First-Quarter GDP Halfway to Recession: Move to These Safe High-Yield Dividend Stocks Now

These five top recession-resistant stocks will weather the potential economic storm while paying reliable, high-yield dividends. The post First-Quarter GDP Halfway to Recession: Move to These Safe High-Yield Dividend Stocks Now appeared first on 24/7 Wall St..

The first report for U.S. gross domestic product (GDP) came in at −0.3% as the economy contracted for the first time in three years. We also experienced a mild recession in 2022 when we had back-to-back quarters with negative GDP. Needless to say, economists and Wall Street pundits pointed to tariffs and the current administration’s policy. The reality is we have likely been in a stealth recession for over a year. With prices finally starting to ease on energy and some food items, it will prove interesting to see if we follow up with another quarter of negative GDP. If we do, that would technically put us into recession.

24/7 Wall St. Key Points:

-

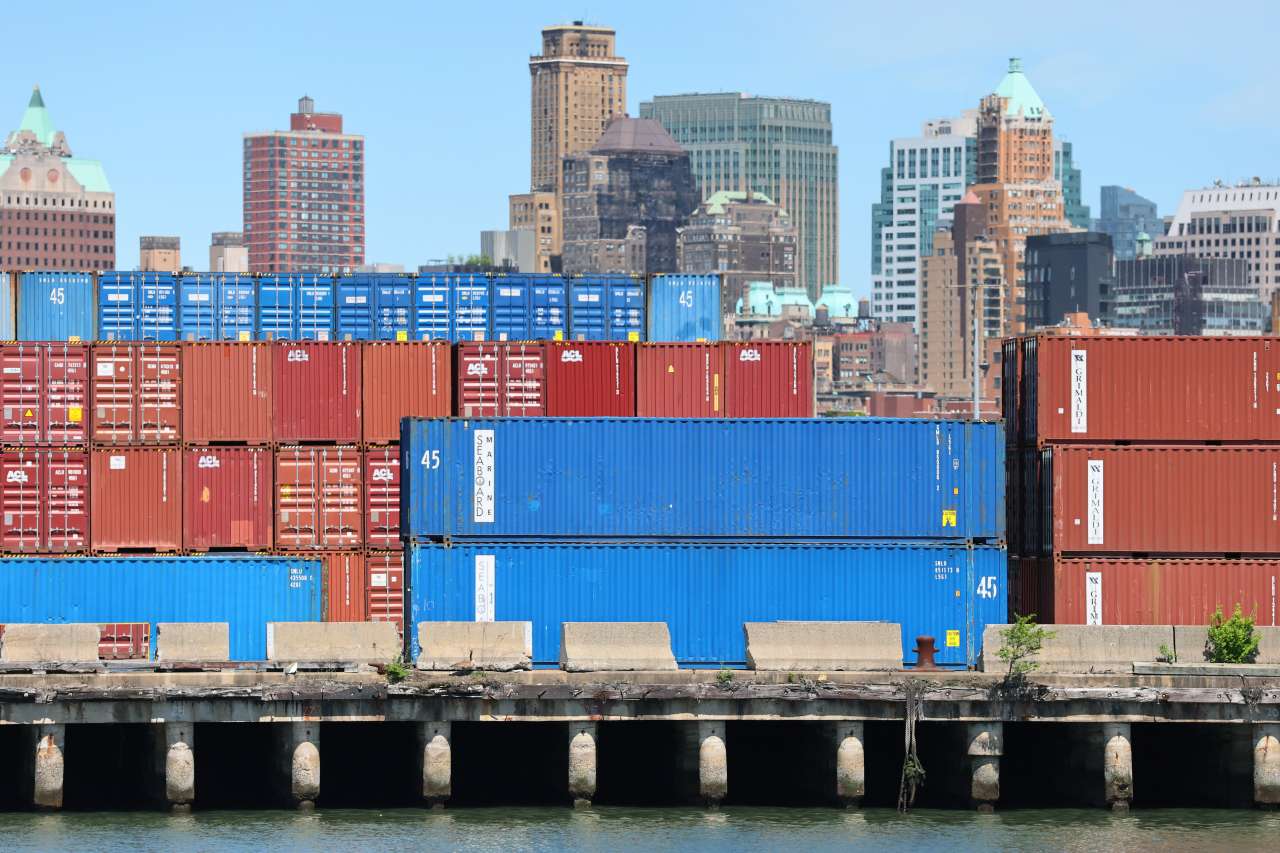

One reason for the first-quarter decline was a surge in imports before the tariffs took effect.

-

Economists had predicted a 0.2% decline for the first quarter.

-

Final sales to domestic purchasers came in at 3% higher than the fourth quarter, a sign of demand.

-

Does your portfolio contain high-yield dividend stocks that are less affected by a recession? Make an appointment with a qualified financial advisor near you for a complete asset review. Click here to get started today. (Sponsored)

Specific stock sectors tend to perform better during recessions due to their nature and the consistent demand for goods or services. These sectors are often regarded as recession-resistant because they offer products and services that people still require, even during economic downturns. Consumer staples, healthcare, utilities, telecommunications, real estate, and gold are among the best sectors to own during recessions.

We screened our 24/7 Wall St. recession stock research database and found five top stocks that will weather the potential economic storm while paying a reliable, high-yield dividend. All are rated Buy at the top Wall Street firms that we cover.

Why do we cover high-yield dividend stocks?

Since 1926, dividends have contributed approximately 32% of the total return for the S&P 500, while capital appreciation has contributed 68%. Therefore, sustainable dividend income and capital appreciation potential are essential for total return expectations. A study by Hartford Funds, in collaboration with Ned Davis Research, found that dividend stocks delivered an annualized return of 9.18% over the 50 years from 1973 to 2023. Over the same timeline, this was more than double the annualized return for non-payers (3.95%).

Altria

This is one of the world’s largest producers and marketers of cigarettes and other tobacco-related products. The stock offers value investors a great entry point. Altria Group Inc. (NYSE: MO) manufactures and sells smokable and oral tobacco products in the United States through its subsidiaries.

The company provides cigarettes primarily under the Marlboro brand, as well as:

- Cigars and pipe tobacco, principally under the Black & Mild and Middleton brands

- Moist smokeless tobacco and snus products under the Copenhagen, Skoal, Red Seal, and Husky brands

- on! Oral nicotine pouches

- e-vapor products under the NJOY ACE brand

It sells its tobacco products primarily to wholesalers, including distributors and large retail organizations, such as chain stores.

Altria used to own over 10% of Anheuser-Busch InBev S.A. (NYSE: BUD), the world’s largest brewer. Last year, the company sold 35 million of its 197 million shares through a global secondary offering. That represents 18% of its holdings but still leaves 8% of the outstanding shares in its back pocket. Altria also announced a $2.4 billion stock repurchase plan partially funded by the sale.

Altria recently increased its quarterly dividend by 4.1%, from $0.98 to $1.02 per share, marking its 59th dividend increase in the past 55 years

Bank of America Securities has a Buy rating with a $65 target price objective.

Bristol-Myers Squibb

Bristol-Myers Squibb Co. (NYSE: BMY) is a global biopharmaceutical company committed to discovering, developing, and delivering innovative medicines worldwide. This remains a solid pharmaceutical stock to own long-term, offering an outstanding entry point with a reliable dividend.

The company offers products in these classes:

- Hematology

- Oncology

- Cardiovascular

- Immunology therapeutic

Bristol-Myers Squibb products include:

- Revlimid, an oral immunomodulatory drug for the treatment of multiple myeloma

- Opdivo for anti-cancer indications

- Eliquis, an oral inhibitor indicated for the reduction in risk of stroke/systemic embolism in NVAF and for the treatment of DVT/PE

- Orencia for adult patients with active RA and psoriatic arthritis, as well as reducing signs and symptoms in pediatric patients with active polyarticular juvenile idiopathic arthritis

The company also provides:

- Sprycel for the treatment of Philadelphia chromosome-positive chronic myeloid leukemia

- Yervoy for the treatment of patients with unresectable or metastatic melanoma

- Abraxane, a protein-bound chemotherapy product

- Implicit for the treatment of multiple myeloma

- Reblozyl for the treatment of anemia in adult patients with beta-thalassemia

Truist Financial has assigned a Buy rating to the shares, with a target price of $64

FirstEnergy

With a substantial dividend and following stellar quarterly results, this is a top pick from Goldman Sachs. FirstEnergy Corp. (NYSE: FE) is involved in electricity transmission, distribution, and generation.

Its segments include:

- Distribution

- Integrated

- Stand-Alone Transmission

The Distribution Segment, which consists of the Ohio Companies and FirstEnergy Pennsylvania Electric Company (FE PA), distributes electricity in Ohio and Pennsylvania.

The Integrated segment includes the distribution and transmission operations under:

- Jersey Central Power & Light Company (JCP&L)

- Monongahela Power Company (MP)

- The Potomac Edison Company (PE), as well as MP’s regulated generation operations

The segment also distributes electricity in New Jersey, West Virginia, and Maryland, provides transmission infrastructure, and operates 3,604 MWs of regulated net maximum generation capacity.

The Stand-Alone Transmission segment consists of its ownership in FET and KATCo, which includes transmission infrastructure owned and operated by the Transmission Companies and used to transmit electricity.

Goldman Sachs has a Buy rating on the shares and set a $47 target price.

Kimberly-Clark

Kimberly-Clark Corp. (NYSE: KMB) is an American multinational personal care company that produces mostly paper-based consumer products. This consumer staples leader is a safe bet for nervous investors. Kimberly-Clark manufactures and markets personal care and consumer tissue products worldwide.

It operates through three segments:

- Personal Care

- Consumer Tissue

- K-C Professional

The Personal Care segment offers a diverse range of products, including:

- Disposable diapers

- Swim pants, training and youth pants, baby wipes

- Feminine and incontinence care products, as well as related products under the Huggies, Pull-Ups, Little Swimmers, GoodNites, DryNites, Sweety, Kotex, U by Kotex, Intimus, Depend, Plenitud, Softex, Poise, and other brand names

The Consumer Tissue segment provides facial and bathroom tissues, paper towels, napkins, and related products under the brands Kleenex, Scott, Cottonelle, Viva, Andrex, Scottex, Neve, and others.

The K-C Professional segment offers wipers, tissues, towels, apparel, soaps, and sanitizers under the Kleenex, Scott, WypAll, Kimtech, and KleenGuard brands.

Starwood Property Trust

Starwood Capital is a well-established global investor with international investments spanning over 30 countries and is an affiliate with this high-yielding company, run by real estate legend Barry Sternlicht. Starwood Property Trust Inc. (NYSE: STWD) operates as a real estate investment trust (REIT) in the United States, Europe, and Australia.

It operates through four segments:

- Commercial and Residential Lending

- Infrastructure Lending

- Property

- Investing and Servicing segments

The Commercial and Residential Lending segment:

- Originates, acquires, finances, and manages commercial first mortgages

- Non-agency residential mortgages

- Subordinated mortgages

- Mezzanine loans

- Preferred Equity

- Commercial mortgage-backed securities (CMBS)

- Residential mortgage-backed securities

The Infrastructure lending segment originates, acquires, finances, and manages infrastructure debt investments.

The Property segment primarily develops and manages equity interests in stabilized commercial real estate properties, including multifamily properties and commercial properties subject to net leases, which are held for investment purposes.

The Investing and Servicing segment:

- Manages and works out problem assets

- Acquires and contains unrated, investment grade, and non-investment grade rated CMBS comprising subordinated interests of securitization and re-securitization transactions

- Originates conduit loans to sell these loans into securitization transactions and acquire commercial real estate assets, including properties from CMBS trusts

Warren Buffett Warned Investors: Grab Berkshire Hathaway’s Highest-Yielding Dividend Stocks Now

The post First-Quarter GDP Halfway to Recession: Move to These Safe High-Yield Dividend Stocks Now appeared first on 24/7 Wall St..