I’m 39, debt-free with over $3 million invested, and retiring today – are my numbers too tight for comfort?

A lot of people dream of retiring early. And with enough money, it may be a goal you can pull off. Early retirement can mean different things, though. For some people, it means ending their careers at age 60. For others, it means stopping work at 50. But in this Reddit post, we have […] The post I’m 39, debt-free with over $3 million invested, and retiring today – are my numbers too tight for comfort? appeared first on 24/7 Wall St..

Key Points

-

Retiring very early carries risk.

-

It’s important to be honest about your spending and lifestyle.

-

It’s best to consult a financial professional to make sure your numbers work.

-

Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; get started by clicking here here.(Sponsor)

A lot of people dream of retiring early. And with enough money, it may be a goal you can pull off.

Early retirement can mean different things, though. For some people, it means ending their careers at age 60. For others, it means stopping work at 50.

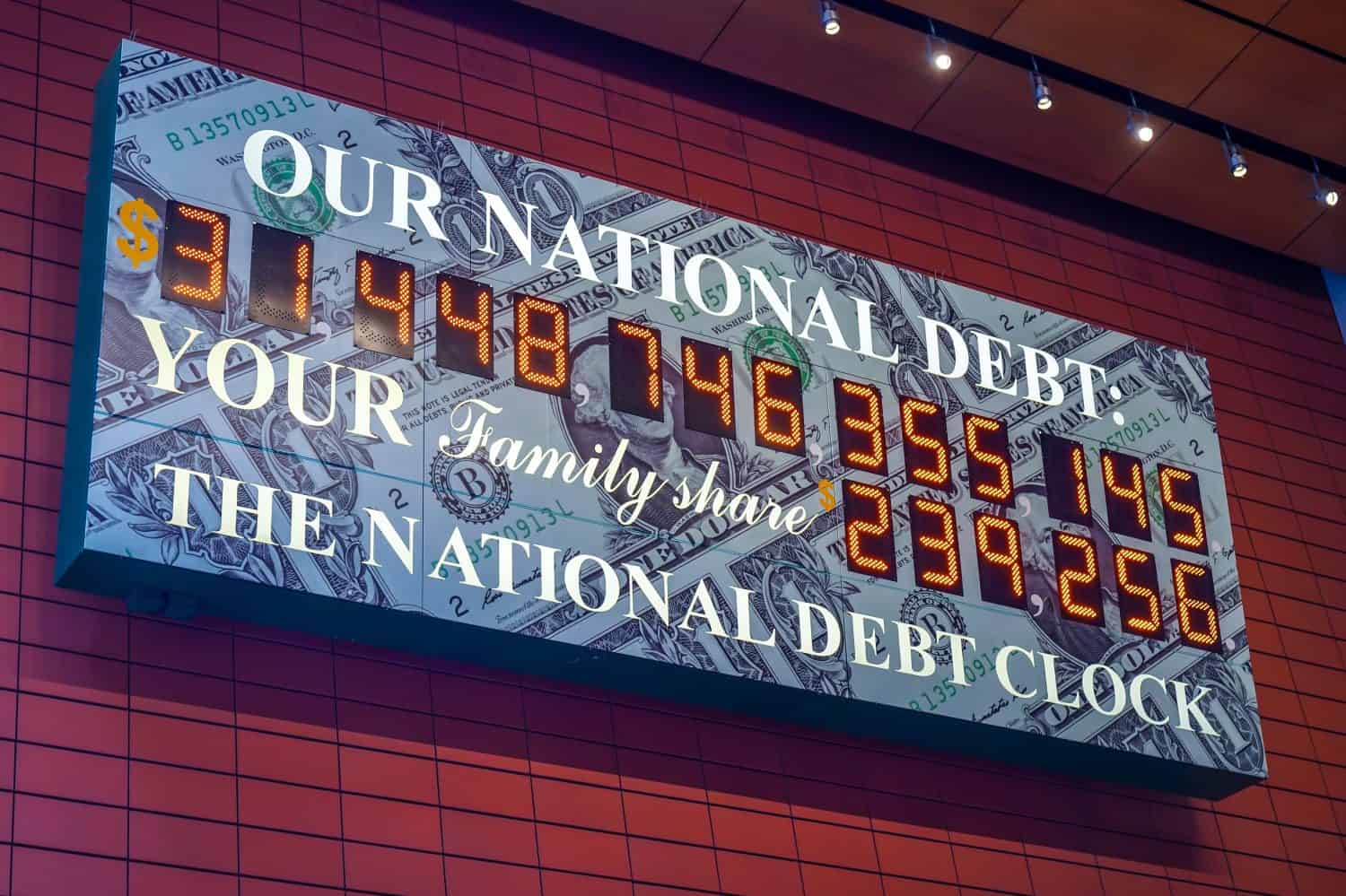

But in this Reddit post, we have 39-year male who’s married to a stay-at-home mom and has two young children. He has a little more than $3 million in investments, plus a home he owns outright and a share in a rental property that brings in $40,000 a year.

He’s wondering if he’s okay to move forward with retirement given his relatively young age. And the answer is, it depends on what he thinks his spending will look like.

It’s a matter of personal expenses

There’s no question that $3 million is a large nest egg — for someone in their 50s or 60s. But for someone who’s 39 years old with young kids, it’s actually not a whole lot. That money could easily run out over time if the poster isn’t careful.

Now the fact that he has $40,000 of income coming in from that rental property helps matters. And it may be that his portfolio is set up with a nice mix of income-producing investments that give him a nice annual income to work with.

But all told, the poster needs to be careful, since his nest egg might need to last for decades. And also, he doesn’t know what child-related expenses lie ahead. Paying for college could also be a challenge.

But that doesn’t mean the poster can’t pull off early retirement. It just means he’ll need to be careful, and perhaps commit to a fairly frugal lifestyle. If he’s willing to do that and, more importantly, will be happy with that, then he has a prime opportunity to be present for his children while they’re young and enjoy time with his family.

It’s a good idea to get a reality check

What the poster is doing here is something risky given his young age. So I would suggest that he consult with a financial advisor to make certain his numbers work.

A financial advisor can help the poster create an annual spending budget based on the income his investments are able to provide. An advisor can also help the poster plan for future expenses that might arise and catch him off guard.

Of course, one thing the poster may want to do is work on a very part-time basis to not only generate income, but stay busy. Once he has two kids in school full-time, he may find that he needs something to do with those daytime hours.

Given his financial situation, even a small amount of income could buy his family some wiggle room with spending. And part-time work could allow his family to travel more and enjoy more experiences together. So it’s something worth considering, even if a financial advisor says that he’s fine without that additional income.

If you’re thinking about retiring very early like the poster above, before you make that decision, it’s a good idea to consult a professional and get their take. At the very least, talking to a financial advisor could help you approach your decision with more confidence.

The post I’m 39, debt-free with over $3 million invested, and retiring today – are my numbers too tight for comfort? appeared first on 24/7 Wall St..