How high can XRP price go?

Key takeaways:XRP has surged 65% in a month, with technicals pointing to another 45% rally.Liquidation heatmap shows $2.68 as key resistance; a breakout could drive price toward $2.87Symmetrical triangle patterns suggest long-term targets of $5.24 and even $17, based on Fibonacci projections.XRP (XRP) has surged 65% in a month, rebounding from a $1.61 low to $2.65 by May 14, driven by whale accumulation and easing US-China trade tensions.XRP/USD daily price chart. Source: TradingViewHow high can XRP’s price go from here? Let’s examine.XRP rising wedge hints at 45% rally nextXRP has broken out of a multimonth falling wedge pattern, aiming for a potential upside target near $3.69 by June, up around 45% from the current price levels. XRP/USD three-day price chart. Source: TradingViewThe breakout outlook is picking up additional support from XRP’s 20-3D (purple) and 50-3D (red) exponential moving averages (EMA).However, if the price falls back below the wedge’s upper trendline and loses support at these EMAs, the bullish setup could be invalidated, risking a decline toward the lower trendline near $1.75.XRP liquidation heatmap hints at $2.68-2.87The Binance XRP/USDT liquidation heatmap reveals key liquidity zones where large liquidation events may occur. These levels often act as magnet zones, influencing price direction based on the amount of liquidity at a given level.XRP/USDT three-month liquidation heatmap (Binance). Source: CoinGlassA large concentration of leveraged positions near $2.68 marks it as a key resistance level, with around $17.33 million in potential liquidations. XRP nearly tested this level on May 14. A decisive break above $2.68 could trigger a short squeeze scenario, forcing liquidations and potentially driving the price toward the next major liquidity zone at $2.87.XRP price symmetrical triangle points to $17XRP is showing signs of breaking out of a symmetrical triangle forming on the 2-week chart since 2025’s beginning, which may lead to a broader bullish continuation trend in the coming months.XRP/USD two-week price chart. Source: TradingViewSymmetrical triangle breakouts typically lead the price higher by as much as the pattern’s maximum height. This technical rule brings XRP’s upside target to around $5.24, a level which aligns with the 1.618 Fibonacci retracement line.Related: Can XRP price reach $4 in May? Analysts are watching these key levelsApplying the same rule on XRP’s multiyear symmetrical triangle, which entered its breakout stage in November 2024, the upside target is over $17.This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Key takeaways:

XRP has surged 65% in a month, with technicals pointing to another 45% rally.

Liquidation heatmap shows $2.68 as key resistance; a breakout could drive price toward $2.87

Symmetrical triangle patterns suggest long-term targets of $5.24 and even $17, based on Fibonacci projections.

XRP (XRP) has surged 65% in a month, rebounding from a $1.61 low to $2.65 by May 14, driven by whale accumulation and easing US-China trade tensions.

How high can XRP’s price go from here? Let’s examine.

XRP rising wedge hints at 45% rally next

XRP has broken out of a multimonth falling wedge pattern, aiming for a potential upside target near $3.69 by June, up around 45% from the current price levels.

The breakout outlook is picking up additional support from XRP’s 20-3D (purple) and 50-3D (red) exponential moving averages (EMA).

However, if the price falls back below the wedge’s upper trendline and loses support at these EMAs, the bullish setup could be invalidated, risking a decline toward the lower trendline near $1.75.

XRP liquidation heatmap hints at $2.68-2.87

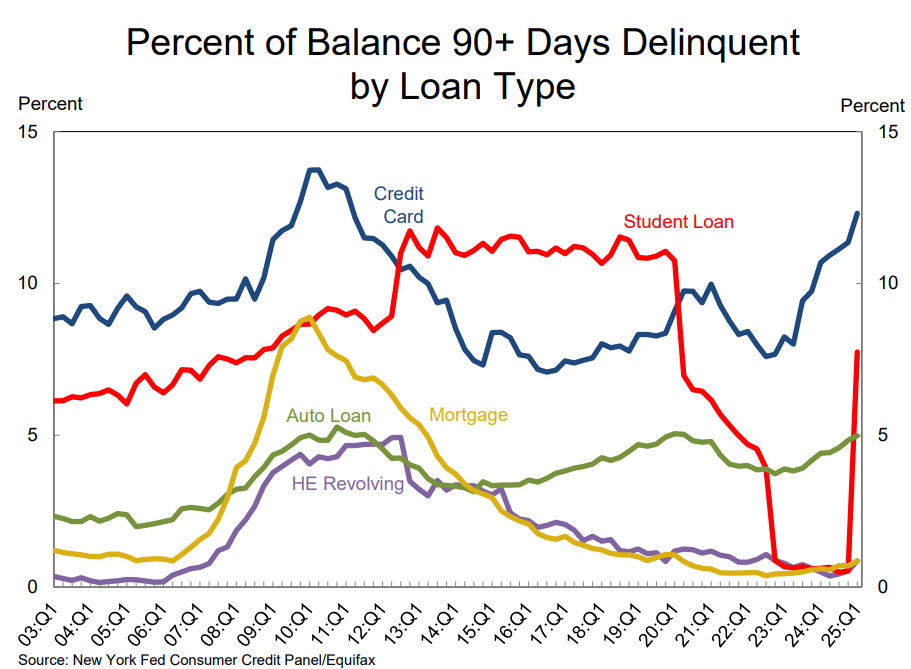

The Binance XRP/USDT liquidation heatmap reveals key liquidity zones where large liquidation events may occur. These levels often act as magnet zones, influencing price direction based on the amount of liquidity at a given level.

A large concentration of leveraged positions near $2.68 marks it as a key resistance level, with around $17.33 million in potential liquidations. XRP nearly tested this level on May 14.

A decisive break above $2.68 could trigger a short squeeze scenario, forcing liquidations and potentially driving the price toward the next major liquidity zone at $2.87.

XRP price symmetrical triangle points to $17

XRP is showing signs of breaking out of a symmetrical triangle forming on the 2-week chart since 2025’s beginning, which may lead to a broader bullish continuation trend in the coming months.

Symmetrical triangle breakouts typically lead the price higher by as much as the pattern’s maximum height. This technical rule brings XRP’s upside target to around $5.24, a level which aligns with the 1.618 Fibonacci retracement line.

Related: Can XRP price reach $4 in May? Analysts are watching these key levels

Applying the same rule on XRP’s multiyear symmetrical triangle, which entered its breakout stage in November 2024, the upside target is over $17.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.