Advanced Micro Devices (AMD) and Teradyne (TER) Are Way Better AI Names Than NVDA Stock Right Now (and It’s Not Even Close!)

Nvidia (NASDAQ:NVDA) has been an artificial intelligence juggernaut, racking up jaw-dropping numbers that make Wall Street drool. Revenue exploded 265% since 2022 to $96 billion in fiscal 2025, with earnings rocketing from $1.74 per share to $24.17 per share — call it a 1,300% spike. The AI chipmaker’s graphics processing units (GPUs) power everything from […] The post Advanced Micro Devices (AMD) and Teradyne (TER) Are Way Better AI Names Than NVDA Stock Right Now (and It’s Not Even Close!) appeared first on 24/7 Wall St..

Nvidia (NASDAQ:NVDA) has been an artificial intelligence juggernaut, racking up jaw-dropping numbers that make Wall Street drool. Revenue exploded 265% since 2022 to $96 billion in fiscal 2025, with earnings rocketing from $1.74 per share to $24.17 per share — call it a 1,300% spike.

24/7 Wall St. Insights:

-

Nvidia (NVDA) has dominated AI and rightly been an investor favorite, but its stock has stalled, opening opportunities for challengers.

-

Because AI is still in its infancy and is growing far beyond just GPUs, there are a multitude of ways for investors to play the space with solely betting on one stock to win.

-

Nvidia made early investors rich, but there is a new class of ‘Next Nvidia Stocks’ that could be even better. Click here to learn more.

The AI chipmaker’s graphics processing units (GPUs) power everything from ChatGPT to self-driving cars, cementing a track record that’s pure gold. But trading under $118 today, it’s down 23% from its $172 peak as supply chain snags and China export curbs crimp the party. That $2.9 trillion market cap still screams premium, with a P/E of 40 dwarfing the S&P 500’s 28. This isn’t a collapse of Nvidia, just chinks in its armor. It provides a wedge for challengers to its dominance.

AI is a sprawling landscape, and other players are muscling in with fresh angles. Nvidia’s bottlenecked production and trade-war headaches mean rivals can snag market share where it stumbles. The two AI bets below are stocks investors should consider for the next leg of the technology’s growth trajectory.

While Nvidia is still king, its hiccups spotlight these underdogs as better buys today. The growth is there without the nosebleed price tag so let’s see why they are worth your cash.

Advanced Micro Devices (AMD)

Just as pork is “the other white meat” to chicken, Advanced Micro Devices (NASDAQ:AMD) is “the other AI stock” to Nvidia. Despite a solid fourth-quarter earnings report that saw the chipmaker beat analyst expectations on the top and bottom line, investors were disappointed by guidance that didn’t offer up the kind of robust growth they expected in the space.

All anyone was really interested in was AMD’s data center segment, which came in lower than the $4.14 billion forecasts at $3.86 billion. Investors got spooked even though that represented a 69% year-over-year jump, with $5 billion from its Instinct GPUs. AMD had no AI business a year ago and it is growing rapidly now, but it highlights the problem of giving your competition such a big, early lead.

AMD stock is also cheaper than NVDA, trading at a P/E of 30 versus Nvidia’s 40, and its $168 billion market cap has room to run. Data center revenue nearly doubled in 2024 (up 94%), and CEO Lisa Su’s “double-digit growth” call for 2025 maintains the momentum, even if slightly delayed. Nvidia’s supply woes and the curbs on China exports — the country represents 31% of Nvidia’s sales — bite harder than they do at AMD’s (26% of sales).

AMD has tailwinds of its own, including its MI325 GPUs that are expected to launch in mid-2025, followed by the MI350 and MI400 series in the second half of the year. They are more powerful GPUs targeting inference workloads, which will be AI’s next boom. There is more upside potential in AMD stock than the downside risk inherent in Nvidia’s shares.

Teradyne (TER)

Teradyne (NASDAQ:TER) is the second stock to buy to topple Nvidia as an AI beast, and it’s flying under the radar at $89 per share. The stock is down almost 30% year-to-date, but it has significant long-term growth potential.

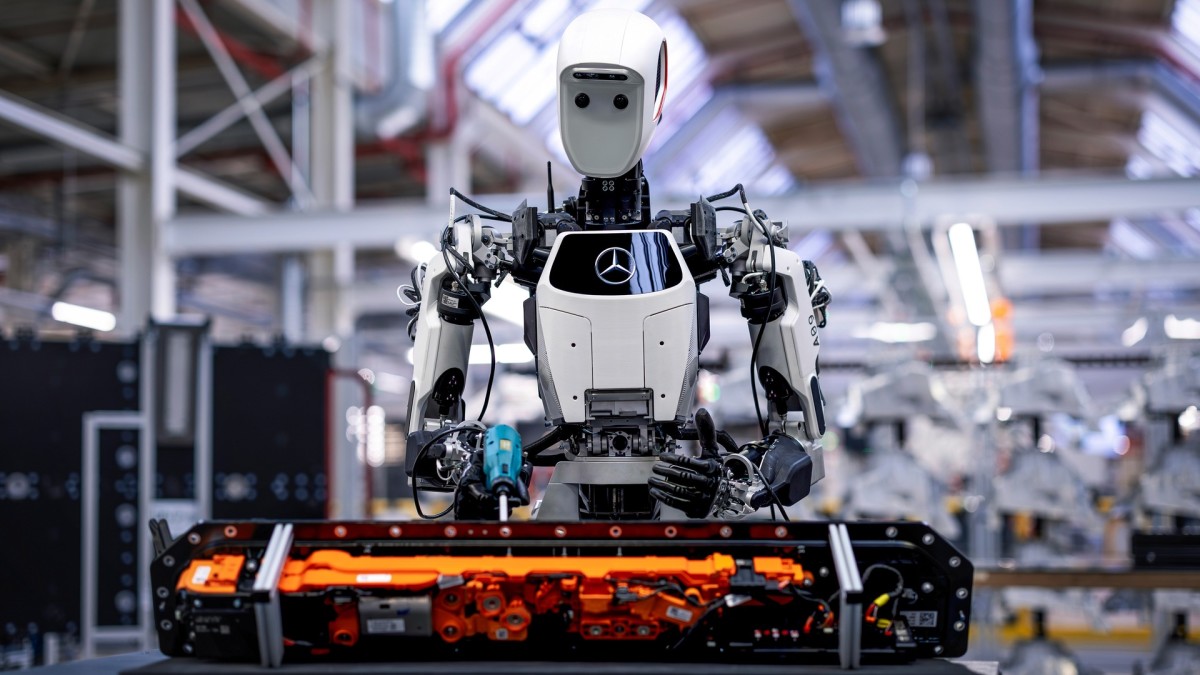

Nvidia itself has pointed to robotics as a coming phase of major growth for the AI industry. Teradyne isn’t exactly a robot-maker, but rather its gear tests chips and automates factories, making it a linchpin for AI’s infrastructure. And it is quietly stacking wins.

Fourth-quarter revenue rose 12% to $753 million, easily beating $736 million estimates while adjusted earnings hit $0.95 per share, topping $0.90 forecasts, with semiconductor testing riding a 30% AI-driven surge. Robotics chipped in $98 million, making it flat but steady and poised to capitalize on the uptake in the next phase in AI’s trajectory.

Teradyne’s new AI-powered testing rigs, which debuted at Nvidia’s GTC 2025 this week, juice precision and cut errors, allowing for robots to have fewer meltdowns, more uptime, and increasing their productivity, padding TER’s bottom line.

A meaningful recovery in Teradyne’s core smartphone market and increasing AI-related demand should drive compute and memory-related revenue growth over the next few years. Let’s not forget the ongoing on-shoring and capacity expansion underway in the semiconductor market as tech companies seek to derisk their China exposure as a significant tailwind for Teradyne.

Buying TER now is admittedly getting in early before the AI robotics shift is in full swing. But it trades at a fantastic discount to Nvidia’s and TER’s lean $19 billion size and P/E of 27 make it a cheap alternative to Nvidia. While dips in chip demand could sting, Teradyne’s robotics pivot and $1.2 billion cash pile give it plenty of muscle to invest and grow over the long haul.

The post Advanced Micro Devices (AMD) and Teradyne (TER) Are Way Better AI Names Than NVDA Stock Right Now (and It’s Not Even Close!) appeared first on 24/7 Wall St..