The Vanguard ETF That Dividend Investors Can Buy and Hold for Decades

Dividends can easily boost your portfolio's balance over the years. You get a steady stream of cash that enables you to be less reliant on the stock's performance. You can reinvest that dividend income or simply use it to help pay bills or contribute to your savings.And investing in a diversified exchange-traded fund (ETF) can be safer than picking individual dividend stocks. That way you're less vulnerable if a particular company struggles and needs to cut or suspend its payout unexpectedly. And when it comes to dividends, you want to prioritize safety to ensure those recurring payments continue, because there's nothing worse for income investors than learning that a stock they own has stopped or reduced its dividend. Not only can that hurt your cash flow, it can also send the stock into a tailspin.One of the better dividend-focused ETFs you can invest in today is the Vanguard Dividend Appreciation Index Fund ETF (NYSEMKT: VIG). Continue reading

Dividends can easily boost your portfolio's balance over the years. You get a steady stream of cash that enables you to be less reliant on the stock's performance. You can reinvest that dividend income or simply use it to help pay bills or contribute to your savings.

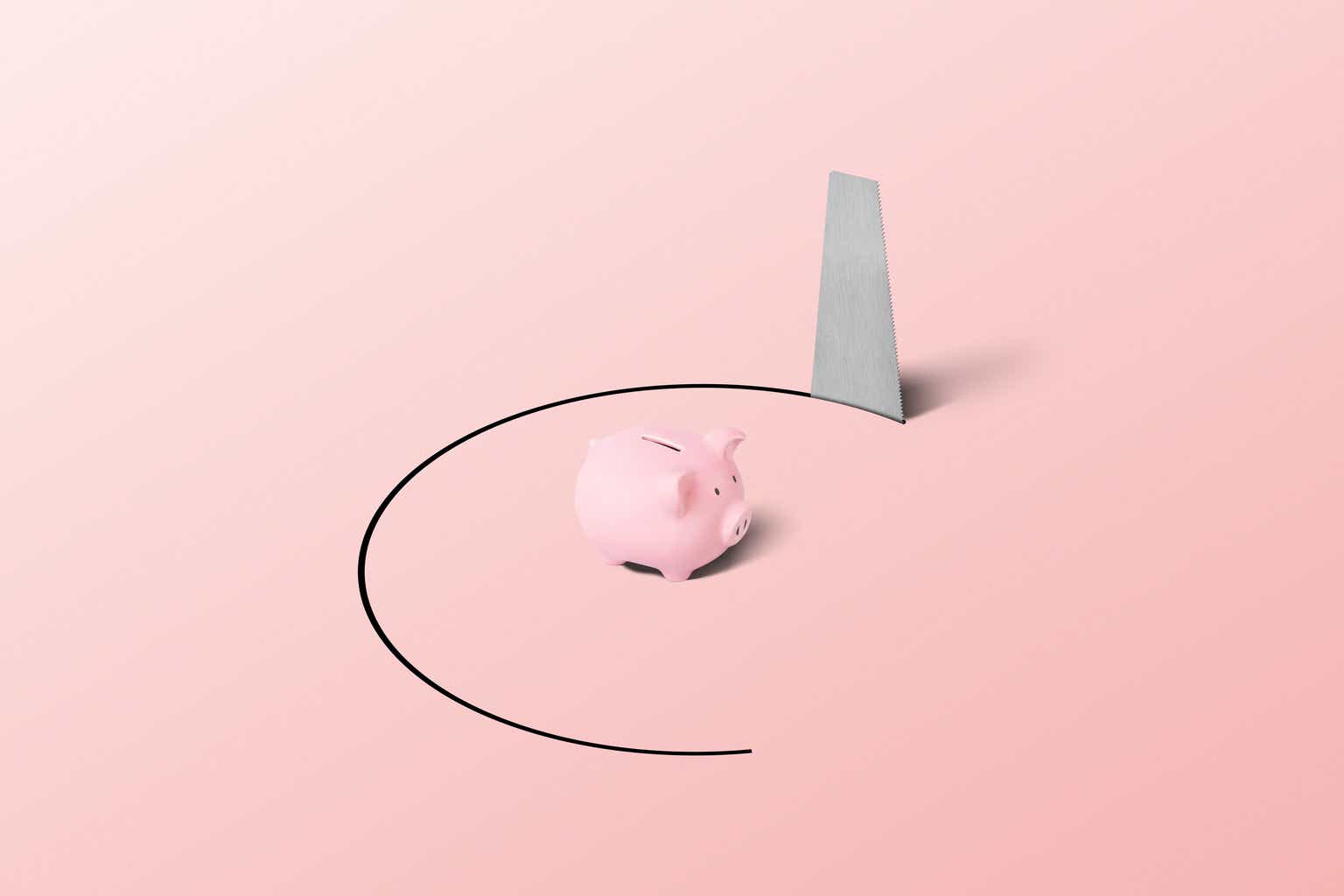

And investing in a diversified exchange-traded fund (ETF) can be safer than picking individual dividend stocks. That way you're less vulnerable if a particular company struggles and needs to cut or suspend its payout unexpectedly. And when it comes to dividends, you want to prioritize safety to ensure those recurring payments continue, because there's nothing worse for income investors than learning that a stock they own has stopped or reduced its dividend. Not only can that hurt your cash flow, it can also send the stock into a tailspin.

One of the better dividend-focused ETFs you can invest in today is the Vanguard Dividend Appreciation Index Fund ETF (NYSEMKT: VIG).