Dave Ramsey says the typical millionaire lives in a middle-class house and buys blue jeans at Walmart

Financial advice comes in all flavors, and finding the wisdom that resonates with you may be tricky. However, the practical words of Dave Ramsey are held in high regard. With record-breaking debt burdening many Americans and new home prices over $400,000, Ramsey’s expert advice comes at an excellent time. Making smart money choices can save […] The post Dave Ramsey says the typical millionaire lives in a middle-class house and buys blue jeans at Walmart appeared first on 24/7 Wall St..

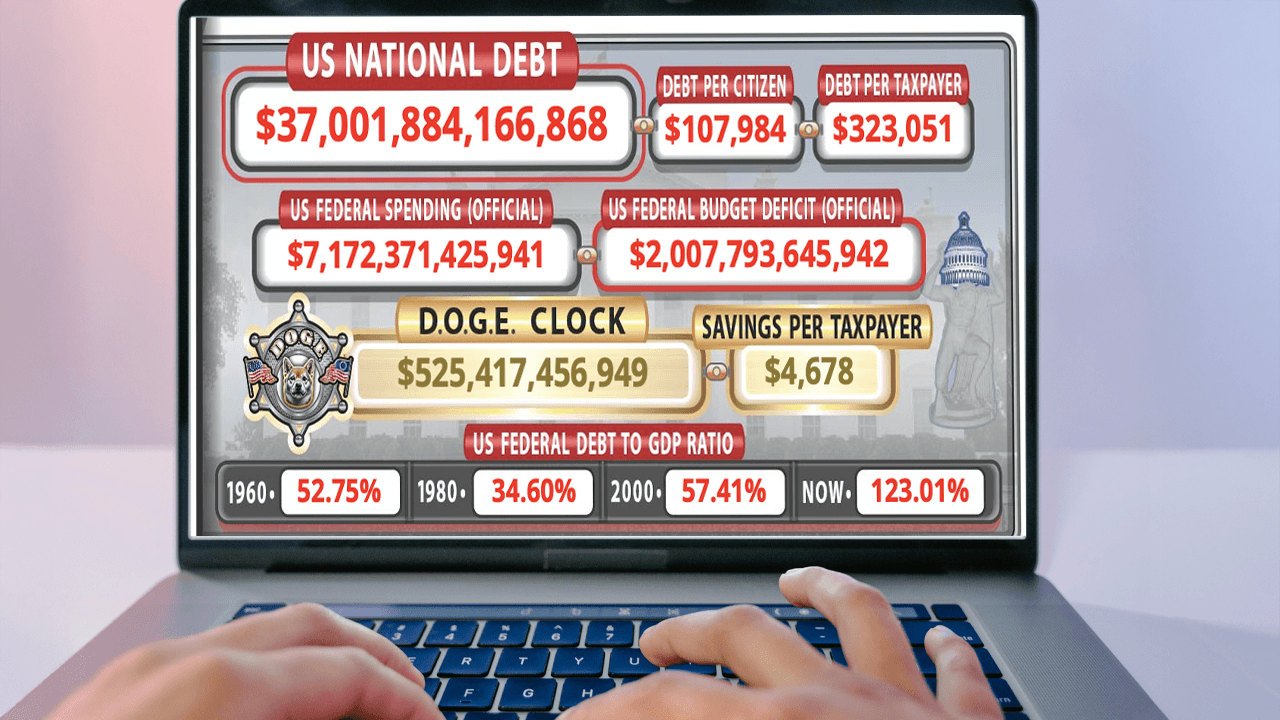

Financial advice comes in all flavors, and finding the wisdom that resonates with you may be tricky. However, the practical words of Dave Ramsey are held in high regard. With record-breaking debt burdening many Americans and new home prices over $400,000, Ramsey’s expert advice comes at an excellent time. Making smart money choices can save individuals from a lifetime of debt payments and suffering.

Dave Ramsey espouses many practical lifestyle tips, like living within your means and sticking to a budget. Perhaps he is best known for his approach to getting (and staying) out of debt, by paying off debts in sequence from small to large, a strategy he labeled the “debt snowball”. This method has helped countless grateful families crawl out from under crushing debt. Though his teachings date back over a decade, Americans living through the economic uncertainty of today may need his advice more than ever.

This slideshow explores eight of Ramsey’s most famous teachings and financial advice. If you’ve been struggling with how to budget or worried you can’t make a dent in your credit card debt, click through these slides to learn valuable money-saving insights. They may just be the push you need to make some strides toward financial peace of mind.

Live Within Your Means

- Spend less than you earn to maintain financial stability

- Prioritize needs over wants and avoid debt.

- Stagnant wages and rising costs make this harder than ever, but it’s crucial to long

Don’t Borrow Against Your Future

- Avoid taking loans against your retirement savings; doing so incurs fees and interrupts compound growth.

- Borrowing from retirement should be a last resort due to its long-term consequences

No More Guessing Games

- A budget helps you control spending and know where your money goes; it’s key to staying financially healthy.

- Budgeting includes tracking fixed, variable expenses, savings, and emergency funds.

Your Future Depends on it

- Gaining control of your money allows you to manage debt, invest, and save effectively.

- Financial control leads to independence and helps shape a secure future.

There are No Shortcuts

- Getting out of debt requires hard work and discipline; there is no secret hack.

- Use structured strategies like the debt snowball to reduce balances and regain control.

Pennywise, Poundwise

- Millionaires often live modestly and avoid excessive spending; wealth grows through frugality.

- Living below your means reflects foresight and financial discipline.

The Credit Trap

- Relying on credit during hard times can lead to long-term debt and financial stress.

- Responsible borrowing and timely repayment are key to financial stability.

Investing Makes Cents

- Saving alone isn’t enough; investing helps your money grow over time and beat inflation.

- Diversified investments can generate passive income and long-term wealth.

The post Dave Ramsey says the typical millionaire lives in a middle-class house and buys blue jeans at Walmart appeared first on 24/7 Wall St..