Billionaire fund manager makes bold bets on Meta, Nvidia stock

The veteran hedge fund manager's latest tech stock trades turn heads.

It's been a rough go for tech stocks so far in 2025. The Magnificent 7's stellar returns over the past two years fueled big gains in the broader S&P 500 index, but mounting worries that a global slowdown could crimp corporate budgets have been a headwind this year.

The S&P 500 has fallen 10% year-to-date in 2025, mainly because tech stocks, representing over 30% of the index, have tumbled. The pain has been widespread across tech-land, with large technology leaders like Nvidia and Meta Platforms being particularly hard hit, dropping 24% and 14%, respectively.

Related: Surprising trade war news sends Nvidia stock reeling

The sell-off in technology stocks has caught the attention of global investors, including Stephen Yiu, who manages money for billionaire Peter Hargreaves, founder of U.K. financial services giant Hargreaves Lansdown.

Yiu's Blue Whale hedge fund is particularly dialed into technology, given that about 40% of the fund's roughly $1.5 billion in assets are invested in the sector.

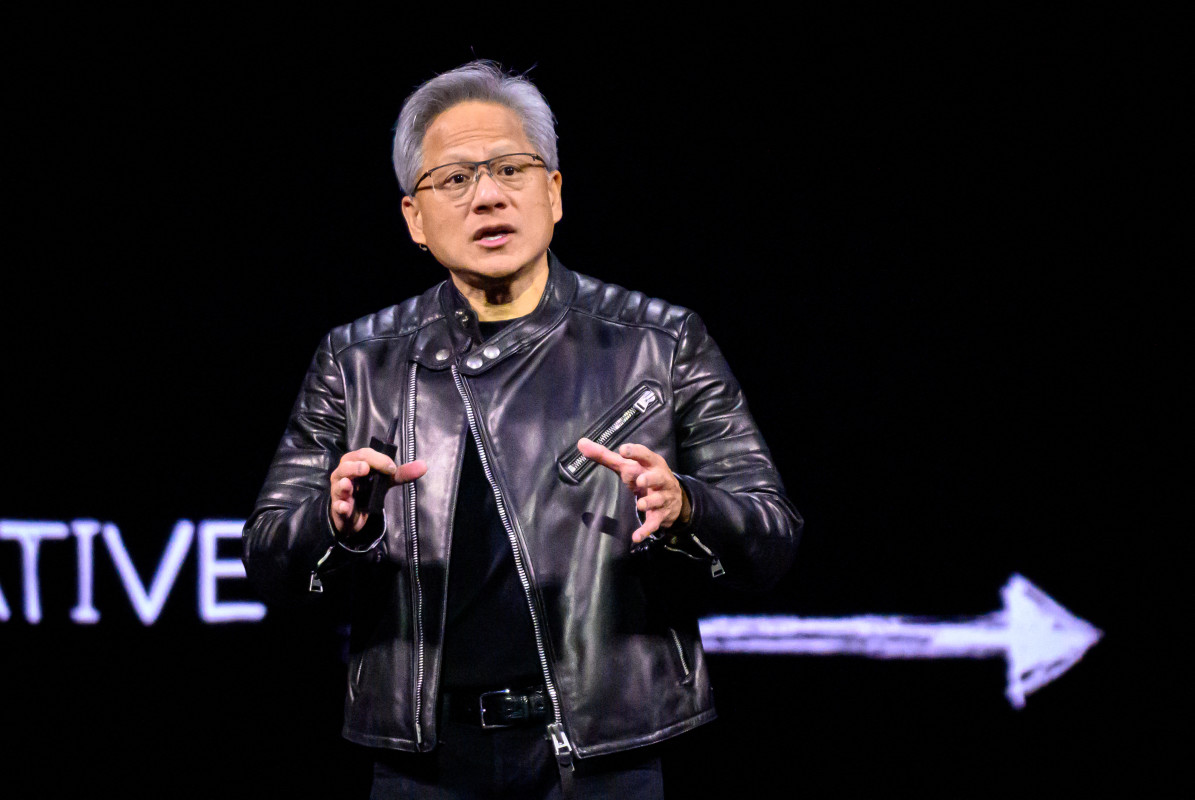

The hedge fund's size and tech-stock focus make Yiu's moves, including his latest bets on what will happen to Nvidia and Meta Platforms stock next, worth watching. Image source: Chih/Bloomberg via Getty Images

Technology stocks' rally hits a roadblock

The technology industry has been a big beneficiary of a flood of investment into artificial intelligence.

After OpenAI's ChatGPT became the fastest app to reach one million users when it was launched in 2022, companies poured massive sums into developing their own large language model AI chatbots and agentic AI programs.

Related: Analyst unveils surprising AMD stock price target after chip export curb

The flurry of AI interest has correspondingly encouraged a staggering overhaul of enterprise and cloud network data centers.

Capital expenditures by hyperscalers like Amazon, Microsoft (MSFT) , and Google have skyrocketed, reaching $192 billion in 2024. Meta Platforms (META) alone spent $39 billion last year, up from 27 billion in 2023.

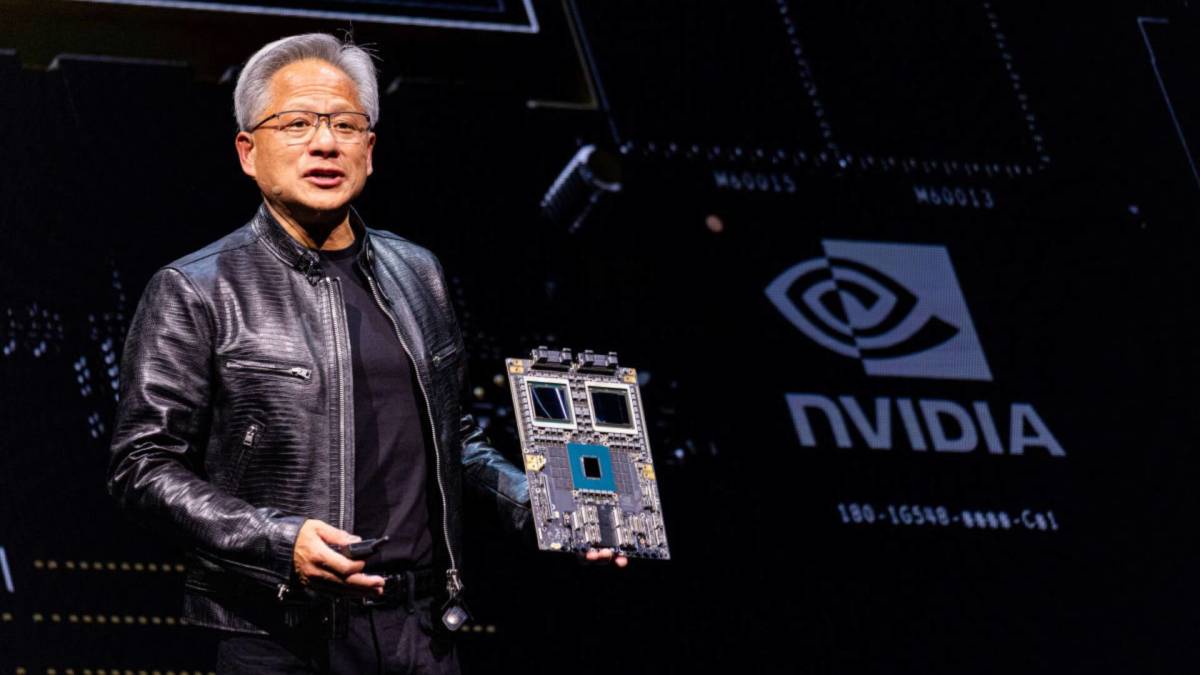

The buildout has been a boon for Nvidia, given that its graphics processing units (GPUs) are far better suited to handling the massive compute power required for training and running AI programs than the central processing units (CPUs) most commonly found in network servers.

Nvidia's (NVDA) revenue has surged since 2022 because of demand for its H100, H200, and Blackwell chips. It reached $130 billion in fiscal 2025, up an eye-watering 114% in 2024 alone.

Hyperscalers' spending on Nvidia chips has largely been financed by cloud customers' rising spending on AI research and strength in other business segments.

For instance, Meta Platforms' advertising revenue led to its Family of Apps (Facebook, Instagram, WhatsApp, etc.) revenue growing 21% year-over-year in the fourth quarter to $47.3 billion, as businesses capitalized on strong consumer spending.

The tailwinds supporting spending, however, are fading.

Unemployment has risen, and sticky inflation continues to weigh on consumer spending decisions. Consumer sentiment has plummeted recently amid a mounting trade war that could cause GDP to decline even as inflation increases, putting the U.S. at risk of stagflation or recession.

The potential fallout from slowing GDP growth could mean technology companies rethink their CapEx plans, shelving previously planned projects while they wait for greater clarity.

Hedge fund manager sells Meta, buys Nvidia stock

The risk that the tech sector faces a major reset in 2025 isn't lost on Yiu, given his recent moves include selling Meta Platforms and Microsoft shares.

Related: Veteran fund manager resets Nvidia stock price target after shocking export news

Yiu unloaded Meta Platforms and Microsoft stock earlier this month after President Trump announced reciprocal tariff plans on April 2, reports the Financial Times.

Those tariffs are designed to encourage a return of manufacturing to the U.S.; however, proposed import taxes were higher than economists and Wall Street expected, causing investors to lower growth expectations and triggering the stock market's sell-off.

His decision to sell Meta Platforms, a holding since 2023 representing about 3% of his fund's assets, is rooted in the risk that ad revenue could fall sharply.

"When you have a global business in digital advertising and a global slowdown and economic uncertainty, then it does impact the top line,” said Yiu regarding the risk to Meta Platform's ad sales.

More Tech Stocks:

- Top analyst revisits Tesla stock price target as Q1 earnings loom

- Google’s Waymo is planning a move that's downright creepy

- Analyst reboots Apple stock price target after tariff meltdown

Yiu also hit the sell button on Microsoft, another big holding, after determining that its AI spending could exceed cash flow.

Perhaps surprisingly, while Yiu has soured on Meta and Microsoft, he's bullish on Nvidia.

He told the Financial Times he's been buying as Nvidia's stock price has been falling, increasing his position in the semiconductor Goliath to 10% of assets from 7% previously.

Although Nvidia will take a $5.5 billion charge following new restrictions on selling its popular H20 AI chip in China, Yiu thinks Nvidia is positioned to continue to do well over time amid the ongoing race for AI dominance.

Related: Veteran fund manager unveils eye-popping S&P 500 forecast