I inherited $10 million and my wife fears she’ll be left with nothing in a divorce – how do we ensure financial fairness?

Under normal circumstances, it’s safe to say that an inheritance can be a welcome gift that alleviates a significant portion of a person’s financial burden. On the other hand, a sudden windfall of money, whether through an inheritance or even a lottery win, can create a lot more stress for you and the people you […] The post I inherited $10 million and my wife fears she’ll be left with nothing in a divorce – how do we ensure financial fairness? appeared first on 24/7 Wall St..

Under normal circumstances, it’s safe to say that an inheritance can be a welcome gift that alleviates a significant portion of a person’s financial burden. On the other hand, a sudden windfall of money, whether through an inheritance or even a lottery win, can create a lot more stress for you and the people you love.

There is no doubt that receiving an inheritance can be a significant challenge for families.

For this Redditor, there is no question that his wife’s concerns must be challenging to hear.

The couple needs to sit down and consider every option, including a postnuptial agreement.

Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; get started by clicking here.(Sponsor)

Key Points

This is the reality one Redditor is facing right now as he tries to navigate how to handle his wife’s concern about learning about a sizable inheritance. Unfortunately, it’s not all smooth sailing as his wife is now very fearful about the sudden windfall of money and what could happen to her in the event the marriage breaks down.

Inheriting Money

This post in r/fatFIRE involves a 29-year-old female and a 30-year-old male Redditor who has been married for a few years without children. The family’s current plan is not to have children, which has meant they have invested all their money in various assets. As a result, they have a current net worth of around $1 million, which is split 80% in real estate investments and 20% in 401(k) accounts.

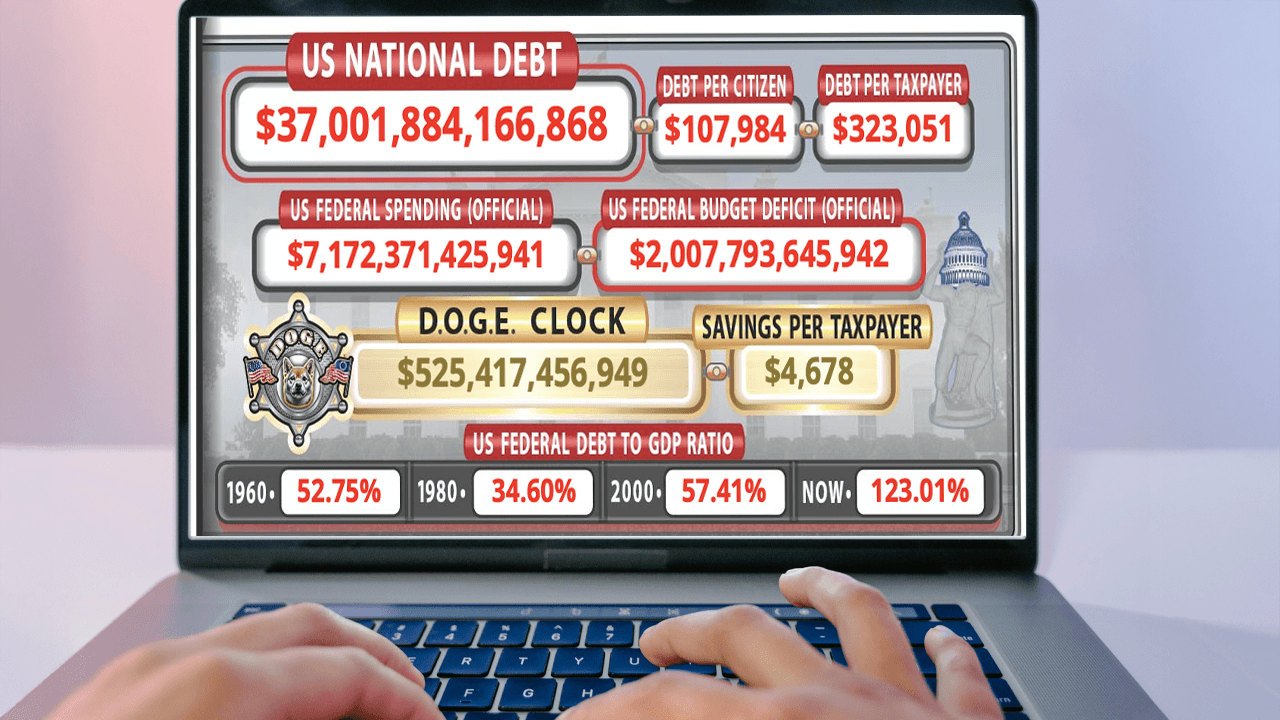

With a combined income of approximately $425,000, it’s not as if the couple is in dire financial straits. On the contrary, considering their net worth. The husband currently earns around $275,000, while the wife contributes another $150,000, so the two of them are financially well-off, even without an inheritance. As a result of their own success, they both plan to stay in the workforce for at least another 20 years before calling it quits.

Unfortunately, the concept of separate financial accounts is causing some headaches in the marriage. This is specific to an approximate $10 million inheritance the Redditor and his husband are set to receive after his grandparents recently passed away. His wife, perhaps understandably, is concerned about what would happen in the event of a divorce.

As a result, the Redditor is seeking advice on how to address the wife’s fears, whether through a postnuptial agreement or another arrangement that provides her peace of mind.

The Big Concerns

Ultimately, the wife’s primary concern is that, due to this money, the couple’s efforts to save will come to an end. Instead, they might look to live off this money rather than save, potentially using it all well before retirement.

On the other hand, the Redditor doesn’t want to commingle the funds because it’s not technically marital property. As this money was introduced during the marriage, one potential scenario is a postnuptial agreement that guarantees the wife a certain percentage of any returns earned on the principal. Alternatively, he is considering setting aside a certain percentage of their W-2 income solely for the wife in the event of a dissolution of marriage.

Still, the whole idea that the wife’s first thought here is what happens if our marriage breaks down is pretty telling. There is nothing that says the husband and wife don’t have a strong marriage, but instead of being happy, she’s worrying about what is undoubtedly a worst-case scenario. It’s okay to be worried about not using all of this money to live the high life, but it’s another thing entirely to think she is going to be left destitute for some reason.

The Best Solution

Ignoring the wife’s concerns for a moment, the best case is to figure out what your current annual spending and savings look like pre-inheritance. Now, the Redditor needs to determine how much they will personally spend, taking into account both household income and any gains from the inheritance.

All you have to do now is just spend that amount every year, and not a penny more, save for emergencies. This maintains pre-inheritance spending from your current income, and any additional funds you need come from the inheritance principal. This means that your current savings remain as joint property, and you continue to save and add to this amount from the W2 income you are currently receiving.

This accomplishes two things that the wife knows are still being saved, which checks off her first concern. The second concern is that she also knows you will not frivolously spend the inheritance money either. Now, if you want to give her a certain percentage of the money in case of divorce, or designate a million or two as hers, that’s entirely up to the Redditor.

The post I inherited $10 million and my wife fears she’ll be left with nothing in a divorce – how do we ensure financial fairness? appeared first on 24/7 Wall St..