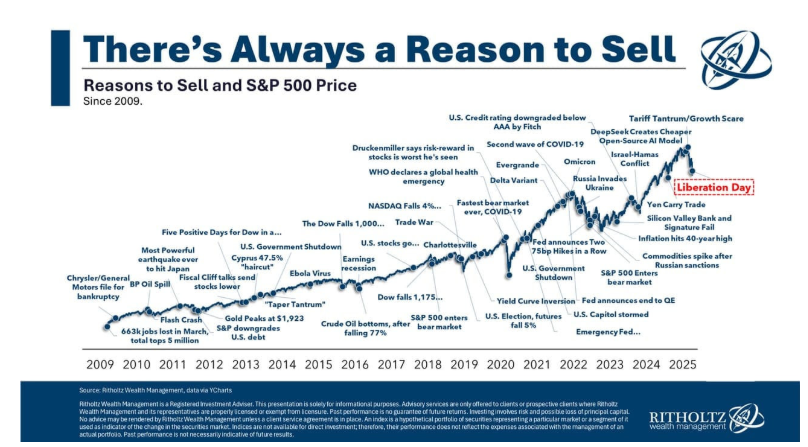

Dow climbs 300 points as stocks extend rally after Trump signals more tariff relief is possible

The Dow Jones Industrial Average increased 312 points, or 0.78%, the S&P 500 added 0.79%, and the Nasdaq picked up 0.64%.

- Stocks continued to rally Monday as investors cheered President Donald Trump’s Friday night tariff exemption. Additionally, Trump suggested he might give the auto industry some relief, and his officials are reportedly prioritizing negotiations with some countries over "reciprocal tariffs."

Stocks continued to rally Monday as President Donald Trump hinted at more tariff relief ahead, following his Friday night exemption of electronic devices.

The Dow Jones Industrial Average increased 312 points, or 0.78%, the S&P 500 added 0.79%, and the Nasdaq picked up 0.64%. All the indices closed well below their intraday highs.

The 10-year Treasury yield fell 11.3 basis points to 4.38%, the US Dollar Index decreased 0.38% to 99.73, and gold prices slipped 0.52% to $3,227.50 per ounce.

Investors initially cheered US Customs and Border Protections guidance issued late Friday that exempted electronic devices from reciprocal duties, though the reprieve will be temporary with new tariffs to follow.

Still, Apple gained 2% Monday and its market cap rallied back above $3 trillion, as its China-made iPhones will not face a prohibitively high tariff, for now.

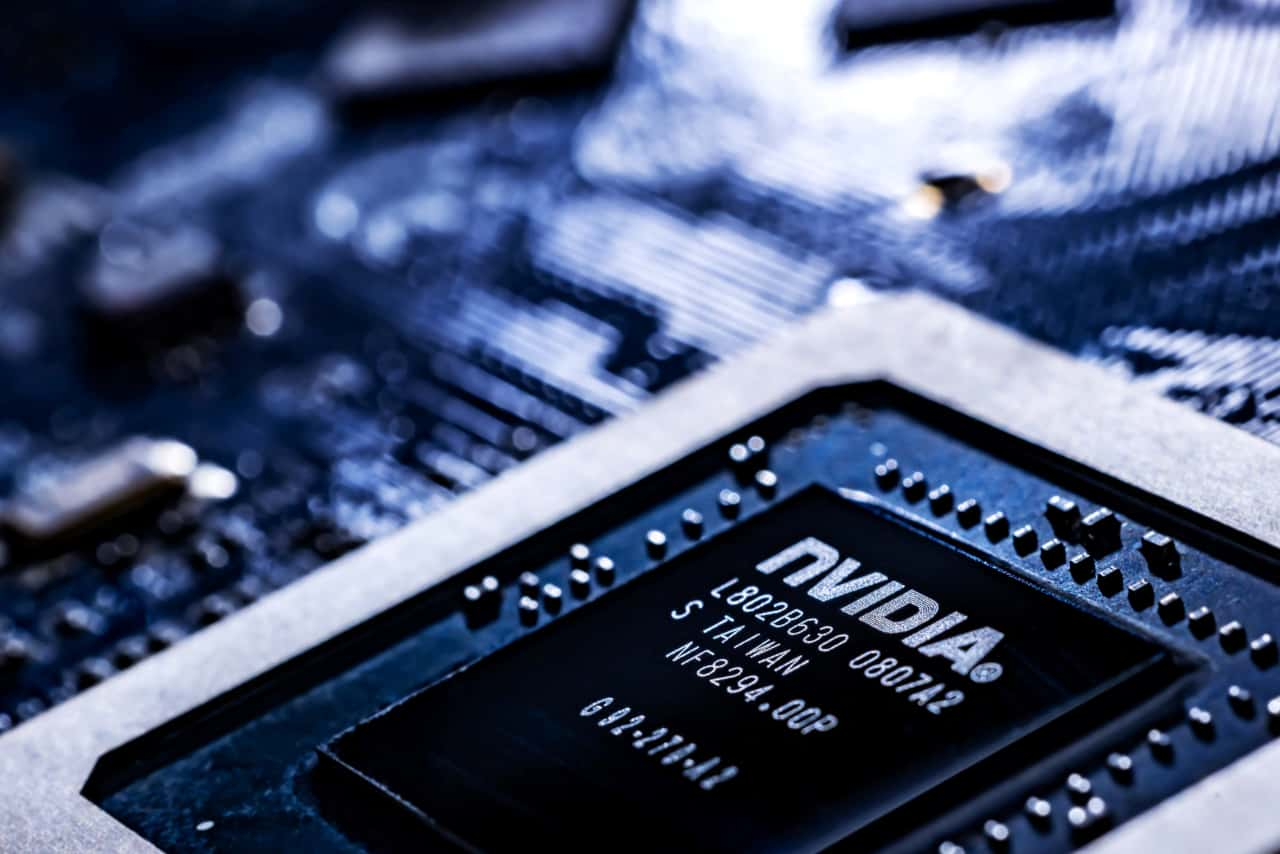

Additionally, Nvidia turned negative and closed down 0.2% after announcing a $500 billion investment to manufacture AI supercomputers in the U.S. for the first time.

Automakers' shares rose in the afternoon after Trump said he’s looking into offering car companies relief so they can change their supply chains.

“I’m looking for something to help some of the car companies, where they’re switching to parts that were made in Canada, Mexico, and other places, and they need a little bit of time, because they’re going to make them here,” he said in the Oval Office. “But they need a little bit of time, so I’m talking about things like that.”

On April 3, Trump imposed a 25% automotive tariff on imported vehicles and part; those have remained in place despite Trump offering a reprieve to some of his so-called “Liberation Day” tariffs last week.

Following Trump’s comments Stellantis stock jumped 5.7%, Ford Motor rose 4%, General Motors added 3%, and Rivian gained 5%. Tesla shares fell 0.1%.

As Trump pulled back on his “reciprocal tariffs” for 90-days to bring countries to the negotiating table, Monday, National Economic Council Director Kevin Hassett told CNBC more than 10 countries have “very good, amazing” trade offers to the United States.

Additionally, Treasury Secretary Scott Bessent is reportedly prioritizing the United Kingdom, Australia, South Korean, and Japan to strike a new trade deal, according to the Wall Street Journal.

The Treasury Department did not immediately respond to Fortune’s request for comment.

Federal Reserve Governor Christopher Waller said Monday he expects the impact of tariffs on prices to be “transitory.” While the term caused the central bank to pick up criticism during the last round of inflation, Waller said that there's no point to not try it again.

“I can hear the howls already that this must be a mistake given what happened in 2021 and 2022. But just because it didn’t work out once does not mean you should never think that way again,” Waller said during a speech in St. Louis.

Waller gave two projections on the outlook of the tariffs, saying that long-term tariffs could bring an inflation spike between 4% and 5% that would eventually decrease as growth slowed and unemployment swells. He also said smaller tariffs would cause an inflation bump of roughly 3% then fall off.

Additionally Waller said both cases would still cause the Fed to cut interest rates, but the timing being the only variable.

“With a rapidly slowing economy, even if inflation is running well above 2 percent, I expect the risk of recession would outweigh the risk of escalating inflation, especially if the effects of tariffs in raising inflation are expected to be short lived,” he said.

This story was originally featured on Fortune.com