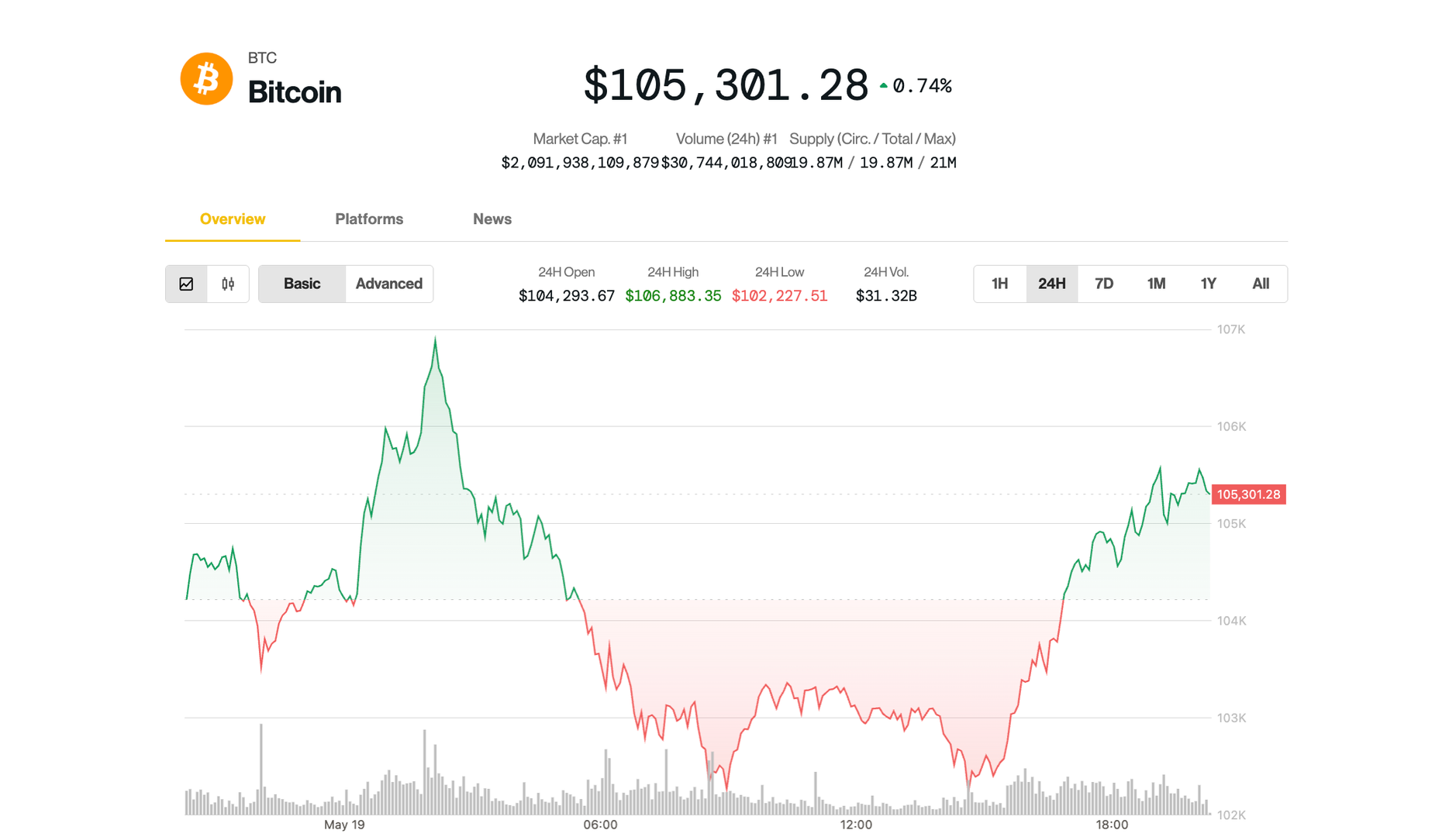

Yalla Net Margin Jumps on AI Gains

Net margin (GAAP) rose to 43.4% in Q1 2025, up from 39.5% a year prior, driven by disciplined cost control and AI-driven user acquisition improvements.

Yalla Group Limited (NYSE:YALA) reported first quarter 2025 earnings on May 19, 2025, delivering $83.9 million in GAAP revenue (up 6.5% year over year) and Net income increased by 17% year over year. Management underscored robust monthly active user (MAU) expansion (Average MAUs grew to 44.6 million, a 17.9% year-over-year increase.), Net margin (GAAP) improved from 39.5% to 43.4%, and a $50 million enhanced share buyback plan for 2025. The following insights examine AI integration, user acquisition efficiency, and capital return policy, and their implications for the long-term investment case.

In Q1 2025, Technology and product development expenses (GAAP) rose 25% to $7.8 million due to increased R&D staffing, focused on AI moderation and analytics tools. Yalla’s proprietary AI platform now extends to nuanced Arabic dialects.

The effective AI integration reduces moderation costs and enhances user experience.