I Have $600,000 at 29 — Should I Rely Solely on the Stock Market or Diversify?

In this piece, we’ll check in on the curious case involving a Reddit user who’s managed to save up $600,000 before turning 30. Undoubtedly, it’s an impressive feat that puts this r/Fire poster well ahead of the game as they look to reach their FIRE (Financial Independence, Retire Early) number, perhaps as early as their […] The post I Have $600,000 at 29 — Should I Rely Solely on the Stock Market or Diversify? appeared first on 24/7 Wall St..

In this piece, we’ll check in on the curious case involving a Reddit user who’s managed to save up $600,000 before turning 30. Undoubtedly, it’s an impressive feat that puts this r/Fire poster well ahead of the game as they look to reach their FIRE (Financial Independence, Retire Early) number, perhaps as early as their mid-to-late 30s. As someone who’s relatively young, it’s worth being more aggressive with one’s asset allocation.

Whether that entails a heftier concentration on stocks or a slight emphasis on the high-growth tech companies, someone who’s in such a situation should definitely have growth (rather than income and volatility avoidance) at the top of mind. And while taking smart, calculated risks to enhance the growth profile of one’s retirement nest egg makes sense, one should be careful to steer clear of the extremely risky asset classes that could entail percentage losses in excess of 80% or even 90%. In short, there are a plethora of fantastic growth assets out there that don’t entail risking most of one’s invested principal (think some crypto coin that’s been smoking hot of late).

Key Points

-

Staying all-in on stocks can make sense for some young investors who are fully focused on growth.

-

Diversifying into other safer asset classes still makes sense for those with larger sums to invest.

-

Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; get started by clicking here.(Sponsor)

Younger investors should embrace stocks.

For someone who’s soon to be in their 30s, there are many decades’ worth of time to recover from any steep crashes suffered by the stock market. So, someone in such a fortunate spot should definitely stay (mostly) invested in stocks, arguably the best asset class to get ahead and build real wealth.

As for asset allocation, some DIY investors go for the rule of 120, which entails subtracting one’s age from 120 to get a target percentage of a portfolio to be put in stocks. For our Reddit user, that number would be close to 90% in stocks. A more conservative variant entails just subtracting one’s age from 100 to get the bond allocation. In this case, it’d be 20% in bonds, leaving 80% to be invested in equities.

Though I have no issue with either rule of thumb, I do think it makes more sense to get a more tailored approach from a financial advisor. At the end of the day, age determines the ability to take on risk, but not the willingness. And given unique circumstances (for instance, an early retirement at some point in the next five years), the services of a fiduciary seem like they’d be well worth the fees paid.

While young people can afford to take more risks with a more aggressive, stock-heavy asset allocation, does it make sense to diversify and derisk if one plans to retire early?

For our Reddit user, it makes plenty of sense to diversify beyond a run-of-the-mill index fund that mirrors the broad S&P 500, especially if their expected retirement falls within the next three to five years. Of course, someone who’s young and focused on early retirement may have a bit of flexibility when it comes to the retirement date.

Diversification makes sense, even for young investors who can handle more investment risk.

Indeed, if our Reddit user would be okay with delaying their retirement plans in the face of a crisis, I’d say it’s fine to stay a bit heavier in stocks versus bonds for better expected returns over the long haul. That said, if our Reddit user is keen on retiring in a few years and would be devastated if they were forced to stay at work until their 40s or 50s, I’d say diversification just makes sense.

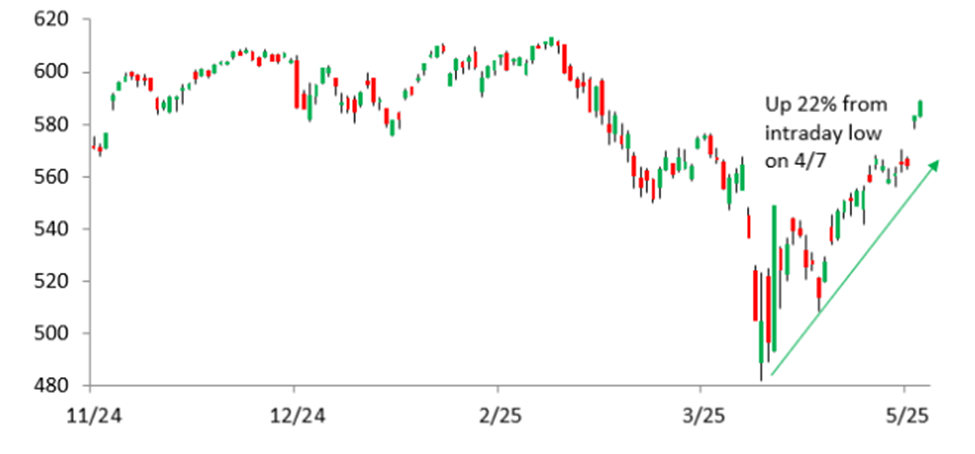

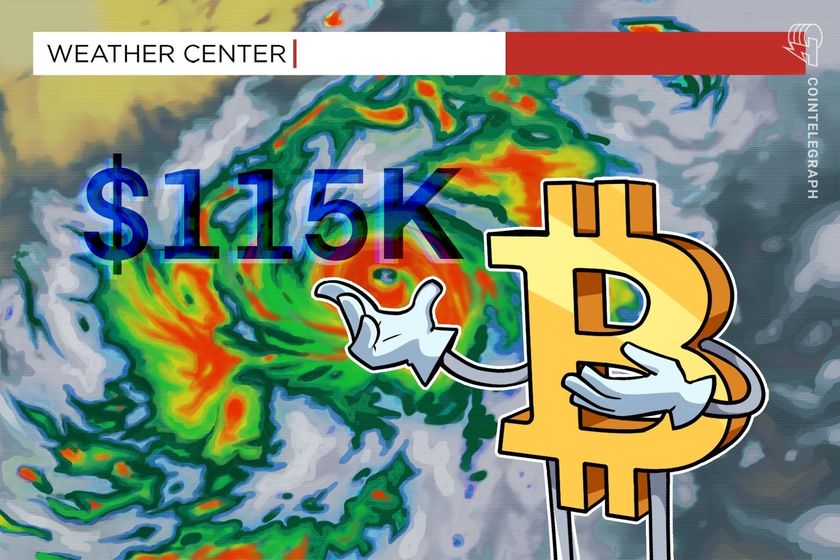

At the end of the day, stocks don’t always ascend. Bear markets happen, and in the face of Trump tariffs, there’s serious concern that the trajectory for stocks could be a lot bumpier. Some big-money investment managers have been derisking in recent quarters, and that’s only prudent in the face of tariff unknowns.

And while a 30-year-old could certainly handle more risk to be had from a near-100% allocation to stocks, I’d argue that our Reddit user has a lot of money invested and they should ask themselves if they’d be fine if their portfolio were to shed more than $300,000 of its value over the medium term. If not, diversification is a smart idea, even if it comes at the cost of growth. The case for CDs (Certificates of Deposit), bonds, bond funds, and precious metals just makes sense, especially for a young person with a huge portfolio.

So, in short, do stay invested in stocks, but do think about diversifying into other asset classes as well.

The post I Have $600,000 at 29 — Should I Rely Solely on the Stock Market or Diversify? appeared first on 24/7 Wall St..