Get Paid 10%+ a Year? These Monthly Dividend Stocks Actually Deliver

Although currently an arm of Warner Communications and fallen into some disrepute, CNN is still one of the most widely available cable TV news stations, and remains ubiquitous at airports, train stations, and other areas where large groups of people congregate and wait, becoming de facto captive audiences. It’s easy to forget that once upon […] The post Get Paid 10%+ a Year? These Monthly Dividend Stocks Actually Deliver appeared first on 24/7 Wall St..

Key Points

-

Although double-digit yields were normal during the 1980s, lower interest rates and a robust stock market have rendered yields of 10% or higher obscure.

-

There are ETFs, CEFs, and individual stocks that can still reliably deliver double-digit yields with considerably less risk than with the junk bonds of the 1980s.

-

ETFs holding large high-yield bond portfolios give investors the benefit of professional fund management to mitigate any commensurate risks that individual bond holders might face.

-

Are you ahead or behind on retirement? Are you intimidated about your lack of knowledge in handling your retirement portfolio? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted and will answer your questions and act in your best interests. Don’t waste another minute – get started by clicking here.(Sponsor)

Although currently an arm of Warner Communications and fallen into some disrepute, CNN is still one of the most widely available cable TV news stations, and remains ubiquitous at airports, train stations, and other areas where large groups of people congregate and wait, becoming de facto captive audiences. It’s easy to forget that once upon a time, Ted Turner owned CNN as part of his Turner Broadcasting System, which also owned MGM and United Artists. And it would never have happened without yields over 10%.

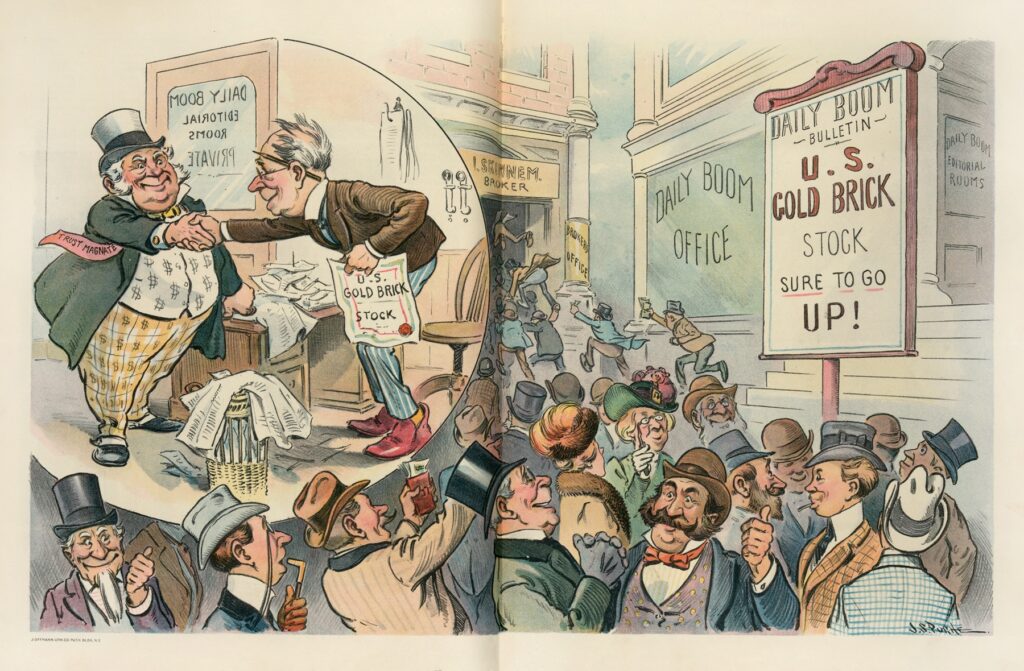

Back in the 1980’s, Drexel Burnham Lambert pioneered the use of high yielding “junk” bonds for a number of leveraged buyouts, with the RJR Nabisco deal being the most high-profile one at the time. In 1986,Ted Turner wanted MGM’s library for his Turner Classic Movies station, and turned to Drexel’s Michael Milken for financing assistance. The deal was financed with junk bonds yielding roughly 11-12%, and the restoration and digital colorization that Turner had performed on the library resurrected many long forgotten cinematic gems for future generations to view.

Yields in double digits have ironically become synonymous with high risk and high defaults, or with international deals from which the average investor is excluded. Surprisingly, the percentage of defaults were actually lower than expected, and proper portfolio diversification strategies mitigated much of the risk that individual bond holders with fewer resources faced. Today, if one does some research, one can find both individual companies and exchange traded funds with solidly collateralized cash flows and exchange traded funds with diverse portfolios that have been consistently delivering double-digit annual yields for years.

The following stocks and Closed-End Funds (CEFs) not only yield over 10% annually, but pay out monthly, especially useful for those who are income dependent, of using DRIP (dividend reinvestment plan) programs. For the sake of easy reference, the yields and dividends cited are based on market price at the time of this writing on a $10,000 investment.

Nuveen Floating Rate Income Fund

Stock #1: Nuveen Floating Rate Income Fund (NYSE: JFR)

Yield: 12.33%

Shares for $10,000: 1,209.19

Annual Dividend: $1,233.00

Monthly Dividend: $102.75

One reason why unionized teachers’ pensions are so healthy is due to Nuveen Investments. As a wholly owned private subsidiary of the Teachers Insurance and Annuity Association of America (TIAA) asset manager Nuveen Investments manages the teachers’ pension fund, as well as portfolios for numerous other institutional clients in government, medicine, and non-profit sectors. The company has spun off a number of funds that manage independent portfolios, all of which have become both lucrative and expansive.

Given that annuities are a key mandate of its parent, Nuveen has an unsurprisingly significant footprint in the fixed income arena. From its offices in Chicago, IL. The Nuveen Floating Rate Income Fund is a closed end bond fund which is focused on the US high yield debt market.

Senior loans comprise 88.4% of the fund’s portfolio, with corporate bonds next at 10.3%. Among the largest positions include bonds from Commscope Holding Co. (1.70%), Medline Borrower LP (1.50%), and Zayo Group Holdings, Inc. (1.40%).

Nuveen Credit Strategies Income Fund

Stock #2: Nuveen Credit Strategies Income Fund (NYSE: JQC)

Yield: 12.18%

Shares for $10,000: 1,879.70

Annual Dividend: $1,218.00

Monthly Dividend: $101.50

San Francisco based Nuveen Credit Strategies Income Fund is a closed-end fund that mostly invests in global senior loans, high yield corporate debt, and collateralized loan obligation (CLO) debt. The fund uses leverage and may also invest in the public equities markets. It is managed by Symphony Asset Management, LLC, a wholly owned Nuveen subsidiary.

To curb risk, the fund has a 30% ceiling for its portfolio in securities rated CCC/Caa or lower. It also has a 25% cap on CLO (collateralized loan obligation) issues. There are no percentage limits on instruments rated BB+/Ba1 or higher.

As of this writing, Nuveen Credit Strategies’ $1.329 billion AUM portfolio was invested 69.8% in senior loans, 20.6% in corporate bonds, and 4.8% CLOs, with 5.6% in cash. Sector wise, 16.7% were Consumer Discretionary, Infotech was 16.3%, and Industrials were 13.5%. Geographically, 77.1% of issues were from the US, 4.4% from the Cayman Islands, 4.2% from Canada, and 3.3% UK.

Ellington Financial, Inc.

Stock #3: Ellington Financial, Inc. (NYSE: EFC)

Yield: 12.12%

Shares for $10,000: 777

Annual Dividend: $1,212.00

Monthly Dividend: $101.00

Old Greenwich, CT based Ellington Management Group, LLC has a presence in several different profit center platforms. Ellington Financial, Inc. represents its real estate sector interests, as a registered Real Estate Investment Trust (REIT). In order to access the US capital markets, REITs are required to remit 90% of their profits to shareholders. This is a fair trade when considering the leverage afforded by the large fund amounts made possible by going public. Ellington Financial has two primary operations:

- The Portfolio Segment manages a portfolio of real estate based commercial and residential mortgage loans, mortgage-backed securities and derivatives, non-mortgage debt, derivatives, and equity stakes in loan origination companies and related investments. This portfolio was $3.3 billion as of April, 2025.

- The Longbridge Segment both originates, acquires, and services reverse mortgage loans

The current anomalously high US interest rates, relative to those of other nations, is a major reason for the slump in mortgage related businesses over the past few years. With the US economy once again on the upswing, cutting interest rates to reflect better parity with Europe and Asia should see growth return to the mortgage sector, and to Ellington Financial as well.

PIMCO Access Income Fund

Stock #4: PIMCO Access Income Fund (NYSE: PAXS)

Yield: 12.01%

Shares for $10,000: 669.79

Annual Dividend: $1,201

Monthly Dividend: $100.08

The PIMCO Access Income Fund is a closed end bond fund that owns bonds from around the globe. It leverages the resources of Newport Beach, CA headquartered Pacific Investment Management Co.’s fixed-income analysts to look at bond issues in a wide range of categories, both domestic and international. Corporate bonds, government and sovereign nation debt, asset-backed and mortgage-backed bonds, floating rate bonds, and even municipal bonds are all fair game if they are available at an attractive price and can deliver on the fund’s income requirements.

With a $686 million AUM war chest, the PIMCO Access Income Fund’s portfolio holds over 39.78% high-yield, or “junk” rated bonds below B, 25.84% B-rated, and 17.6% BB-rated, with the remainder rated BBB to AAA, as of June, 2025.

Advent Convertible and Income Fund

Stock #5: Advent Convertible and Income Fund (NYSE: AVK)

Yield: 11.86%

Shares for $10,000: 843.17

Annual Dividend: $$1,186.00

Monthly Dividend: $98.83

Guggenheim Investments is a $349 billion asset management firm headquartered in New York City, and was founded by the wealthy Guggenheim family, best known for its landmark spiral designed Upper East Side art museum designed by architect Frank Lloyd Wright. It presently owns the Advent Convertible and Income Fund. Advent was founded in 1995 by the former convertible bond department head of Merrill Lynch.

Advent Convertible and Income Fund currently allocates about 46.63% of its $885 million portfolio towards convertible bonds with the remainder in high-yield nonconvertible “junk” bonds (39.63%), equities (6.6%), cash (3.59%), and CLOs (3.54%).

Convertible bonds are hybrid securities. They carry an option for the holder to convert from debt to common stock at a specific price. Investors often will buy the convertible bonds to collect income while waiting for the company to announce significant earnings or for news events that will drive the stock price up, at which point, the investors would exercise the convert option and ride the stock price higher.

Stellus Capital Investment Corporation

Stock #6 : Stellus Capital Investment Corp. (NYSE: SCM)

Yield: 11.70%

Shares for $10,000: 731.53

Annual Dividend: $1,170.00

Monthly Dividend: $97.50

Based out of Houston, TX, Stellus Capital Investment Corp. is a registered Business Development Corporation (BDC). Similarly to REITs, BDCs are required to remit 90% of their profits to shareholders in return for access to the US capital markets. BDCs fill the omnipresent financing gap for smaller and medium sized corporations that were deemed too small for the large, consolidated banking entities that survived the 2008 subprime mortgage banking meltdown. As such, they use the same tangible collateral for their corporate loans, only for a much more lucrative profit, thanks to lower overhead, and more innovative risk management and financing method flexibility.

Participating in both the private corporate debt and private equity markets, Stellus Capital Investment Corp. provides financing deals for North American companies with EBITDA between $5 million and $50 million. Financing may manifest in several configurations, such as first lien, second lien, unitranche, and mezzanine debt, often accompanied with an equity portion.

BlackRock Floating Rate Income Strategies Fund, Inc.

Stock #7: BlackRock Floating Rate Income Strategies Fund, Inc. (NYSE: FRA)

Yield: 11.50%

Shares for $10,000: 774

Annual Dividend: $1,150.00

Monthly Dividend: $95.83

New York headquartered BlackRock is the largest asset manager on the planet Earth, with a recently estimated $11.58 trillion AUM. The BlackRock Floating Rate Income Strategies Fund, Inc. is BlackRock’s presence in the private and public credit, high-yield arena.

With $436.4 million AUM as of May, the BlackRock Floating Rate Income Strategies Fund’s portfolio holds roughly 74.54% of B rated securities, 37.20% rated BB, and 7.3% below B or unrated. (The percentages include leveraged securities.) The three largest issuer holdings are from Medline Borrower LP (1.39%), Dun & Bradstreet (1.37%), and Hub International, Ltd. (1.07%).

PIMCO Corporate & Income Strategy Fund

Stock #8 : PIMCO Corporate & Income Strategy Fund (NYSE:PCN)

Yield: 10.79%

Shares for $10,000: 799.36

Annual Dividend: $1,079

Monthly Dividend: $89.92

One of the guiding rule of thumb principles regarding bonds and other fixed-market instruments is that the lower the rating, the higher the yield, ostensibly due to the inherent perceived risk of default. Higher safety equates to a higher rating, and a subsequently lower yield.

Newport Beach, CA headquartered Pacific Investment Management Co. (PIMCO) flips the script on that rule by generating double digit yields while concurrently maintaining a balanced risk portfolio. Its PIMCO Corporate & Income Strategy Fund is a closed end bond mutual fund that is yielding over 10.75% at the time of this writing, on a portfolio that most analysts would view as relatively conservative and safer than other funds with double-digit yields..

A look at the Pimco Corporate & Income Strategy Fund’s $772.2 million portfolio allocation shows that as of June,15.52% of bonds were AAA, 6.13% were AA, 0.96% were A, 9.09% were BBB, 20.47% were BB, and the remaining 64% were B or below.

Golub Capital BDC Inc.

Stock # 9: Golub Capital BDC Inc. (NASDAQ: GBDC)

Yield: 10.62%

Shares for $10,000: 680.74

Annual Dividend: $1,062.00

Monthly Dividend: $88.50

The private debt market, which continues to service more and more small and medium sized companies’ financing requirements, is exploding and expected to go from its current $1.5 trillion size to $3 trillion by 2028. Golub Capital BDC Inc. has been at the forefront of this trend. In 2024, Golub Capital won the Lender of the Year award, a repeat of 2023, when it also won the Senior Lender of the Year, and BDC Manager of the Year in the Americas awards from Private Debt Investor (PDI). Golub has won 25 PDI awards since 2013. The company has an $8.6 billion investment portfolio across 393 investments

One of the keys to Golub’s success are its One-Stop Loans, which are secured by priority first liens on the issuer’s assets. They comprise 92% of Golub’s portfolio, so its defaults are abnormally low for the industry, thus protecting its 90% profits, which convert to shareholder dividends.

Chimera Investment Corporation

Stock #10 :Chimera Investment Corporation (NYSE: CIM)

Yield: 10.57%

Shares for $10,000: 714.29

Annual Dividend: $1,057.00

Monthly Dividend: $88.08

Located in New York City’s Rockefeller Center, which is also home to NBC-TV Studios, Chimera Investment Corporation is a Real Estate Investment Trust (REIT) that invests solely in securitized mortgages and internally originated mortgage loans. As a registered REIT, Chimera pays out 90% of its profits as dividends to its shareholders.

At the time of this writing, residential mortgage loans comprise 87% of Chimera’s portfolio. Chimera’s underwritings take the form of senior and subordinated notes. Chimera will sell the senior bonds and retain the subordinate bonds. It will usually also retain a call option in case there is a need to liquidate the original securitization trust to receive remaining collateral and then enact a refinancing and fresh securitization of that collateral for lower cost or increased leverage.

This list is a small sample of the double-digit stocks that are available. Although income might be the primary objective in investing in these types of stocks, it’s a good idea to bear in mind the following:

- Even though they may be bought for dividends, these are still stocks and funds. As such, they should be monitored in the event of an acquisition, catastrophe, or other occurrence that could impact their dividends.

- Keeping a short list of alternative double-digit yields on a list for monitoring is a smart precautionary protocol, in the event a replacement is needed quickly.

- As these stocks pay out monthly, they can definitely enhance a DRIP program, which can automatically buy more shares with the dividends automatically without (or with nominal) fees.

The post Get Paid 10%+ a Year? These Monthly Dividend Stocks Actually Deliver appeared first on 24/7 Wall St..