Canada 'got it wrong' labeling stablecoins securities — NDAX exec

Tanim Rasul, chief operating officer at Canadian crypto exchange NDAX, said Canada “got it wrong” categorizing stablecoins as securities in 2022, and the country needs to realize that every other regulatory regime is looking at stablecoins as payment instruments.Rasul made the remarks during a panel on May 13 at the Blockchain Futurist Conference in Toronto, pointing to Europe's crypto regulatory framework as a model for Canada to consider:“I’m sure the regulators are wondering if this was the right choice to approach stablecoins as a security. […] I would just say, look at MiCA, look at the way they’re approaching stablecoins. It’s a payment instrument. It should be regulated as such.”The Canadian Securities Administrators (CSA) classified stablecoins as “securities and/or derivatives” in December 2022, following “recent events in the crypto market,” such as the dramatic collapse of crypto exchange FTX just a month before.Related: What Canada’s new Liberal PM Mark Carney means for cryptoCanadian Web3 Regulation panel at Blockchain Futurist Conference. Source: CointelegraphThe agency elaborated on stablecoin rules in February and October of 2023, placing such tokens under the umbrella of “value-referenced crypto assets.”Canada’s stance on digital assets led many top crypto companies, including Binance, Bybit, OKX, and Paxos, to scale back operations in the local market. Crypto exchange Gemini also announced exit plans in September 2024. The regulatory setback, however, hasn’t stopped Canada’s digital asset market from flourishing. According to Grand View Research, the local crypto industry posted revenue of $224 million in 2024, higher than in previous years. It is expected to grow at a compound annual growth rate of 18.6% until 2030, when it is forecast to reach $617.5 million in annual revenue.Related: Bitstamp’s departure from Canada is ‘timing issue,’ says CEOStablecoins have emerged as key crypto use caseStablecoins, cryptocurrencies pegged to a fiat currency, have emerged as a key use case for digital assets. According to DefiLlama, the current market capitalization for all stablecoins is at $242.8 billion as of May 14, up 51.9% in the past 12 months.Stablecoin market cap. Source: DefiLlamaNation-states and economic blocs are increasingly working on stablecoin regulations to tackle the rising usage across the world. While the most used stablecoins are pegged to the US dollar, there is demand for stablecoins pegged to other fiat currencies.Magazine: Legal Panel: Crypto wanted to overthrow banks, now it’s becoming them in stablecoin fight

Tanim Rasul, chief operating officer at Canadian crypto exchange NDAX, said Canada “got it wrong” categorizing stablecoins as securities in 2022, and the country needs to realize that every other regulatory regime is looking at stablecoins as payment instruments.

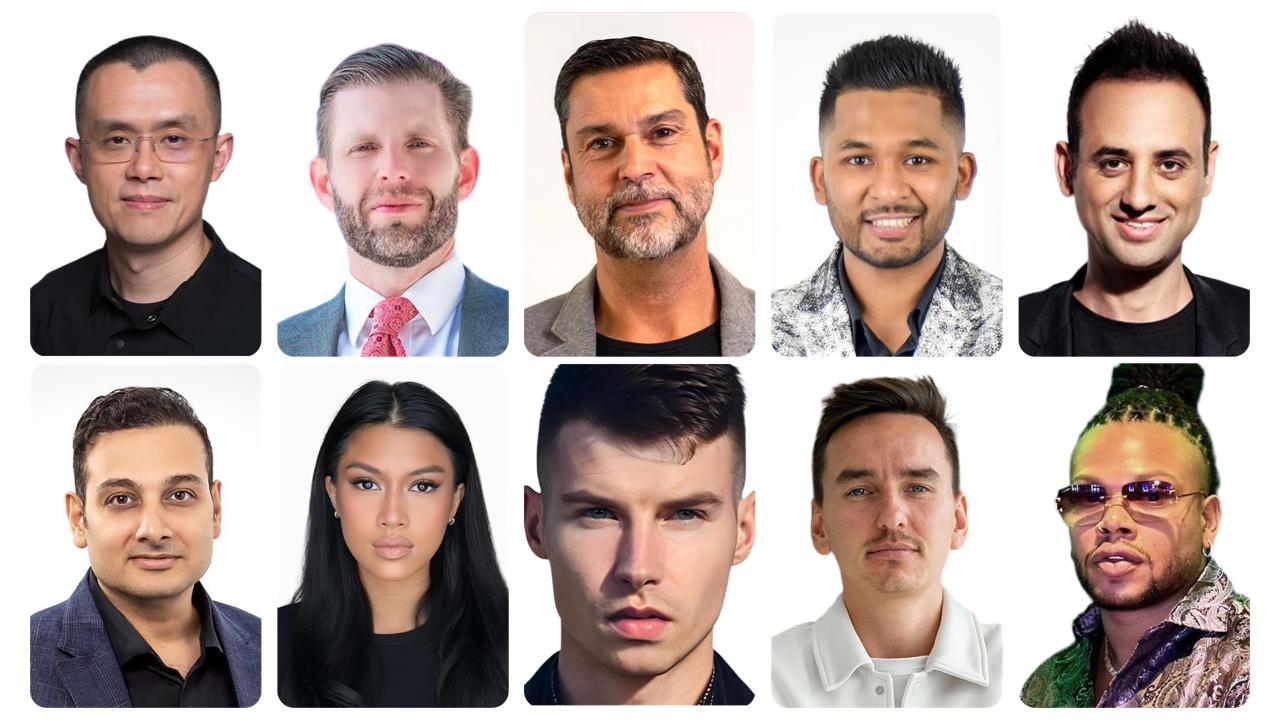

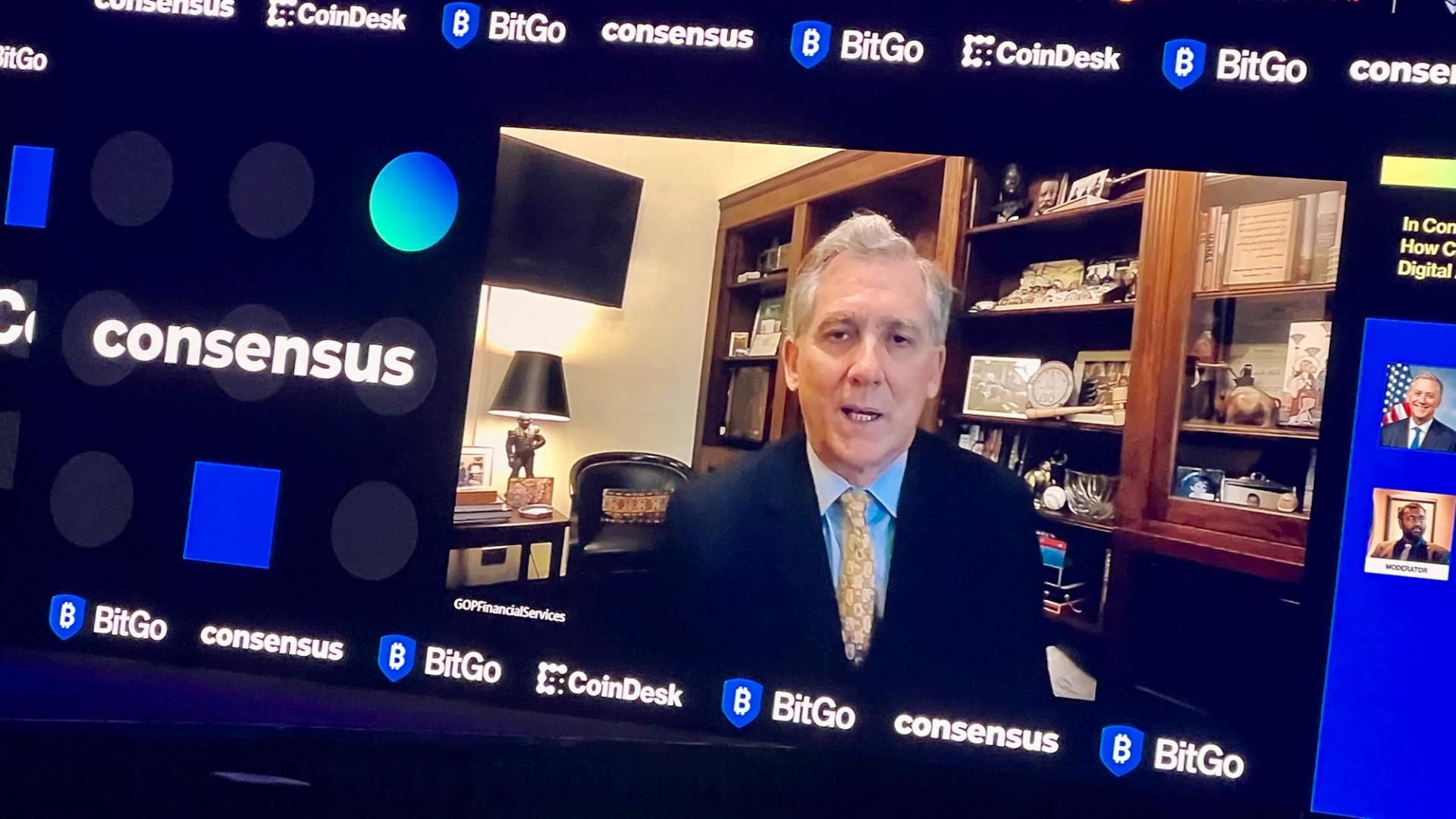

Rasul made the remarks during a panel on May 13 at the Blockchain Futurist Conference in Toronto, pointing to Europe's crypto regulatory framework as a model for Canada to consider:

“I’m sure the regulators are wondering if this was the right choice to approach stablecoins as a security. […] I would just say, look at MiCA, look at the way they’re approaching stablecoins. It’s a payment instrument. It should be regulated as such.”

The Canadian Securities Administrators (CSA) classified stablecoins as “securities and/or derivatives” in December 2022, following “recent events in the crypto market,” such as the dramatic collapse of crypto exchange FTX just a month before.

Related: What Canada’s new Liberal PM Mark Carney means for crypto

The agency elaborated on stablecoin rules in February and October of 2023, placing such tokens under the umbrella of “value-referenced crypto assets.”

Canada’s stance on digital assets led many top crypto companies, including Binance, Bybit, OKX, and Paxos, to scale back operations in the local market. Crypto exchange Gemini also announced exit plans in September 2024.

The regulatory setback, however, hasn’t stopped Canada’s digital asset market from flourishing. According to Grand View Research, the local crypto industry posted revenue of $224 million in 2024, higher than in previous years. It is expected to grow at a compound annual growth rate of 18.6% until 2030, when it is forecast to reach $617.5 million in annual revenue.

Related: Bitstamp’s departure from Canada is ‘timing issue,’ says CEO

Stablecoins have emerged as key crypto use case

Stablecoins, cryptocurrencies pegged to a fiat currency, have emerged as a key use case for digital assets. According to DefiLlama, the current market capitalization for all stablecoins is at $242.8 billion as of May 14, up 51.9% in the past 12 months.

Nation-states and economic blocs are increasingly working on stablecoin regulations to tackle the rising usage across the world. While the most used stablecoins are pegged to the US dollar, there is demand for stablecoins pegged to other fiat currencies.

Magazine: Legal Panel: Crypto wanted to overthrow banks, now it’s becoming them in stablecoin fight