BitMine Launches Bitcoin Treasury Advisory Practice, Secures $4M Deal with First Client

Bitcoin Magazine BitMine Launches Bitcoin Treasury Advisory Practice, Secures $4M Deal with First Client BitMine launches new Bitcoin Treasury Advisory Practice and secures a $4 million deal with its first client, surpassing its entire 2024 revenue. This post BitMine Launches Bitcoin Treasury Advisory Practice, Secures $4M Deal with First Client first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

Bitcoin Magazine

BitMine Launches Bitcoin Treasury Advisory Practice, Secures $4M Deal with First Client

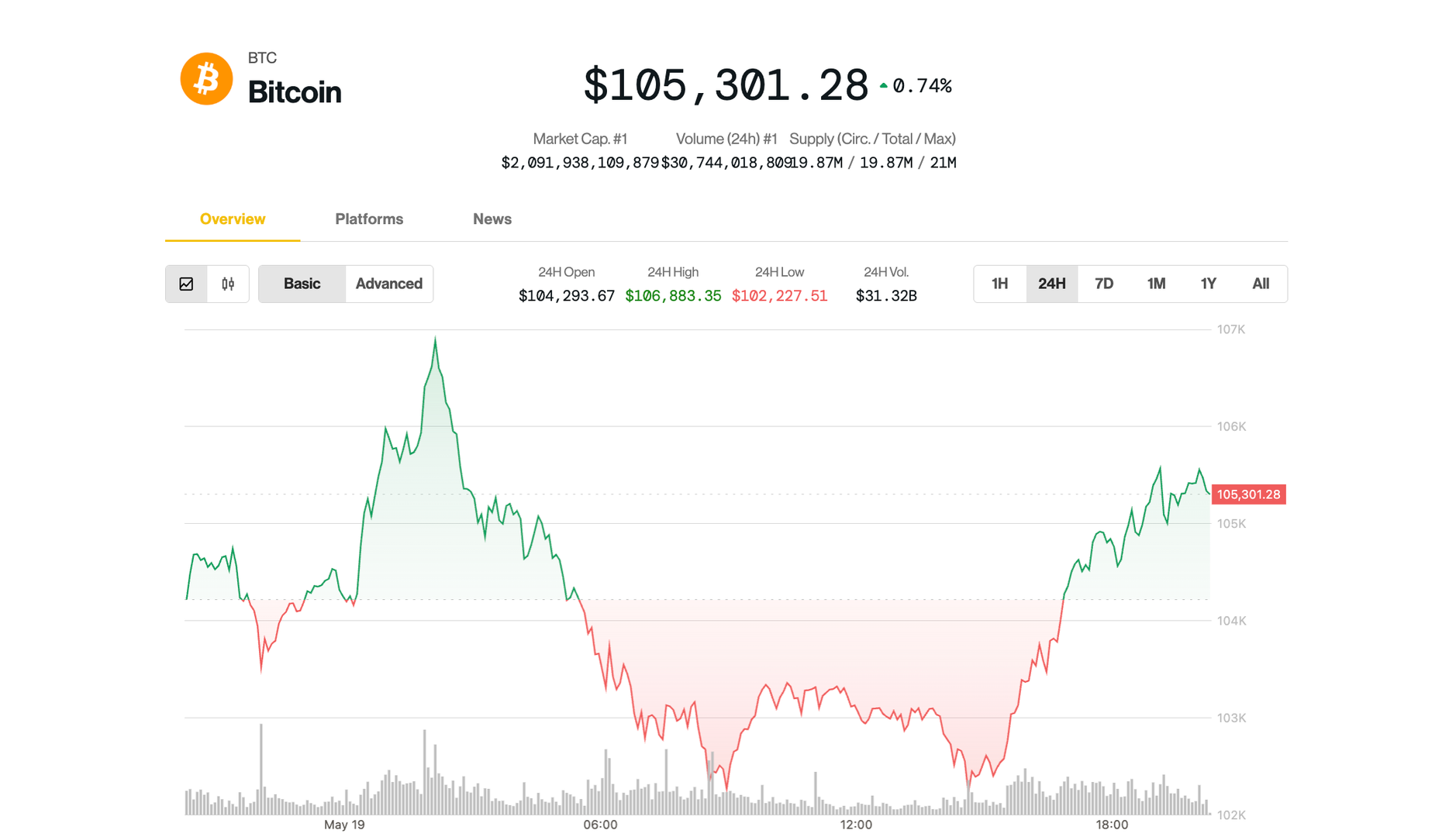

Today, BitMine Immersion Technologies, Inc. (OTCQX: BMNRD) announced the launch of its Bitcoin Treasury Advisory Practice and a $4 million deal with a U.S. exchange-listed company. The deal saw Bitmine surpass its last year’s total revenue in that single transaction alone, according to the announcement.

BitMine will provide “Mining as a Service” (MaaS) by leasing 3,000 Bitcoin ASIC miners to the client through December 30, 2025, in a $3.2 million lease deal, with $1.6 million paid upfront. Additionally, the client has signed an $800,000 consulting agreement for one year focusing on Bitcoin Mining-as-a-Service and Bitcoin Treasury Strategy.

“Currently, there are almost 100 public companies that have adopted Bitcoin as a treasury holding. We expect this number to grow in the future. As more companies adopt Bitcoin treasury strategies, the need for infrastructure, revenue generation, and expert guidance grows along with it,” said Jonathan Bates, CEO of BitMine. “This single transaction is greater than our entire 2024 fiscal year revenue, and we feel there is an opportunity to acquire more clients in the near future as interest in Bitcoin ownership grows.”

BitMine’s first quarter 2025 results showed strong revenue growth, with GAAP revenue rising approximately 135% to $1.2 million, up from $511,000 in Q1 2024, supported by an expanded mining capacity of 4,640 miners as of November 30, 2024, compared to 1,606 the previous year. Despite this growth, the company reported a net loss of $3.9 million in Q1 2025, primarily due to a one-time, non-cash accounting adjustment related to preferred stock; excluding this charge, the adjusted loss was approximately $975,000, consistent with the prior year’s results.

BitMine’s new Bitcoin Treasury Advisory Practice, along with the $4 million deal, joins a trend among public companies exploring Bitcoin not just as a treasury asset but also as a source of revenue.

This post BitMine Launches Bitcoin Treasury Advisory Practice, Secures $4M Deal with First Client first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.