I Feel Like I’m Killin’ It with Saving – Here’s How I Budgeted My Expenses This Year

Building up a savings account is a fantastic achievement for anyone who lives an everyday, non-FIRE life (financial independence, retirement early). This is challenging as it’s hard to remember to put aside money these days, so saving anything should be praised. This is the exact achievement one Redditor posting in r/MiddleClassFinance is feeling right now. […] The post I Feel Like I’m Killin’ It with Saving – Here’s How I Budgeted My Expenses This Year appeared first on 24/7 Wall St..

Building up a savings account is a fantastic achievement for anyone who lives an everyday, non-FIRE life (financial independence, retirement early). This is challenging as it’s hard to remember to put aside money these days, so saving anything should be praised.

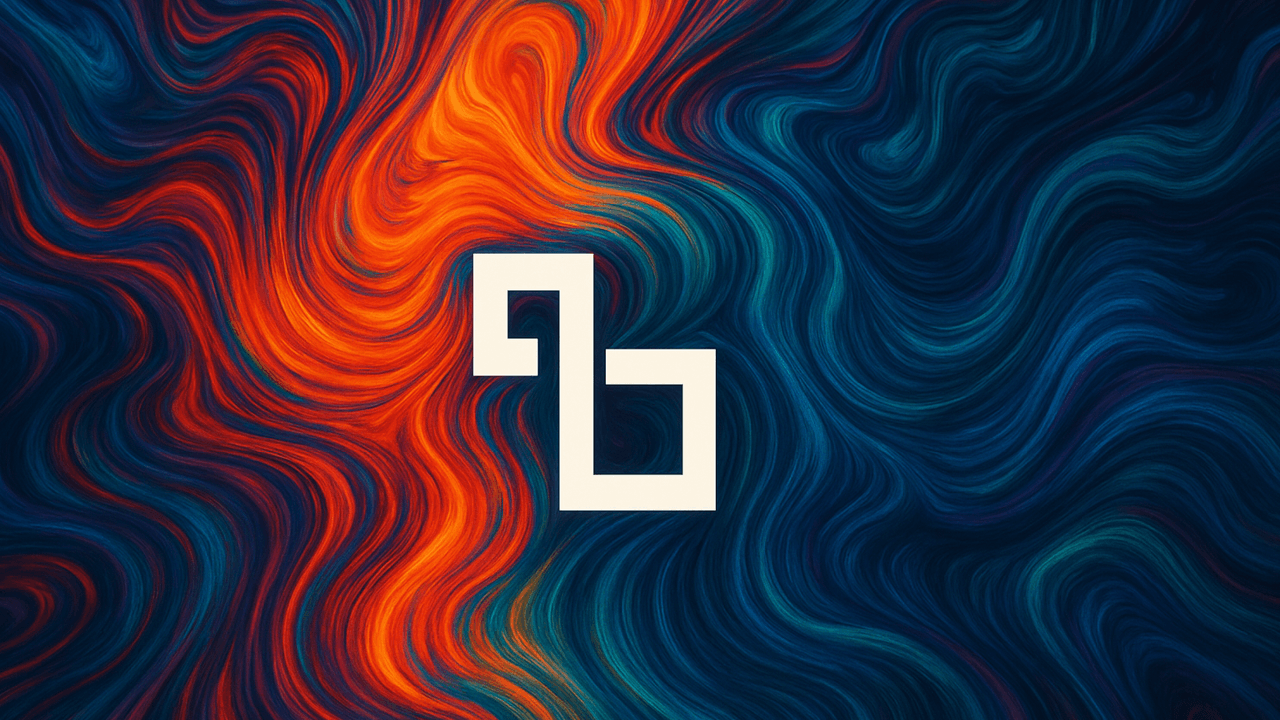

This Redditor is using an iPhone app to track their savings in a very easy-to-follow way.

Using this app, they have saved hundreds of dollars per month.

The hope is that, if their income increases, they can set aside even more money in the future.

Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; get started by clicking here.(Sponsor)

Key Points

This is the exact achievement one Redditor posting in r/MiddleClassFinance is feeling right now. Saying they “are killin’ it with savings so far this year” warrants praise from the Reddit comment section. The best part is that it doesn’t matter if they are saving hundreds of thousands, as long as they are saving.

The reality is that anytime someone decides to be smart with finances, put money away, and try to enjoy life a little, reality sets in, as it’s incredibly difficult to accomplish these days.

The Situation

In this individual’s case, they are looking at having an income of around $7,850 over the last three months. At the same time, they have only spent around $6,009.76, giving them $1,840.24 as savings over this three-month period. This is incredible! If they can keep up this same pace, you’re talking about being able to put aside $7,360 for the whole year.

If they did nothing else and invested this money for the next 30 years, earning an average of 6% annually, they would walk away with $42,272.10. This is nothing to shrug off, especially considering that if they put away the same amount every year, for the next 30 years, they will wind up with $623,824, which is a fantastic number to look at as a potential retirement fund beginning.

In this case, they don’t plan to spend more on TCG, which accounted for $330 as they looked to complete one more trading card set. The coffee, at $329.60, is good for six months as they paid up front, so the reality is that there are even more savings the original poster can look to put away this year.

Better yet, the phone price of $264 is for the whole year, while the pricey cat expense includes annual vaccinations and one grooming session, so it’s another set of costs that only happen once annually. In other words, there is likely another $500 – $1,000 that isn’t accounted for, which the Redditor can put aside as savings over the next three months.

The Budget

Using an app from the App Store on their iPhone, the Reddit user set up a system that helps them see precisely what their expenses are going toward. Of course, it is no surprise that multiple Redditors in the comment section ask where to get this app.

The layout is clear and concise, and it’s easy for the Redditor and everyone reading this subreddit to get a clear sense of what is happening. This allows us to see that at first glance, it looks as if they are only spending $3 per day on food, which is not the whole picture. Even though the poster acknowledges being lean on food spending, they grocery shop monthly.

In the comment section, the Redditor acknowledges saving around $600 out of their $2,600 monthly budget, which is pretty great. The hope is that, based on this picture, they will likely save a lot more.

The thing is, looking at this budget, there is likely to be a whole lot of additional savings coming this Redditor’s way if they can find a job with more earnings. Yes, they should increase their food budget a little, but it doesn’t look like other expenses would need to increase all that much, so the savings amount can jump up nicely.

Congratulations to this Redditor, who is doing a fantastic job by using an app to measure precisely what they are spending to figure out what they can set aside. If everyone followed this advice more closely, there is a good chance you would also find some additional savings.

The post I Feel Like I’m Killin’ It with Saving – Here’s How I Budgeted My Expenses This Year appeared first on 24/7 Wall St..