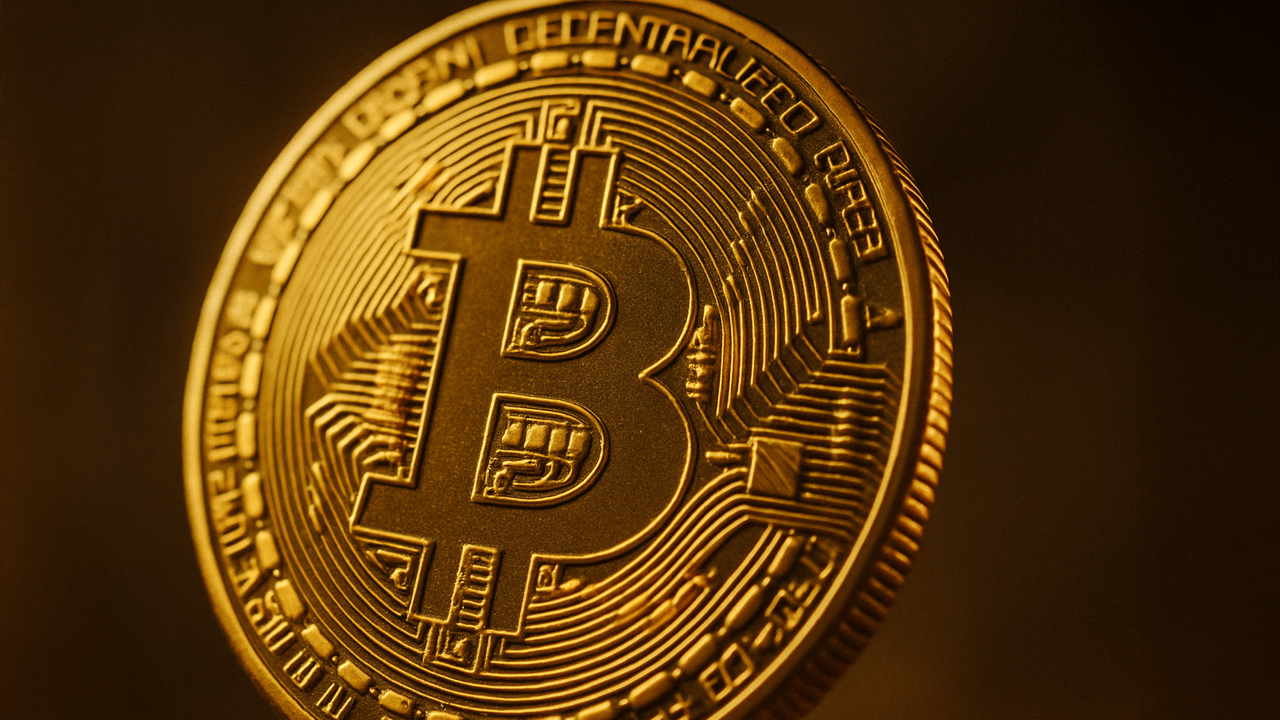

Bitcoin, Stablecoins Command Over 70% of Crypto Market as BTC Pushes Higher

ETH/BTC ratio drops to lowest level in five years, underscoring bitcoin’s dominance.

Bitcoin’s (BTC) commanding position in the crypto ecosystem continues to strengthen.

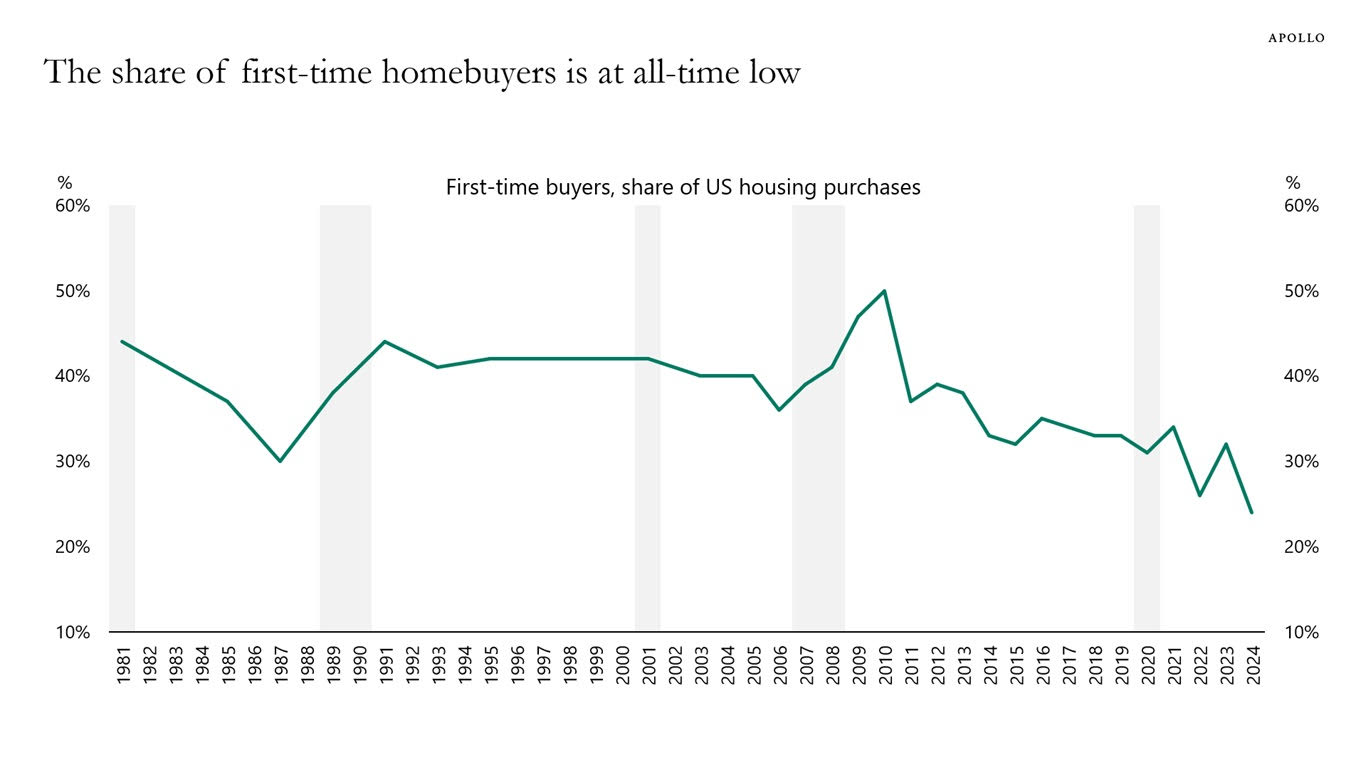

When combined with the top two stablecoins by market capitalization — Tether (USDT) and Circle’s (USDC) — these three assets now represent approximately 72% of the total cryptocurrency market. This dominance underscores a broader consolidation at the top of the digital asset market, as capital gravitates toward perceived safety and strength.

BTC alone has surged to a 64.60% share of crypto market capitalization, briefly touching levels not seen since January 2021. This rise in dominance reflects growing investor preference for bitcoin amid ongoing macroeconomic and market uncertainty.

While bitcoin consolidates its leadership, its closest competitor, ether (ETH), continues to struggle in 2025. ETH has fallen more than 50% year-to-date, underperforming bitcoin. The ETH/BTC ratio has slipped to 0.01765, a level last seen in early 2020, highlighting the widening performance gap between the two leading digital assets.

Bitcoin has also notably diverged from U.S. equities. Since "Liberation Day" at the beginning of April, the S&P 500 is down 6%, while BTC is up 4%, effectively holding its ground despite external market pressures. As of writing, bitcoin trades slightly above $88,000, while ether is holding just above $1,600.

Key technical levels to watch for bitcoin

Bitcoin currently sits just under several critical on-chain and technical levels that could influence short-term price direction:

- 200-Day Moving Average: $87,965

- 2025 Realized Price (average on-chain cost basis for 2025 BTC buyers): $91,565

- Short-Term Holder Realized Price (average entry price for BTC held under six months): $92,385

Historically, bitcoin tends to enter a sustained bull market when trading above these key technical levels.