Billionaire Jeffrey Gundlach sends blunt warning on stocks, bonds

The billionaire hedge fund manager delivered a startling message.

Much has been said on tariffs this past week, and for good reason. President Trump's decision to ramp up import tariffs has sent shockwaves through the global economy, sending stocks and Treasury bond markets reeling.

The tariff turmoil has sparked fierce debate among proponents and opponents. Those favoring tariffs say they're the best way to arm wrestle manufacturing back to America, while those against them argue they're inflationary and put the economy on track for recession.

The reality is that we won't know how the tariff experiment pans out for a while. Building factories takes a long time, and it could be months before we know for certain how inflation will impact business and consumer spending trends.

Negotiations with nations that may reduce tariffs on their exports are also kicking off and could significantly change assumptions over the impact of import taxes over the coming months.

In short, there's tremendous uncertainty, and markets traditionally hate uncertainty.

Related: Analyst resets recession risk after Jamie Dimon’s message on economy

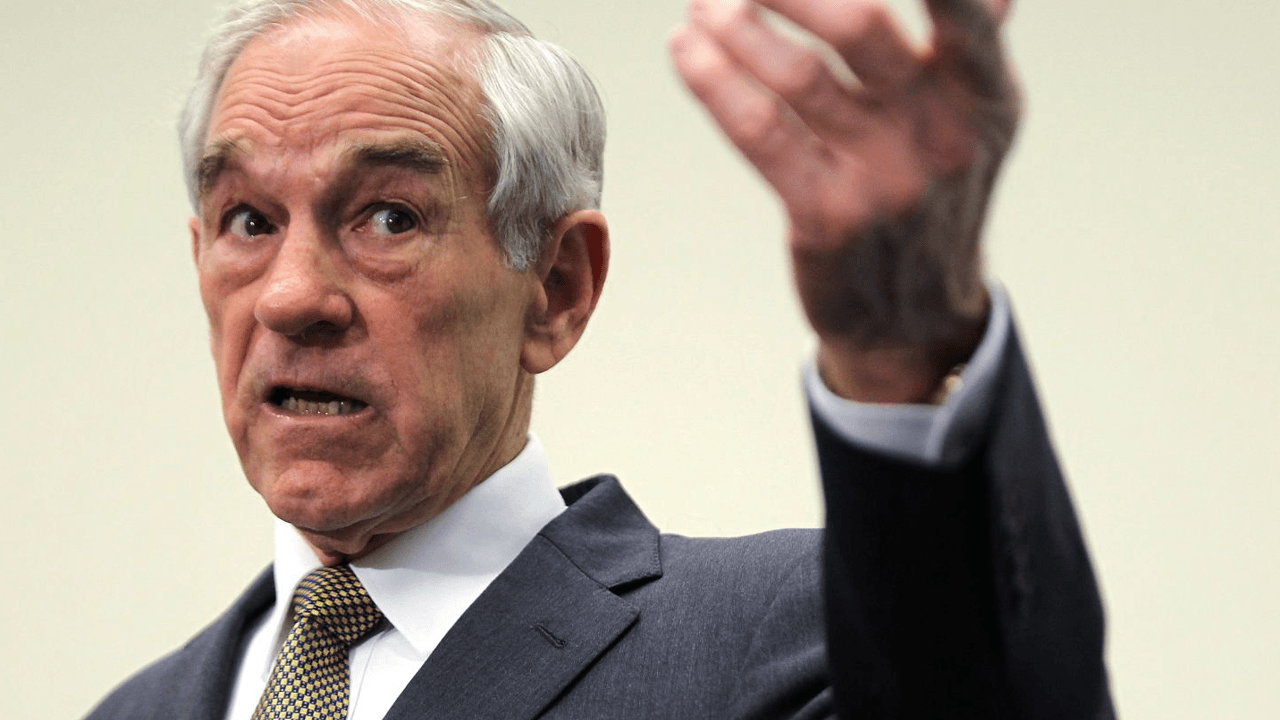

That fact isn't lost on billionaire hedge fund manager Jeffrey Gundlach. Gundlach is the founder of DoubleLine, a hedge fund with over $90 billion in assets under management.

Gundlach recently offered a blunt take on the current fallout from the tariff tussle, and given he's been professionally navigating markets since the mid-1980s, investors ought to pay attention.

The U.S. economy is at an important crossroads

Much has happened in the past five years. The Covid pandemic shutdown required massive fiscal and monetary stimulus to prevent a Great Depression-like meltdown.

However, that flood of cash sparked runaway speculation and skyrocketing inflation that eclipsed 8% in 2022. As a result, the Fed, after incorrectly arguing inflation was transitory in 2021, embarked on the most restrictive series of interest rate hikes since Fed Chair Paul Volcker battled inflation in the early 1980s.

Related: Legendary fund manager sends blunt 9-word message on stock market tumble

The restrictive monetary policy successfully wrestled inflation below 3% last year but also caused cracks in the jobs market, sending the unemployment rate to 4.2% from 3.5% in 2023.

Now, the economy faces the jarring reality that higher tariffs could cause massive dislocations in economies worldwide, re-sparking inflation even as the jobs market remains shaky.

Over 275,000 Americans lost their jobs in March, according to Challenger, Gray, & Christmas, as Department of Government Efficiency job cuts took a toll -- up 205% year over year, and the worst showing since Covid in 2020.

Unsurprisingly, that's taking a toll on confidence.

On April 11, the University of Michigan's Consumer Confidence Index plunged 11% in April from March to 50.8, which was below Wall Street outlooks for 54.5. The Consumers Expectations Index dropped to 47.2 from 52.6 in March. The one-year inflation outlook surged to 6.7% from 5%. Unemployment expectations are now "more than double the November 2024 reading and the highest since 2009," according to the Surveys of Consumers Director Joanne Hsu.

The risk that falling confidence will cause consumer and business spending to retrench, creating a self-fulfilling prophecy of recession isn't the only fallout from the ongoing trade war.

Jeffrey Gundlach sends frank 3-word message on the U.S. economy

Gundlach has seen a thing or two over his forty-year career managing money. His role as the head of one of the largest money managers gives him access to insight across sectors, industries, and asset classes.

Related: Stanley Druckenmiller sends curt 7-word response to tariff war

He's not a fan of what he's seeing right now, and given the size of the U.S. debt pile; the government isn't nearly in the position it was in 2020 to prop up the economy if things worsen.

"Halfway through fiscal year 2025, the U.S. Budget deficit increased by $1.3 trillion. So we are up to a $2.6 trillion annual rate. That rounds up to an incredible 9% of GDP," wrote Gundlach in a post on "X."

The soaring budget deficit means we rely heavily on foreign Treasury bond buyers to finance (and refinance) our spending. Foreign buyers own 30% of Treasuries, according to Torsten Slok, Chief Economist at Apollo Group.

Given our hefty deficit, the appetite to own Treasuries could weaken amid the ongoing trade war. We may already be feeling some shockwaves.

"The 30-year US Treasury yield is going vertical," wrote Gundlach.

The 10-year U.S. Treasury yield is often used as a benchmark by banks to set mortgage rates. It's also the risk-free rate businesses often use when weighing whether or not to invest in new projects, and investors use it to consider whether the risk of owning stocks is worth the possible reward.

More Economic Analysis:

- Wall Street overhauls S&P 500 price targets as tariff selloff accelerates

- Inflation would like a word, please

- Stocks could bounce, but big bank earnings hold the cards

The 10-year Treasury Note yield has also surged in the past week, rising to 4.5% from below 4% on April 5th.

We're also seeing a massive drop in the value of the U.S. Dollar, which has long been considered a safe haven in times of distress. It has slumped to the lowest level in three years, "having fallen around 8.8% against a basket of its global peers since the start of the year", writes TheStreet's Martin Baccardax.

The S&P 500 is down nearly 10% year-to-date, and Gundlach worries it's not over. In a CNBC interview on April 7, "The odds favor a recession at this point. It's kind of hard to see how we avoid it... The market was ridiculously overvalued going into 2025."

Gundlach thinks the S&P 500 could see 4,500. It's currently 5,314.

"The 30-year Treasury yield experienced the biggest increase since 1982, equities are falling, the dollar is falling, and gold hit an all-time high," wrote UBS economist Paul Donovan.

The combination of a Treasury sell-off, which caused yields to spike and created headwinds for economic activity, and the U.S. Dollar decline may suggest a structural shift in the global framework that has benefited America for a very long time.

Or, to put it bluntly:

"The fit is hitting the shan," wrote Gundlach.

Related: Veteran fund manager unveils eye-popping S&P 500 forecast