Harvey raises $300 million at $5 billion valuation to be legal AI for lawyers worldwide

Legal LLM Harvey has raised a $300 million Series E at a $5 billion valuation.

Happy Monday. It’s Alexandra Sternlicht subbing for Allie.

Today, we’re sharing news that legal LLM Harvey raised a $300 million Series E at a $5 billion valuation. The company, which sells lawyers AI solutions, lists large law firm customers like Paul, Weiss as well as in-house legal departments at major corporations, including KKR and PwC. With the fresh funding, Harvey plans to double its headcount to expand its global presence and diversity into new professional services like tax accounting.

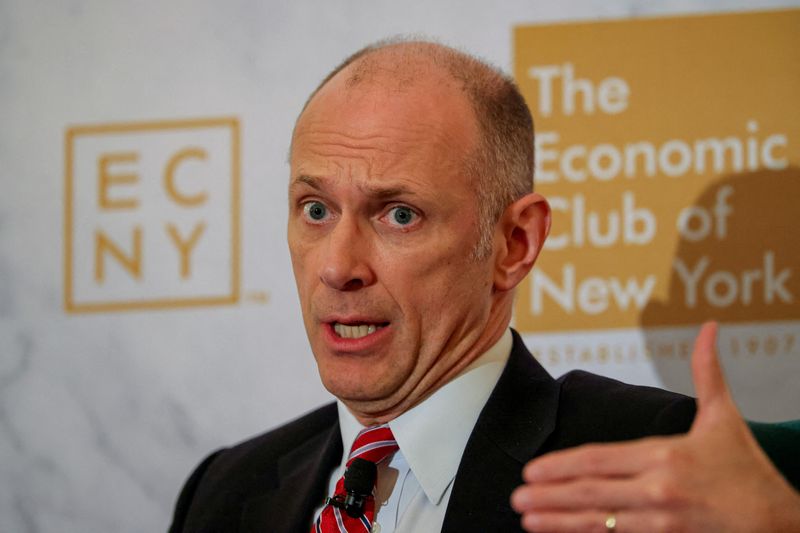

“If you expand as quickly as we are, you just need to do raises like this,” says Winston Weinberg, who is the company’s CEO, cofounder and a lawyer. Though Harvey is only about three years old, it has clients in 53 countries and boasts a 340-plus person headcount.

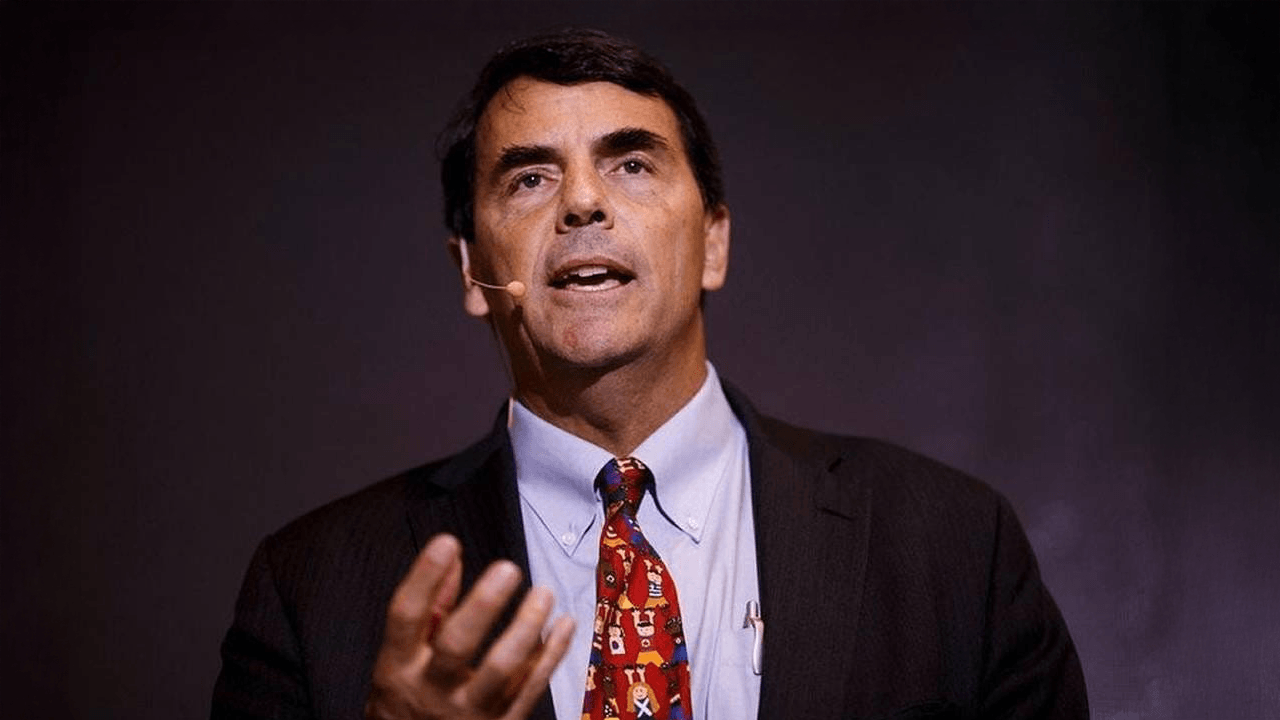

The Series E is co-led by Kleiner Perkins and Coatue. It counts Sequoia, GV, DST Global, Conviction, Elad Gil, Open AI Startup Fund, Elemental, SV Angel, Kris Fredrickson and REV (the VC group LexisNexis owner RELX Group) as participants.

On Friday, I had the pleasure of visiting Harvey’s swanky Park Avenue NYC headquarters. And it was filled with lawyers. Lawyers in the kitchen. Lawyers spinning in ergonomic chairs. Lawyers smiling and waving at me.

Though CEO Weinberg notes that the lawyer-workforce is unique to the company’s New York office, and that only 18% of its headcount is lawyers, he believes that these attorney-employees are essential to achieve Harvey’s goal of “partnering” with the industry. So far the strategy is working: Harvey boasts 337 legal clients.

Long before OpenAI released its first ChatGPT bot, entrepreneurs have been trying to make AI lawyers a thing. These companies have largely failed. Harvey, by its investors’ accounts, is not failing.

“We’ve seen the company perform incredibly well across all facets,” Kleiner Perkins’ partner Ilya Fushman, who co-led this round as well as Harvey’s Series B and C, tells me. “It sets the blueprint for how a vertical AI enterprise company can build and execute.”

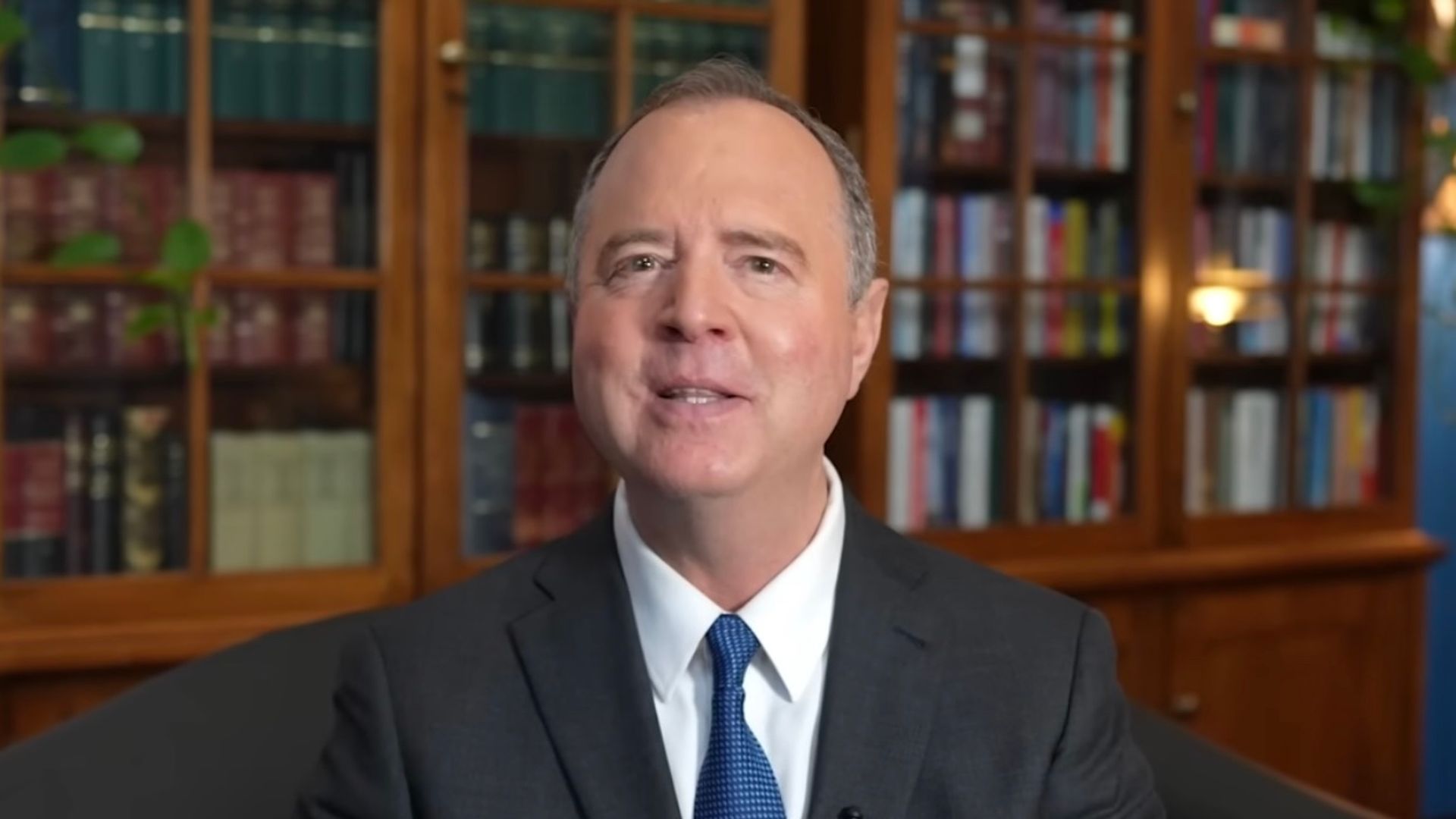

Still, Harvey is just one solution in the crowded field of AI lawyers that aim to disrupt the $1 trillion legal market. Though it could be meaningless in the long-run, with this funding, Harvey has nabbed the highest public valuation of any legal AI startup. Competitors Ironclad raised a 2022 Series E at a $3.2 billion valuation and Clio raised a 2024 $900 million Series F at a $3 billion valuation.

Harvey’s technology is built atop leading large language models—OpenAI’s ChatGPT, Claude’s Gemini and so on and combined with data and work flows designed for and by lawyers. It also customizes its models on firm-specific data by feeding the tech proprietary documents that remain private to the firm. While the security and privacy of client data is obviously critical in legal matters, Harvey says it meets industry-recognized security standards, engages in regular third-party testing and maintains that over 10% of its organization is security professionals.

Juan Pablo Sandoval Celis, a lawyer/MBA, who works on the company’s business development team says that customers have used Harvey to reduce legal processes from weeks to minutes.

Of course, law firms make money from hours billed to clients. So lawyers finding efficiencies with Harvey could lead to an enormous revenue loss for these law firms. Weinberg notes that certain legal work is increasingly billed via fixed fee, though certain specialized work will forever be billed hourly. He also believes that widespread use of AI will increase work for lawyers. Says Weinberg, “I think it’ll get to a certain point where you aren’t able to compete—or able to support large corporations—unless you are using tools like this.”

See you tomorrow,

Alexandra Sternlicht

X: @iamsternlicht

Email: alex.sternlicht@fortune.com

Submit a deal for the Term Sheet newsletter here.

Nina Ajemian curated the deals section of today’s newsletter. Subscribe here.

This story was originally featured on Fortune.com