Why Monthly Dividend Stocks Are the Smartest Play in a High-Rate World

The current high interest cycle has been restrictive for much longer than many had expected two years earlier. Many people expected rate cuts to begin in 2023, but “transitory” inflation kept lingering on and on. Even now, core inflation is not at 2%, but trends have shown that it is starting to cool faster than […] The post Why Monthly Dividend Stocks Are the Smartest Play in a High-Rate World appeared first on 24/7 Wall St..

Key Points

-

Monthly dividend stocks should be among your go-to investments in the current environment.

-

They are trading at deep discounts ahead of potential interest rate cuts.

-

Yield hunger could push them much higher.

-

Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; get started by clicking here.(Sponsor)

The current high interest cycle has been restrictive for much longer than many had expected two years earlier. Many people expected rate cuts to begin in 2023, but “transitory” inflation kept lingering on and on. Even now, core inflation is not at 2%, but trends have shown that it is starting to cool faster than expected. Then, the recent tariff scare caused Wall Street to get rattled again, as many expected inflation to surge from double-digit tariffs.

Thankfully, this did not happen. Suppliers took some of the burden, whereas companies managed to absorb some of the costs. The tariffs also came in with plenty of warning, so businesses were able to stockpile plenty of inventory and were able to wait it out before the tariff pause went into effect.

Regardless of what you think about tariff policy, most people can agree that the impact on inflation hasn’t been as bad as previously thought. Recent macro figures coming in cooler have given investors confidence that the Federal Reserve will be able to make do on its promises of two rate cuts by the end of this year.

All of that is great news for monthly dividend stocks. Here’s why.

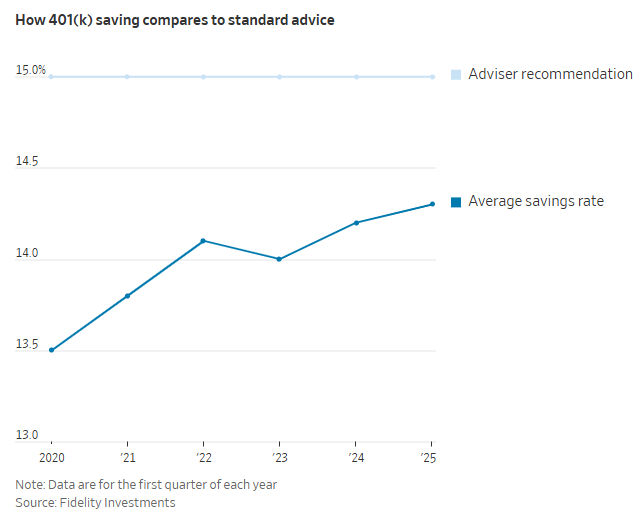

Higher Rates Allow You to Buy Dividend Stocks for Cheap

When interest rates are high, so are Treasury yields. This, in turn, leads to lower investment in dividend stocks of all types, including monthly ones. It may look like a negative thing, and it is, but it gives bulls a great opportunity to go shopping for monthly dividend stocks at cheap prices.

When interest rates inevitably go down and take down Treasury yields with them, the hunger for more yield kicks in. Investors have no option but to turn to dividend stocks, and the same stocks they’ve abandoned for Treasuries end up recovering significantly.

REITs constitute one of the largest segments of dividend-paying stocks, and investors are underweight here. Interest in REITs is still low, comparable to levels seen in 2007/2008. Real estate has held strong despite the high interest rates, but fear is what’s mainly driving under-investment.

No two recessions are the same, so any future downturn is unlikely to hit real estate as hard as it did in 2008. The industry has learned a lot from the Great Recession. You won’t find NINJA (No Income, No Job, and no Assets) loans anymore. If anything, borrowing is becoming increasingly challenging with AI-powered screening.

Monthly Dividend Stocks Often Have Higher Yields

Firms that pay dividends monthly are often Real Estate Investment Trusts (REITs) and Business Development Companies (BDCs). They characteristically have high dividend payout ratios. The monthly dividends are also often the primary reason behind investors buying and holding these stocks in the first place, so management has extra incentive to keep payouts steady regardless of the economic environment.

Quality monthly payers combine investment-grade credit and conservative payout ratios, with decades-long dividend streaks. Wall Street is willing to pay a big premium for these traits, especially when yield hunger starts kicking in.

They Also Compound Faster

Dividends paid monthly can be reinvested much faster, hence they also compound faster. The difference may seem tiny in one or two years, but it quickly starts to add up and compound over decades. This is one of the biggest benefits of investing in dividend stocks that pay monthly.

These stocks are perfect for a dividend reinvestment plan (DRIP) if your aim is to hold and let them compound for decades.

Monthly Dividends Act as a Cushion During Downturns

Another big plus is that you’re not going to have to wait for the next quarterly payout during a sudden downturn. Many investors don’t have enough free cash sitting around to fund both opportunistic buys and their lifestyle, especially if they lose their primary source of income in the said downturn. This can force them not only to miss out on these once-in-a-decade buying opportunities, but also to sell shares at cheap prices.

Monthly dividend stocks can be your lifesaver in this case. If you have enough of them in your portfolio, you can either cover your own expenses or redirect some of those dividends into buying opportunities. Even if you leave those stocks to reinvest, they are going to reinvest at much lower prices and meaningfully boost your portfolio’s recovery.

Finally, a Big Caveat to Keep In Mind

Recessions and downturns cause almost all stocks in the stock market to go down. There are often very few exceptions. You’ll have to weather these downturns no matter the sector you invest in. Fear causes BDCs and REITs to see bigger declines, even if nothing is fundamentally wrong.

Moreover, recessions often hit when the interest rate plateaus and starts being cut. This is unlikely to be always the case, but dollar-cost averaging is a good remedy to this risk. Also, this isn’t a caveat that is exclusive to monthly dividend stocks. If anything, they should recover pretty quickly, since they already trade at deep discounts. For example, The Monthly Dividend Company, or Realty Income (NYSE:O) is down over 25% from pre-pandemic prices, despite a 5.6% dividend yield and solid financials.

The post Why Monthly Dividend Stocks Are the Smartest Play in a High-Rate World appeared first on 24/7 Wall St..