Dave Ramsey said retirement is not merely a dream, it is a goal that requires you to make a plan

If you’re looking for some of the best, most direct retirement advice you can find, Dave Ramsey is going to be the person to tell you straight. Dave, an American radio personality, is the co-host of The Ramsey Show, where he offers advice to callers each show, addressing their unique financial scenarios. Among the most […] The post Dave Ramsey said retirement is not merely a dream, it is a goal that requires you to make a plan appeared first on 24/7 Wall St..

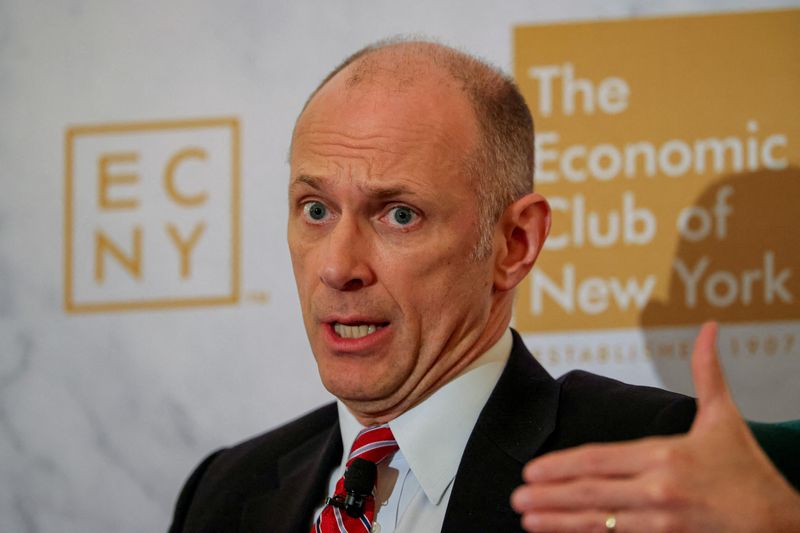

If you’re looking for some of the best, most direct retirement advice you can find, Dave Ramsey is going to be the person to tell you straight. Dave, an American radio personality, is the co-host of The Ramsey Show, where he offers advice to callers each show, addressing their unique financial scenarios.

Dave Ramsey is a popular radio personality who frequently discusses financial issues.

There is no doubt that Dave is a strong advocate of having a solid retirement plan.

Dave has made numerous quotes over the years, highlighting his stance on retirement and financial security.

Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; get started by clicking here.(Sponsor)

Key Points

Among the most discussed topics on Dave’s show is how to properly plan for retirement. Dave knows what most people don’t, and that is, if you don’t have a retirement plan, you’re already behind. Because of this, Dave has plenty of quotable moments to help you start planning and think about the future.

Social Security Funds

One of the most important pieces of advice for anyone is to remember that Social Security isn’t designed as a retirement plan. At most, it’s only supposed to replace around 40% of your pre-retirement income. It’s for this reason that Dave highlights how people should think about Social Security.

“Remember, Social Security is like the dessert to your main course – it’s the added bonus, not your complete retirement plan. If you still have debt or are living without a fully funded emergency fund, taking your benefits early is not the way to go.”

The last part of this quote serves as a strong reminder from Dave that, instead of taking Social Security at 62, you should wait until you are closer to 70, if not 70 itself. Not only will you get a higher payment, but you can use this increased benefit amount to help pay off any outstanding debt you might have in retirement.

Be Sure to Invest

“You will retire broke if you don’t invest. No one is coming to save you. It’s not too late to take control of your future….If you don’t have a plan for investing, you’re planning to struggle in retirement.”

Unsurprisingly, Dave is a big advocate for making smart and sensible investments with your money. He’s someone who knows that investments will pay off in the long run, not only helping you build up wealth, but also helping you pay down any debt. In fact, Dave generally recommends that retirees withdraw around 8% of a portfolio’s starting value each year for retirement and then adjust for inflation in subsequent years.

Don’t Take Loans

“Never take a loan against your retirement! When you pay interest against your retirement, you cost yourself interest.”

In this quote, Dave aims to remind you that any plan you might devise involving taking a loan against a 401(k) or IRA is a poor plan. Dave knows that if you have this loan and you have to pay interest back toward it, that is interest money that could otherwise be going directly into your savings and investments. He’s very familiar with the idea that asking you to have a plan is to make sure you don’t have a plan that involves doing something you’ll regret down the road, either. Sometimes, not planning to do something can be a plan in itself.

Have a Budget

Even in retirement, Dave knows that you want to have a budget so you can manage your money properly and not overspend. “A budget is telling your money where to go instead of wondering where it went.”

This is a straightforward quote, serving as a reminder that having a solid budget is as good a plan as you can make for retirement. You still have a finite amount of money to work with, so you want to be sure and budget this money down to the dollar so you know exactly what you can spend and when you can spend it. This is also a reminder that any retirement plan with your money should put you in the driver’s seat.

Change How You Think

According to Dave Ramsey, “You have to change the way you think before you can change the way you act.”

This is actually really great advice, as someone moving toward retirement needs to have the right mindset. Being retired can actually be more of a financial headache because now you’ve all the time in the world to spend the money you’ve saved over decades. This can be very tempting, so before developing any bad financial habits, you need to change your mindset before retirement, ensuring you are not overspending.

The post Dave Ramsey said retirement is not merely a dream, it is a goal that requires you to make a plan appeared first on 24/7 Wall St..

4_M_1440049442.jpg?#)