Fiscal fears push bond yields higher as stocks fall

Bond yields rose higher as fiscal fears mount.

Global concern about America’s fiscal health and how long it will retain its status as an economic safe harbor triggered bond yields to push higher yesterday after a 20-year auction saw a muted reaction.

The long-term outlook for the U.S. is taking a hit as analysts eye America’s $36.2 trillion national debt burden. Debt-to-GDP is expected to spiral to all-time highs in the coming decades.

The fears are partly down to the “big, beautiful bill” President Trump is trying to encourage Congress to pass. The bill includes a raft of tax cuts, partly an extension of a temporary bill first passed in 2017.

While the Trump team argues that tax cuts will increase discretionary income and, as such, lead to a rise in economic activity and growth, other economists counter that the White House is shutting off vital revenue needed to rebalance its books.

These concerns played out in the bond market yesterday with 30-year Treasury yields closing above 5% at 5.09% for the first time since October 2023.

Yields took a further step yesterday when a 20-year Treasury auction received a muted response, with $16 billion in bonds issued at 1.2 basis points above the pre-sale held at 5.05%.

Real yields spun even higher, finishing the day at 2.65% per the St Louis Fed’s securities yield index, which is quoted on an investment basis and is inflation-indexed. May 2025 marks the highest the index has risen since the St Louis Fed started tracking the data in 2010.

“Market volatility has resurfaced amid renewed uncertainty surrounding trade policy and the fiscal outlook. With bond yields elevated and tariff and budget risks in focus, this volatility may persist as investors monitor further developments in policy,” Mark Haefele, CIO at UBS Global Wealth Management, wrote in a note seen by Fortune this morning.

If surging yields spell trouble ahead, then some caution bleed into the stock market. The S&P 500 closed 1.6% down yesterday, with Mag7 stocks down 1.41% over the past five days.

The performer of the day was Alphabet, which jumped 2.9% by close up to $170 a share.

Uncertainty appears to have bled into other regions, with Germany’s DAX down 0.8% Thursday at the time of writing, and London’s FTSE 100 down 0.6% as of Thursday morning.

The Nikkei 225 finished down 0.8%.

Here’s a snapshot of today’s action prior to the opening bell in New York:

- The S&P 500 fell 1.61% Tuesday. The index is down 0.6% YTD.

- S&P futures traded down 0.2% this morning.

- The Stoxx Europe 600 was down 0.7% in early trading.

- Asia was up down: Japan was down 0.8%. Hong Kong down 1.1%. Shanghai was down 0.8% and India’s Nifty 50 was down 1.1%.

- The Mag7 was down with the exception of Alphabet, up nearly 3%.

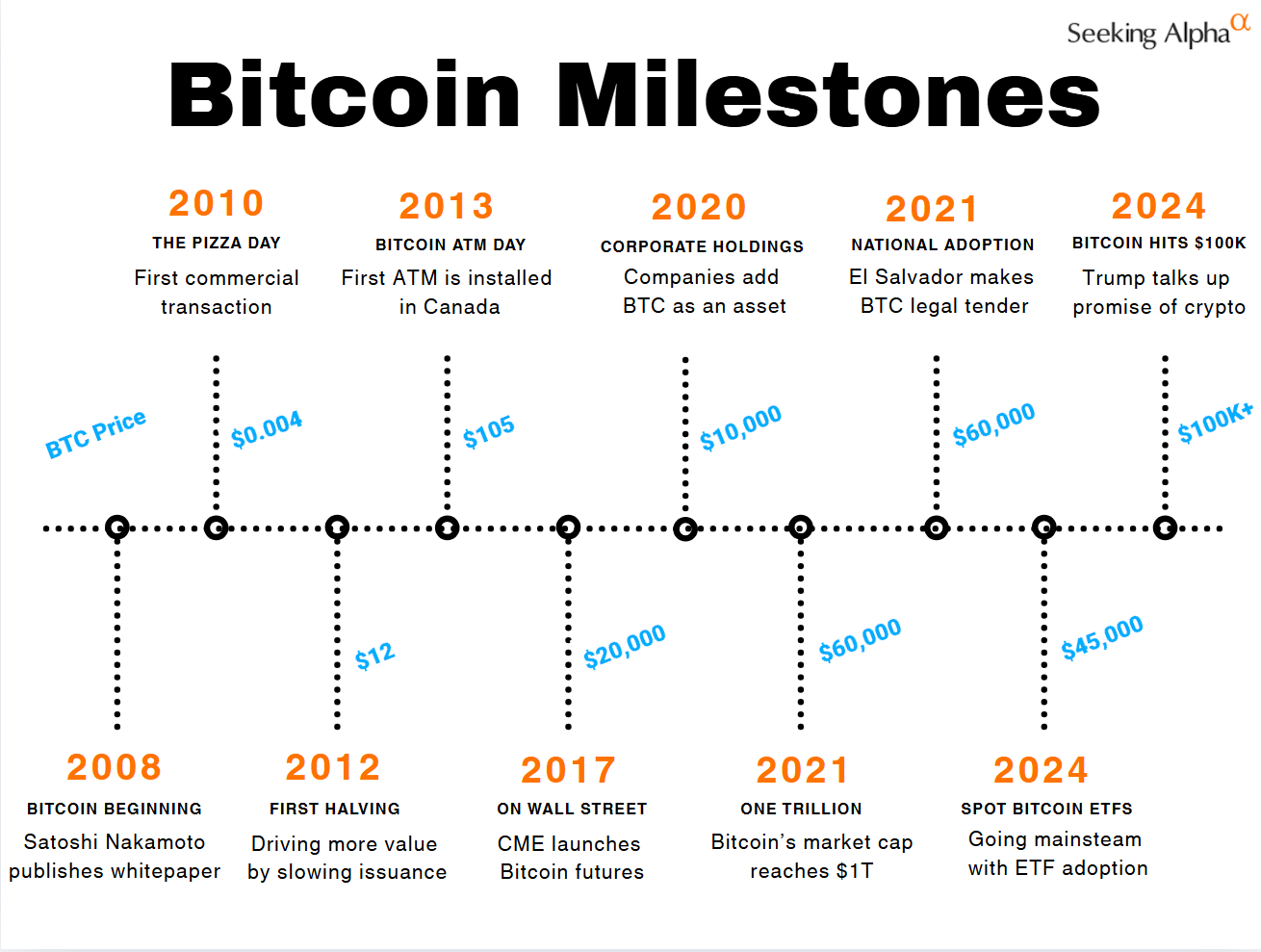

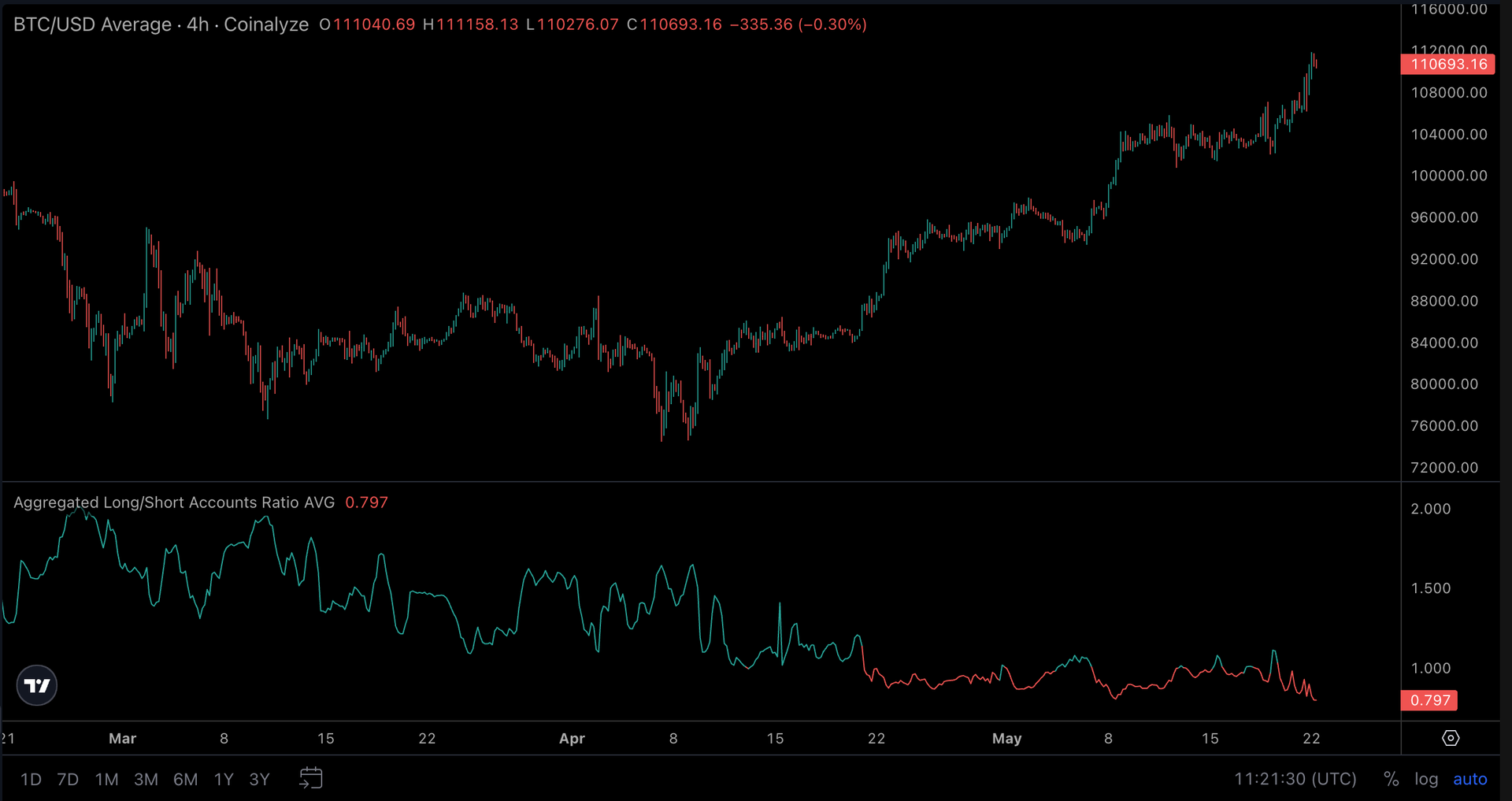

- Bitcoin was sitting up at approximately $110,600 this morning.

This story was originally featured on Fortune.com