themselves reassessing their financial picture later in life, especially with the cost of living climbing and job markets shifting. The good news? You still have time. The key is staying proactive and making smart moves—starting now.

It is never too late to start saving for retirement, especially if your expectations are reasonable. There are practical things you can do even at 55 to make retirement more affordable.

Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; get started by clicking here here.(Sponsor)

Key Points

Step One: Know Where You Stand

Before you do anything else, get clear on your current financial situation. Write down all your income sources, monthly expenses, and outstanding debts. Be honest. This snapshot will show you where your money’s going and where you can start making changes. Use a spreadsheet or an app like YNAB or Mint to track spending. Awareness is step one in reclaiming control.

Step Two: Set Realistic Retirement Goals

Once you understand your finances, figure out what kind of retirement you’re aiming for. Do you want to travel? Downsize? Live near family? Use that vision to estimate what your annual expenses might be. A good rule of thumb is to aim for 70–80% of your current income in retirement. From there, reverse-engineer how much you’ll need—and how fast you need to save to hit that target.

Step Three: Boost Your Income

At 55, you’ve still got earning power. Consider asking for a raise, switching to a higher-paying job, or picking up a side hustle. Your skills and experience are valuable. Also, the longer you keep working, the more you can save—and the better your Social Security benefits will be when you do retire. Delaying retirement even a few years can make a big difference.

Step Four: Get Serious About Saving

This is the time to go all-in on saving. If your employer offers a 401(k), max it out—especially if they match contributions. If not, open an IRA (Traditional or Roth, depending on your tax situation). People over 50 can make “catch-up” contributions, which raise your annual limits. These tax-advantaged accounts are designed to help you grow wealth fast in your final working years.

Step Five: Invest Wisely

Even with less time to grow your money, smart investing can still play a major role. If you’ve got an emergency fund in place, start putting extra cash into investments that fit your timeline. A mix of low-risk and moderate-growth options—like index funds or balanced portfolios—can help your money grow while limiting downside. Keep it diversified to spread out risk.

Step Six: Cut Back, Strategically

Trimming expenses isn’t about deprivation—it’s about creating space to save. Look at your budget and ask: What can I scale back? Could you downsize your home, reduce car costs, or pause big vacations? Every dollar you free up now is a dollar that can be invested in your future.

Step Seven: Know Your Retirement Benefits

Social Security will likely be a core part of your retirement income, so make sure you understand how it works. The longer you wait to claim benefits (up to age 70), the higher your monthly payments will be. Also check if you’re eligible for any pensions, veteran benefits, or other assistance programs that can supplement your income.

Step Eight: Consider Working in Retirement

Retirement doesn’t have to mean quitting work entirely. Part-time jobs, consulting, or freelance work can help supplement your savings and delay the need to draw from them. Plus, staying active in the workforce—on your own terms—can be rewarding mentally and socially, not just financially.

Step Nine: Use Your Assets Strategically

If you own a home, it could be a major asset. Downsizing, renting out a room, or exploring a reverse mortgage (carefully) are all potential options. Think of your net worth holistically—what you own, not just what you earn.

Step Ten: Talk to a Pro

If all of this feels overwhelming, bring in a financial advisor—ideally one who specializes in retirement planning. They’ll help you make sense of your options, assess your risk tolerance, and put together a clear, actionable plan. Think of them as your personal trainer, but for your money.

It’s Not Too Late

You’re not starting at zero—you’re starting with life experience, work ethic, and a clear goal. And that’s powerful. It’s not about matching someone else’s timeline—it’s about making the most of the one you’ve got. Start today, stay consistent, and keep your eyes on the prize: a stable, secure retirement that works for you.

The post I’m 55 And Have Nothing Saved for Retirement… Help! appeared first on 24/7 Wall St..