Billionaire investor Ray Dalio says this is the “most important thing you need to do in order to invest well”

When the 2008 subprime mortgage banking crisis hit, it decimated many long-standing firms, such as Bear Stearns, Lehman Brothers, and others. However, hedge fund Bridgewater Associates had accurately forecast the problems of excess leverage in the mortgage sector, the panic selling that would follow, and the remedial steps that the Federal Reserve would need to […] The post Billionaire investor Ray Dalio says this is the “most important thing you need to do in order to invest well” appeared first on 24/7 Wall St..

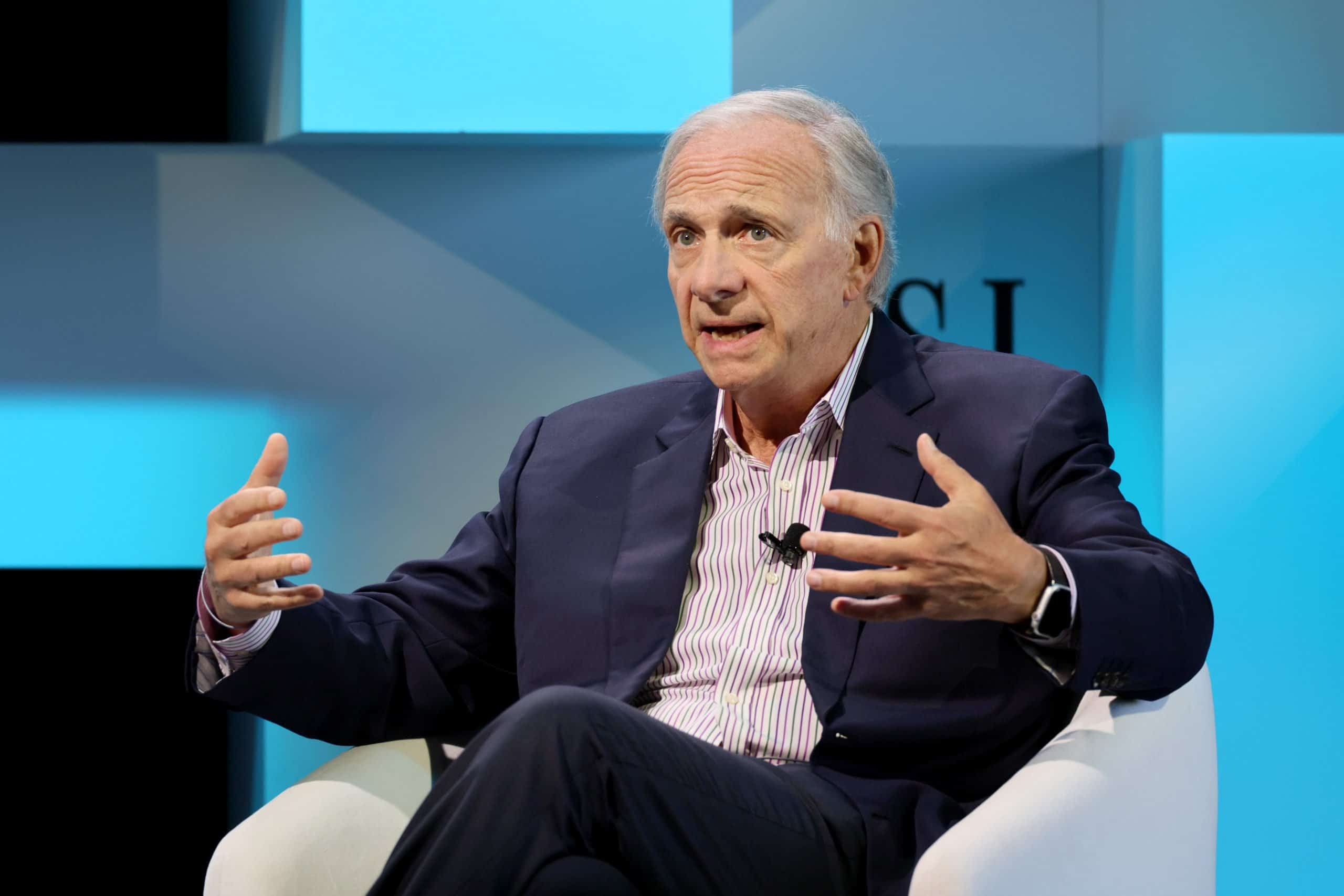

When the 2008 subprime mortgage banking crisis hit, it decimated many long-standing firms, such as Bear Stearns, Lehman Brothers, and others. However, hedge fund Bridgewater Associates had accurately forecast the problems of excess leverage in the mortgage sector, the panic selling that would follow, and the remedial steps that the Federal Reserve would need to take to get things back on track. Dalio shorted the US dollar and went long on gold, commodities, and US Treasuries, resulting in a 9.5% gain when most of his rivals needed TARP money or went belly up.

After 42 years at the helm of Bridgewater Associates Dalio stepped down from the CEO position. He has authored several books, with Principles: Life and Work selling close to a million copies, and thousands of subscribers read his blog posts on current events and their influence on financial markets.

Key Points

-

Thanks to Ray Dalio’s investment strategies, his Bridgewater Associates became the largest hedge fund in 2005, growing to $160 billion when he stepped down as CEO in 2017.

-

Bridgewater Associates’ reputation was cemented when it had accurately anticipated the 2008 subprime mortgage banking meltdown and rose 9.5% when many of its rivals floundered or folded.

-

Ray Dalio has authored a number of books on finance and investing, and has often been quoted for his insights on global markets.

-

Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; get started by clicking here here.(Sponsor)

The Most Important Thing

Similar to Warren Buffett, Charlie Munger, and other renowned investors, many people have followed Ray Dalio and collected his quotes as guides for their own investment strategies. One of his more popular quotes is:

“Diversifying well is the most important thing you need to do in order to invest well.”

It is helpful to understand Dalio’s approach, worldview and methodology to place his quotes in context for application in individual circumstances. In its ascent to becoming the world’s largest hedge fund with $160 billion AUM, Bridgewater Associates counted among its institutional clients the following entities:

- California Public Employees’ Retirement System (CALpers)

- National Australia Bank, Ltd.

- United Technologies Corp (now merged with Raytheon)

- General Motors

- Government Investment Company of Singapore

Unlike Warren Buffett, Stan Druckenmiller, or other notable stock traders, Ray Dalio’s success is predicated more on a macroeconomic perspective. He assiduously tracks economic trends such as interest rates, exchange rates, GDP growth and international events. As such, Dalio has rarely touted individual stocks or companies, and has tended to focus more on broader asset classes, such as sovereign bonds, commodities, indexes, going either long or short and utilizing leverage when deemed appropriate. Given the international makeup of Bridgewater Associates’ institutional clientele, this makes total sense, and encompasses broader geopolitical concerns that can affect those parameters.

Dalio has also taken some criticism for his admiration of China’s economic and technological strides, human rights violations notwithstanding, and has pointed out that American capitalism needed reform. Dalio based this premise on the unfunded social liabilities, unsustainable national debt, and systemic barriers to upward mobility that exacerbated income inequality in the US.

Diversifying For the Individual Investor

For those seeking to put Dalio’s diversification principle into practice, there is a literal and a figurative approach that individual investors can take:

Literal Approach: If an investor wishes to take a macroeconomic diversification approach, one does not need to have a $160 billion war chest. One can create a comparable portfolio utilizing ETFs for precious metals, commodities, sovereign bonds, and similar asset classes. Some examples for consideration might be:

- iShares MSCI Global Gold Miners ETF (NASDAQ: RING)

- Invesco DB Agriculture Fund (NYSE: DBA)

- Vanguard Emerging Markets Government Bond Index Fund (NASDAQ: VWOB)

- iShares China Large Cap ETF (NYSE: FXI)

Of course, careful monitoring of geopolitical news events and how they might create impacts on various precious metals, commodities, interest rates, forex rates and other markets would dictate one’s investment decisions. Therefore, closely following the trends that Ray Dalio identifies in his blog would be a crucial reference guide,

Figurative Approach: Taking Ray Dalio’s advice figuratively, one can use that underlying principle as a fundamental standard risk mitigation strategy. The notion of buying an ETF or a mutual fund, which represents a pool of various securities instead of a single one, inherently uses diversification to prevent having “all of the eggs in one basket.” However, one can expand a personal portfolio to vertically diversify asset classes as well. Some considerations can include:

- A High Yield Savings account with FDIC insurance for an emergency fund.

- A selection of REITs or REIT ETFs that are not interest rate sensitive for reliable income streams separate from bonds or other fixed income assets.

- Physical precious metals in the event of infrastructure failure, such as a power outage negates access to digital accounts, ATMs, or other modes of exchange.

- Cryptocurrencies as an alternative asset class with international acceptance and relative liquidity.

Another of Ray Dalio’s more famous quotes is: “I think that the first thing is you should have a strategic asset allocation mix that assumes that you don’t know what the future is going to hold.”

This is wise advice and something to bear in mind and to plan for, accordingly.

The post Billionaire investor Ray Dalio says this is the “most important thing you need to do in order to invest well” appeared first on 24/7 Wall St..