I think a recession is coming- Is it a bad idea to convert 90% of my 401(k) into cash?

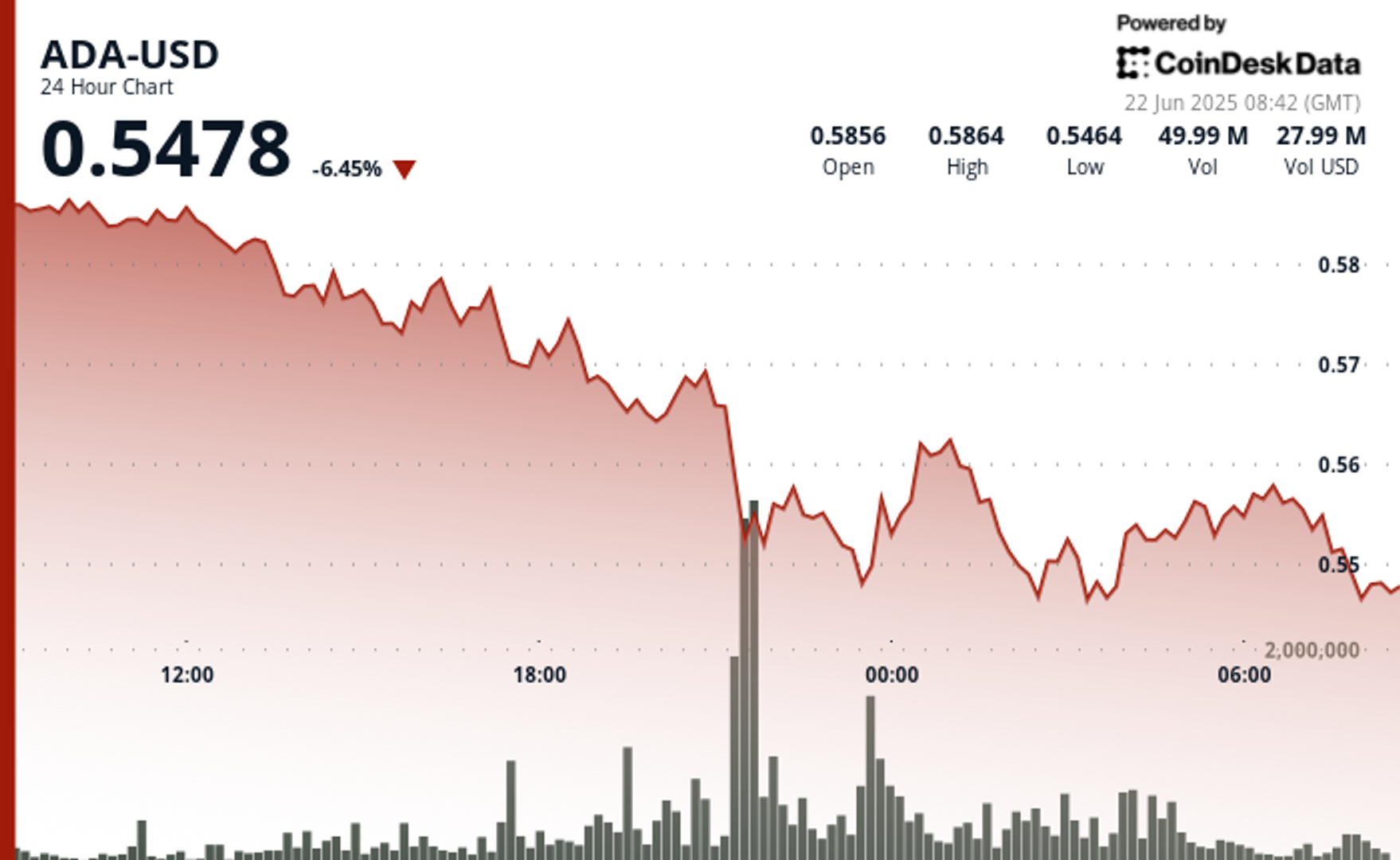

The last 2 years have been excellent regarding returns from the S&P 500. So, investors are understandably a bit concerned. Will the momentum from 2023 and 2024 continue? Or is the lucky streak over? Expert Scott Wren predicts continued returns, though modest, at only 10%. However, no expert is infallible, and many investors wonder if […] The post I think a recession is coming- Is it a bad idea to convert 90% of my 401(k) into cash? appeared first on 24/7 Wall St..

The last 2 years have been excellent regarding returns from the S&P 500. So, investors are understandably a bit concerned. Will the momentum from 2023 and 2024 continue? Or is the lucky streak over? Expert Scott Wren predicts continued returns, though modest, at only 10%. However, no expert is infallible, and many investors wonder if they should pull back.

One Reddit user on r/fatFIRE revealed their anxiety about the situation. Due to fears of a potential recession, they plan to liquidate 90% of their 401(k). However, such a drastic financial move may not be the best option. The debate sparked in the forum raises many questions.

In this slideshow, we discuss what causes recent economic fears, why market timing is of utmost importance, and how smart financial guidance can ease anxiety. If you are wondering what move to make in the current financial climate, this content might help you decide whether to ride it out or sell quickly.

Why Investors Are Worries About 2025

- After two consecutive years of strong S&P 500 returns, some fear the streak won’t continue.

- Wells Fargo estimates more modest 2025 returns, closer to 10%, which has triggered investor caution.

A Redditor Plans to Exit the Market

- A user on r/fatFIRE wants to move 90% of their 401(k) into cash due to recession fears.

- This extreme move shows how emotional reactions can influence major financial decisions.

Why Timing the Market is Risky

- Trying to guess when markets will rise or fall is notoriously difficult and rarely pays off.

- Even seasoned economists struggle to predict recessions and market reactions with accuracy.

The Market Has Been Strong, But Not Unprecedented

- Though recent gains are impressive, the overall market return since late 2021 is about 28.3%.

- That figure aligns more with long-term expectations than a speculative bubble.

Don’t Let Fear Dictate Your Strategy

- Emotional decisions often lead to poor outcomes in investing.

- It’s better to evaluate your personal circumstances and goals than to react to market headlines.

What To Do Instead of Cashing Out

- Consider rebalancing or trimming overvalued assets rather than fully exiting the market.

- Maintain some liquidity but remain invested for long-term growth.

The Danger of Going All-In or All-Out

- Going 100% into cash or staying 100% invested can both carry risks.

- A diversified strategy allows for flexibility as markets shift.

How Advisors Can Help

- If your financial circumstances change, speak to an advisor before making big moves.

- A professional can help tailor your investment plan to your needs and risk tolerance.

Key Lessons for Long-Term Investors

- Stay focused on long-term goals, not short-term noise.

- Keep dry powder for buying opportunities, and avoid letting fear guide your strategy.

The post I think a recession is coming- Is it a bad idea to convert 90% of my 401(k) into cash? appeared first on 24/7 Wall St..