Crypto Trader Sees Bitcoin Hitting $160K By Year-End; ETH, SOL, ADA to Gain on Middle East Truce

Crypto majors recover alongside equities as ceasefire steadies risk sentiment, with analysts citing ETF flows and Fed pivot hopes as upside drivers.

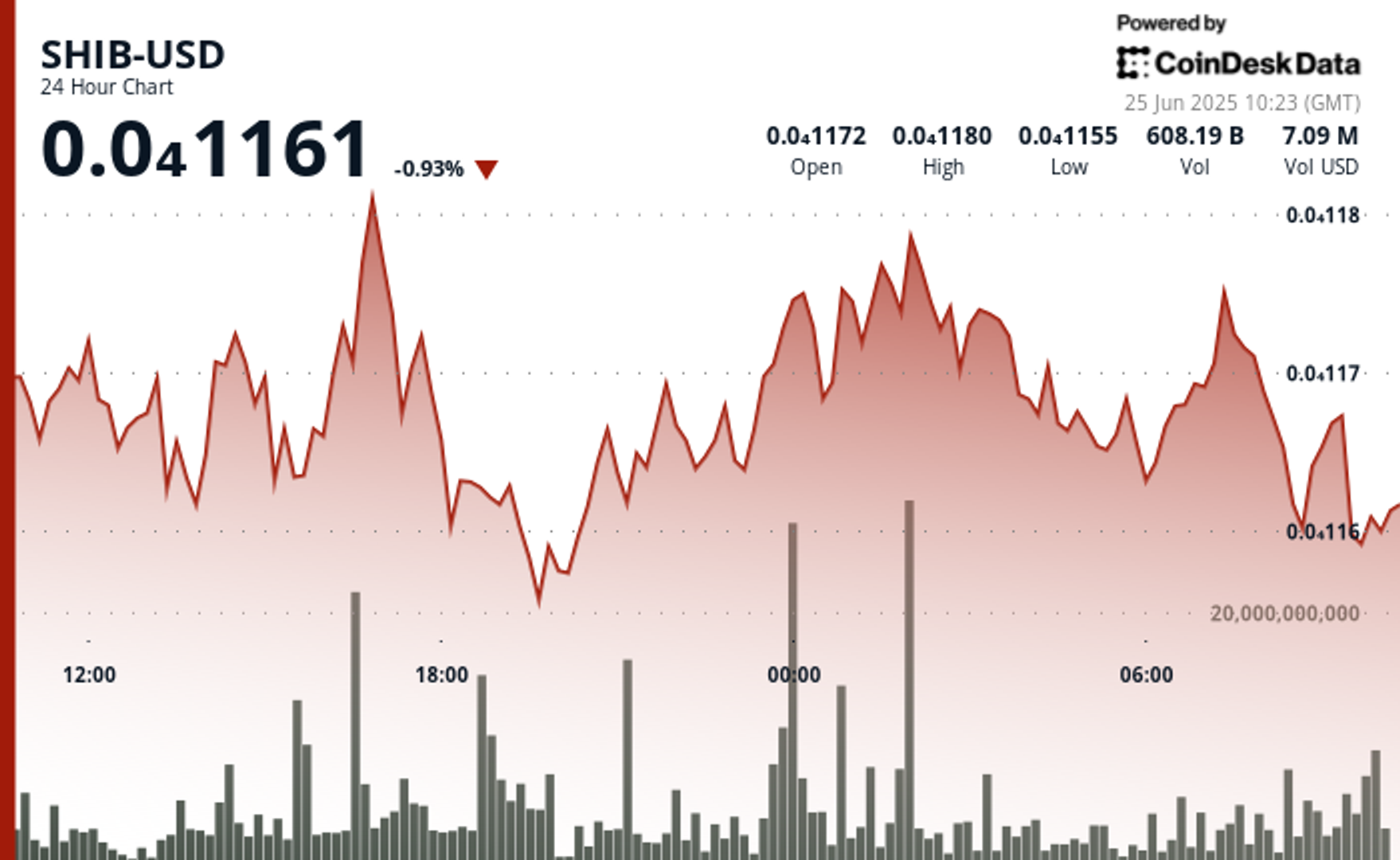

Bitcoin BTC is back above $106,000 after dipping below five figures earlier this week, as global markets steadied on signs that a ceasefire between Israel and Iran is holding.

Meanwhile, Ether ETH traded at $2,400, up 0.5% on the day, approaching resistance near $2,450. Dogecoin DOGE hovered at 16 cents after a minor 0.6% rise, while Solana’s SOL SOL dipped to $145, down 0.2%. Cardano’s ADA ADA slid nearly 1.3% to 58 cents after briefly testing the 60 cents level earlier in the week.

Ryan Lee, chief analyst at Bitget Research, said BTC’s inability to stabilize immediately after its initial drop below $99,000 signaled lingering caution, even as ETF inflows — now totaling $46 billion — continue to provide structural support.

“Its potential as a safe-haven shines through, but tempered risk appetite delays recovery,” Lee said.

Despite this, Lee sees bitcoin hitting $110,000–$115,000 by Q3 and potentially $130,000–$160,000 by year-end. Lee expects ether to be in the $2,600–$2,800 in the near term and as high as $5,500 longer term.

The rebound comes amid a broader shift in risk sentiment. U.S. equity futures edged higher on Wednesday, building on the Nasdaq 100’s record close the previous session, while Asian stocks extended their two-day rally.

Treasuries firmed and the dollar steadied after Federal Reserve Chair Jerome Powell said “many paths are possible” for monetary policy, reinforcing bets on interest rate cuts as consumer confidence weakens.

Bitcoin's recovery after its weekend fall has reignited debate over whether it’s maturing into a true safe-haven asset or simply responding to macro tailwinds and ETF-driven flows.

“Bitcoin’s status as a safe-haven asset is still taking shape,” said Gadi Chait, head of investment at Xapo Bank. “Its V‑shaped recovery back above $105K in under 48 hours after falling into the nineties highlights its growing liquidity and integration into mainstream portfolios.”

Chait added that while geopolitical shocks often spark a flight to cash, recent cycles show that institutional bids now help shallow the dips and accelerate rebounds.