Boomers: Trump’s Social Security Plan Has a Major Flaw No One Is Addressing

It’s an unfortunate fact that many Americans enter retirement without savings. People in that boat inevitably wind up heavily reliant on Social Security, to the point where it’s their only source of income. If the only income you have access to in retirement is Social Security, there’s a good chance you don’t have to […] The post Boomers: Trump’s Social Security Plan Has a Major Flaw No One Is Addressing appeared first on 24/7 Wall St..

Key Points

-

President Trump wants to get rid of taxes on Social Security.

-

While that would save many seniors money, it could push the program closer to insolvency.

-

Changing the thresholds at which benefits are taxed may be a more reasonable approach.

-

Over 4 Million Americans set to retire this year. If you’re one, don’t leave your future to chance. Speak with an advisor and learn if you’re ahead, or behind on your goals. Click here to get started.

It’s an unfortunate fact that many Americans enter retirement without savings. People in that boat inevitably wind up heavily reliant on Social Security, to the point where it’s their only source of income.

If the only income you have access to in retirement is Social Security, there’s a good chance you don’t have to pay federal taxes on your benefits. But when you have even a little bit of income outside of Social Security, you run the risk of losing some of those benefits to taxes.

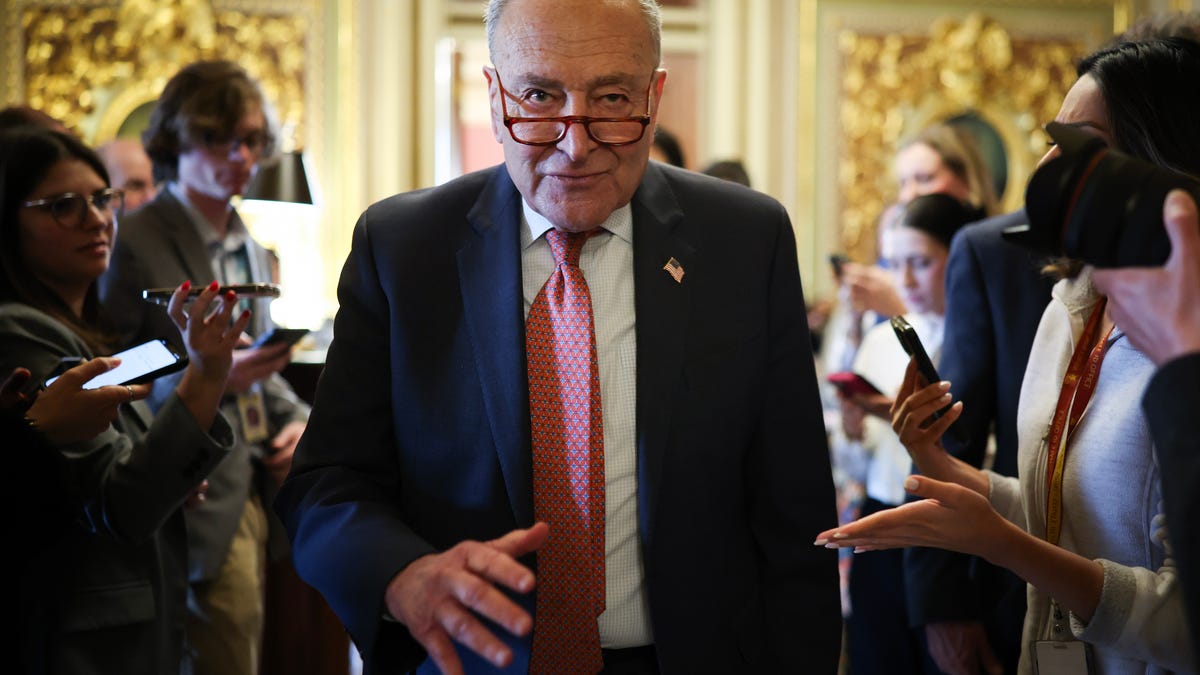

That’s not something President Trump is a fan of. And as part of his campaign, he pledged to eliminate taxes on Social Security benefits. But his plan has a serious flaw that could the program a world of upheaval.

Social Security needs all the revenue it can get

You may have heard a rumor that Social Security is on the verge of going broke. That’s not true, simply because the program can’t go broke by design.

But it’s true that in the coming years, Social Security expects to owe more in benefits than it collects in revenue. That’s because the program is primarily funded by payroll taxes. But as baby boomers retire, that revenue stream will shrink.

Social Security can use the money in its trust funds to keep up with benefit payments for a while. But the program’s Trustees estimate that by 2035, those trust funds will be out money. At that point, benefit cuts will be on the table, and seniors could see their monthly checks shrink by more than 20%.

What does this have to do with Trump’s plan to get rid of taxes on Social Security benefits? It’s simple. Those taxes, though a burden for many seniors, are used to help fund the program. If they go away, it could make benefit cuts more likely. And it could make them happen a lot sooner.

A potential compromise

Getting rid of taxes on Social Security benefits completely might push the program into an even worse financial state. So a better approach could be to change the income thresholds at which those taxes apply.

Right now, taxes on benefits apply to individuals with a combined income of $25,000 or more, or joint tax-filers with a combined income of $32,000 or more.

Combined income is calculated as follow:

- Adjusted gross income +

- Tax-exempt interest income +

- One-half of your annual Social Security benefits

As you can see, it doesn’t take much to be taxed on Social Security. But instead of getting rid of those taxes completely, Trump could push to raise the combined income limits so that relatively low- and moderate-income seniors aren’t losing some of their Social Security. At the same time, higher earners in retirement who can afford those taxes could continue paying them.

Of course, this is not an optimal solution, either. But it may be a preferable one to Trump’s idea of completely eliminating one of Social Security’s critical revenue streams at a time when the program is at risk of benefit cuts.

The post Boomers: Trump’s Social Security Plan Has a Major Flaw No One Is Addressing appeared first on 24/7 Wall St..