How Do Cash Back Credit Cards Really Work Today?

As the most popular credit card type, you can use cash-back credit cards everywhere. No matter what name or issuer is on your card, there are bound to be some excellent benefits available, including the opportunity to earn “free money” just for shopping. For most people, these cards are already in their wallets, but there […] The post How Do Cash Back Credit Cards Really Work Today? appeared first on 24/7 Wall St..

As the most popular credit card type, you can use cash-back credit cards everywhere. No matter what name or issuer is on your card, there are bound to be some excellent benefits available, including the opportunity to earn “free money” just for shopping.

Cash-back credit cards are widely regarded as the most popular type of credit card.

There are also a ton of different cash-back credit card options you can choose from today.

Flat-rate cards are very popular, but you can also choose from rotating category options.

The right cash back credit card can earn you hundreds, or thousands of dollars a year for free. Click here now to see our top picks. (Sponsor)

Key Points

For most people, these cards are already in their wallets, but there has long been a lingering question on places like Quora of exactly how they work. In many cases, it is as simple as just swiping and earning, but there are a few nuances between the various cards you can pick from today.

What Is Cash Back?

First and foremost, it’s essential to understand precisely what cash back means. In the case of credit cards, it refers to a type of reward you receive with every purchase made using your credit card. These rewards can then be redeemed in various ways, often depending on the specific card.

Most cards will let you redeem your rewards for statement credits or depositing into a bank account, but some may let you use the money for gift cards or some other kind of redemption, like travel points.

Additionally, it’s also important to note that cash-back balances typically don’t update when a purchase is completed. This means you may not see your reward money appear until after you have paid off the purchase, which could be at the end of each billing cycle. In other words, if you make a purchase today, you won’t be able to redeem the cash back rewards from that purchase tomorrow morning.

What Doesn’t Cash Work On

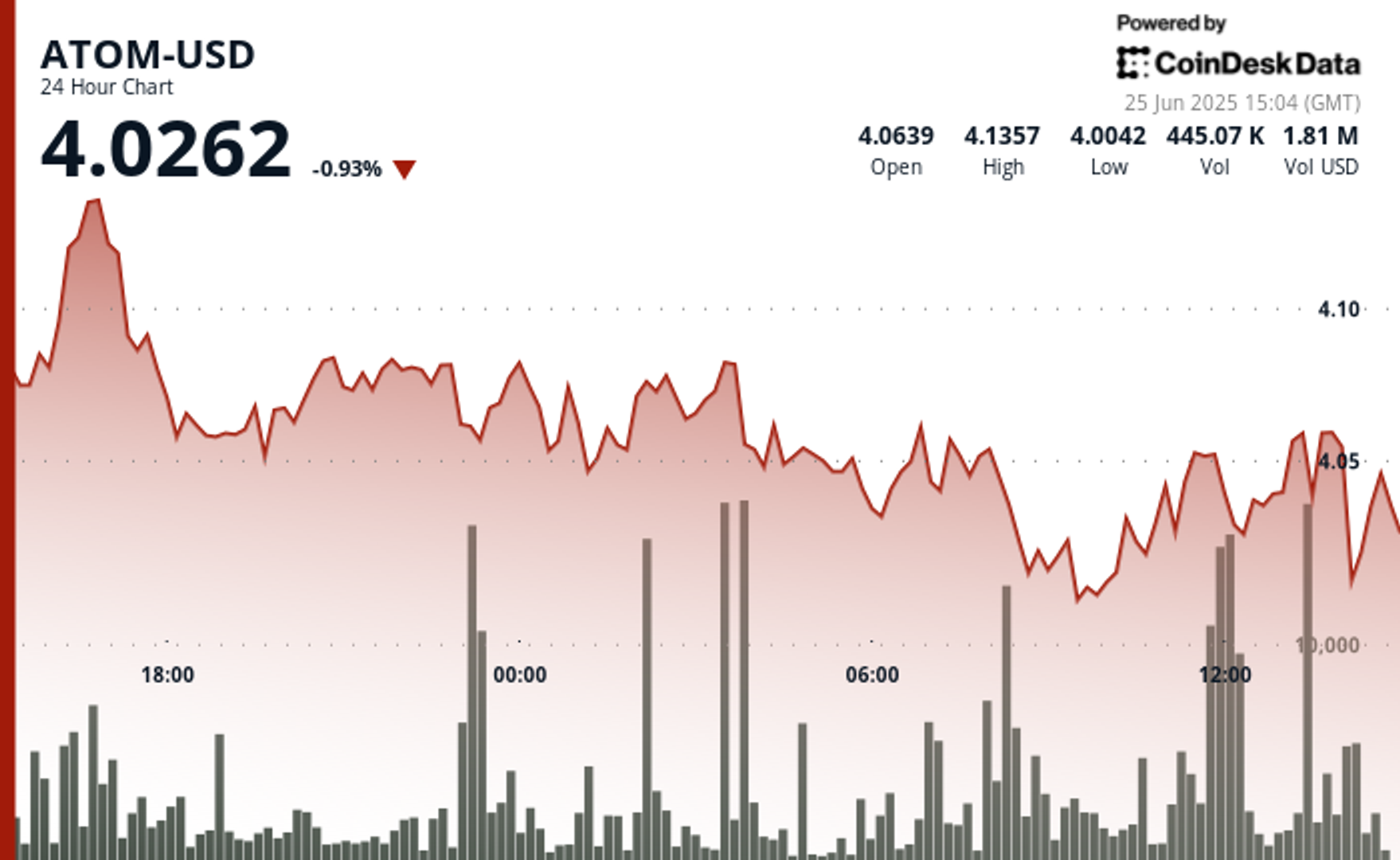

Another important reminder is that cash back rewards don’t apply to every purchase made with a credit card. This includes, but is not limited to, cash advances, lottery tickets, gambling-related purchases, cash-like transactions such as cryptocurrency or money orders, or balance transfers. This means that no matter how much you spend on any of these purchase types, you won’t see any kind of cash balance.

How to Earn Cash-Back Rewards

Flat-Rate Cards

At the top of the list, flat-rate cards are widely considered the most common type of cash-back card. These cards frequently offer a reward amount between 1.5% to 2% for every transaction you make. This means that every $1,000 you spend every month, you will earn between $15 and $20.

Rotating Category Cards

Another very popular type of cash back rewards is the rotating category card, which frequently offers up to 5% cash back on every purchase in this category each quarter. Popular cards in this lineup include the Chase Freedom Flex and Discover it cards.

These cards offer rotating bonus categories every three months, which can include grocery stores, home improvement stores, or drugstores, as well as locations like Walmart, Target, and Amazon. Any purchase made in this category, when active, will earn you 5% cash back with every purchase, while all other purchases likely earn 1% cash back.

Tiered Reward Cards

The third category in the cash-back credit card world is the tiered rewards card, which offers varying percentage rewards based on the category of purchase. For example, the Blue Cash Preferred Card from American Express offers 6% cash back on groceries and streaming subscriptions, 3% on public transportation and gas, and 1% cash back on all other purchases.

Additional Benefits

In addition to the cash-back rewards that come with this card type, there are also a host of other benefits you can take advantage of. This includes benefits like an extended warranty, where using a cash-back credit on an item, such as an iPhone purchase, effectively doubles the manufacturer’s warranty.

In other words, Apple will give you a one-year warranty on the iPhone, while your cash-back credit will offer a second year of warranty protection. Along with an extended warranty, some cash-back credit cards offer purchase protection, which means that if you buy an iPhone on January 1 and the price drops anytime within the next 90 days, the credit card company will refund you the difference if the retailer does not.

Of course, there are also other benefits you could use from time to time, like auto rental coverage that is secondary to your primary insurance. There are also a few cards, such as the Wells Fargo Active Cash-back card, that will give you up to $600 in the event you lose or damage your cell phone, as long as you purchased it with the card.

The post How Do Cash Back Credit Cards Really Work Today? appeared first on 24/7 Wall St..