Bitcoin tops Amazon market cap on ‘Pizza Day’ as price sets new highs

The market cap of the world’s first cryptocurrency, Bitcoin, surpassed that of retail and tech behemoth Amazon on “Bitcoin Pizza Day.”Market data shows that Bitcoin (BTC) had a market cap of $2.205 trillion at the time of writing, $70 billion more than the $2.135 trillion Amazon valuation.“By surpassing Amazon in terms of capitalization, Bitcoin has attracted even more attention from the non-crypto audience,” said Alex Obchakevich, founder of Obchakevich Research. Obchakevich said the latest rally “will strengthen confidence in Bitcoin and lead to new injections into the crypto market.” The surge came as Bitcoin set a new all-time high and traded above $110,000, which Obchavich said will “attract new investors to large funds.” Obchakevich noted that institutional players continue to expand their role in the digital asset space:“In May, BlackRock became the second largest bitcoin holder after Satoshi Nakamoto, surpassing Binance in this indicator.”Hassan Khan, the CEO of Bitcoin liquidity platform Ordeez, told Cointelegraph that “this is a structural change.” He explained that “Bitcoin is no longer simply a hedge, it’s in the process of becoming a benchmark currency.”Related: Bitcoin ‘looks exhausted’ as next bear market yields $69K targetThe crypto market approaches new highsAccording to CoinMarketCap data, the total cryptocurrency market cap stood at $3.49 trillion at the time of writing. While high, this is still nearly 6% lower than the all-time high of $3.71 trillion reported at the end of 2024.Total crypto market cap one-year chart. Source: CoinMarketCapMore CoinMarketCap data shows that Bitcoin exchange-traded funds (ETFs) saw nearly $604 million of net inflows on May 21. The current open interest on crypto derivatives is $756.16 billion for perpetual swaps and $3.24 billion for futures. Looking into the future, Obchakevich shared his view on Bitcoin’s direction:“We are moving gradually towards $200,000, with gradual adjustments. I am sure that this year we will see Bitcoin at $150,000 and $90,000.“Khan said that “large net inflows to ETFs and increasing open interest demonstrate that institutional confidence is growing.” Looking forward, he said:“Short term profit taking and macro rate uncertainty are tempering momentum. But below-the-surface metrics […] point to continued high conviction. The foundation is more solid than in any other cycle before it.“Related: BlackRock’s Bitcoin ETF notches 2-week high inflow as BTC nears $112KToday is a special day for BitcoinToday, May 22, is “Bitcoin Pizza Day,” a recurrence commemorating May 22, 2010, when programmer Laszlo Hanyecz made the first documented purchase of goods using Bitcoin, paying 10,000 BTC for two Papa John’s pizzas.“What was once considered a highly speculative risk has evolved into a serious asset class,” said Ulli Spankowski, chief digital officer at Boerse Stuttgart Group.Spankowski added that, nowadays, Bitcoin “boasts a market capitalization of over 2 trillion US dollars, ranking it as the fifth-largest asset globally, behind gold and the three largest publicly traded companies.”Magazine: NBA star Tristan Thompson misses $32B in Bitcoin by taking $82M contract in cash

The market cap of the world’s first cryptocurrency, Bitcoin, surpassed that of retail and tech behemoth Amazon on “Bitcoin Pizza Day.”

Market data shows that Bitcoin (BTC) had a market cap of $2.205 trillion at the time of writing, $70 billion more than the $2.135 trillion Amazon valuation.

“By surpassing Amazon in terms of capitalization, Bitcoin has attracted even more attention from the non-crypto audience,” said Alex Obchakevich, founder of Obchakevich Research.

Obchakevich said the latest rally “will strengthen confidence in Bitcoin and lead to new injections into the crypto market.” The surge came as Bitcoin set a new all-time high and traded above $110,000, which Obchavich said will “attract new investors to large funds.”

Obchakevich noted that institutional players continue to expand their role in the digital asset space:

“In May, BlackRock became the second largest bitcoin holder after Satoshi Nakamoto, surpassing Binance in this indicator.”

Hassan Khan, the CEO of Bitcoin liquidity platform Ordeez, told Cointelegraph that “this is a structural change.” He explained that “Bitcoin is no longer simply a hedge, it’s in the process of becoming a benchmark currency.”

Related: Bitcoin ‘looks exhausted’ as next bear market yields $69K target

The crypto market approaches new highs

According to CoinMarketCap data, the total cryptocurrency market cap stood at $3.49 trillion at the time of writing. While high, this is still nearly 6% lower than the all-time high of $3.71 trillion reported at the end of 2024.

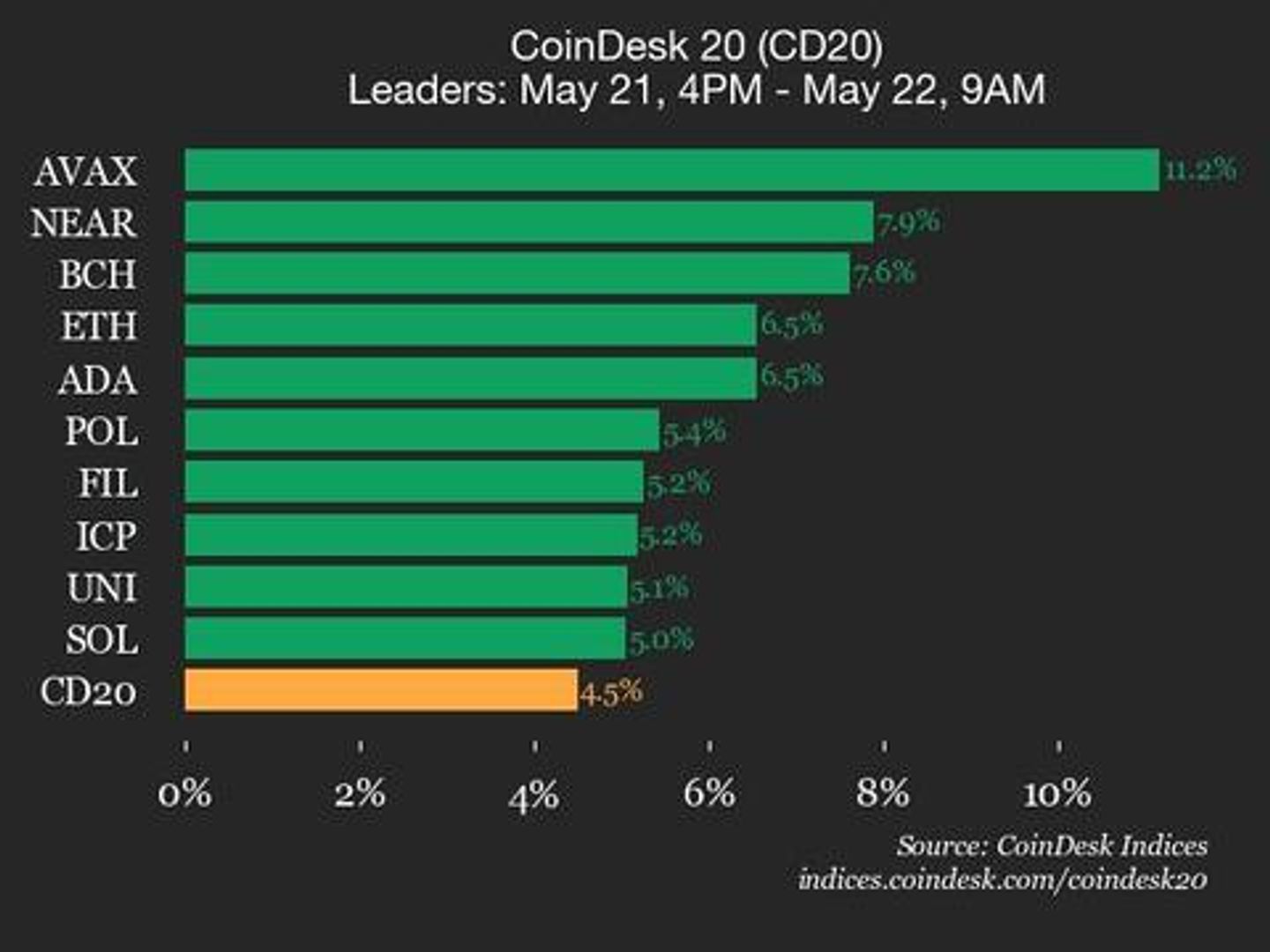

More CoinMarketCap data shows that Bitcoin exchange-traded funds (ETFs) saw nearly $604 million of net inflows on May 21. The current open interest on crypto derivatives is $756.16 billion for perpetual swaps and $3.24 billion for futures. Looking into the future, Obchakevich shared his view on Bitcoin’s direction:

“We are moving gradually towards $200,000, with gradual adjustments. I am sure that this year we will see Bitcoin at $150,000 and $90,000.“

Khan said that “large net inflows to ETFs and increasing open interest demonstrate that institutional confidence is growing.” Looking forward, he said:

“Short term profit taking and macro rate uncertainty are tempering momentum. But below-the-surface metrics […] point to continued high conviction. The foundation is more solid than in any other cycle before it.“

Related: BlackRock’s Bitcoin ETF notches 2-week high inflow as BTC nears $112K

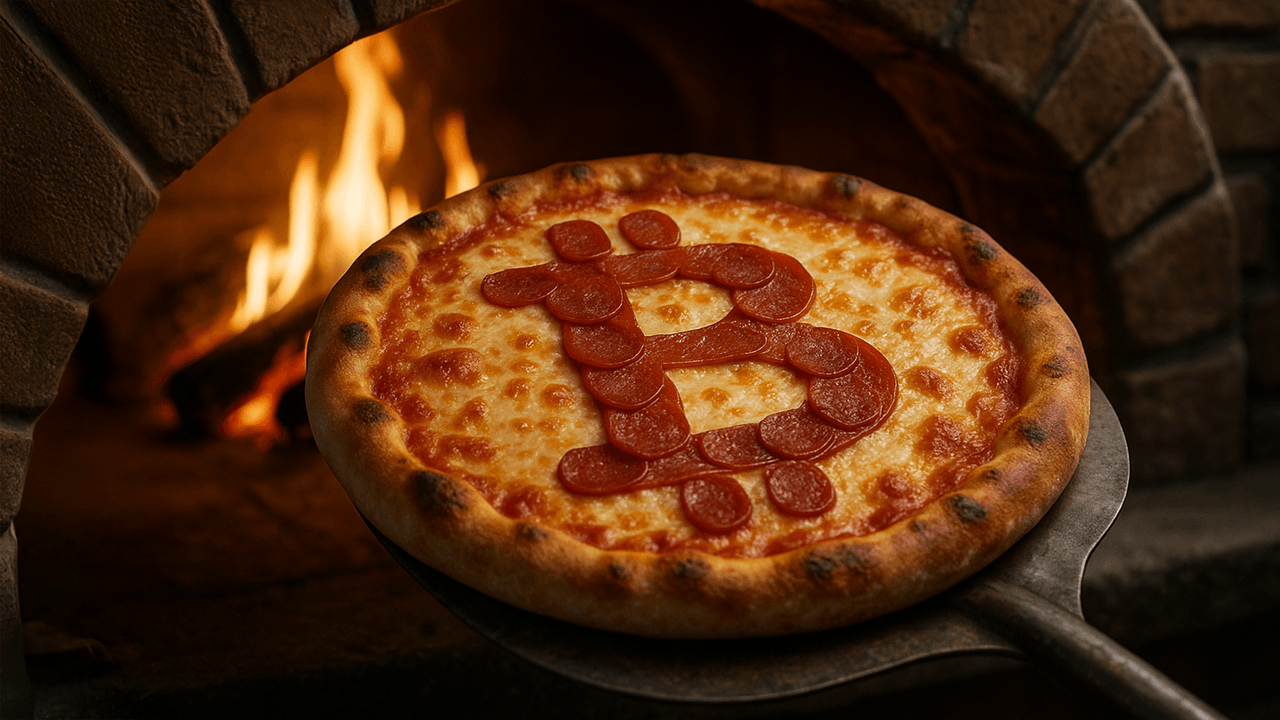

Today is a special day for Bitcoin

Today, May 22, is “Bitcoin Pizza Day,” a recurrence commemorating May 22, 2010, when programmer Laszlo Hanyecz made the first documented purchase of goods using Bitcoin, paying 10,000 BTC for two Papa John’s pizzas.

“What was once considered a highly speculative risk has evolved into a serious asset class,” said Ulli Spankowski, chief digital officer at Boerse Stuttgart Group.

Spankowski added that, nowadays, Bitcoin “boasts a market capitalization of over 2 trillion US dollars, ranking it as the fifth-largest asset globally, behind gold and the three largest publicly traded companies.”

Magazine: NBA star Tristan Thompson misses $32B in Bitcoin by taking $82M contract in cash