Big tech’s earnings problem is estimates may be way too high

There’s little expectation that executives will be able to give estimates with any degree of confidence, given the high level of macroeconomic uncertainty.

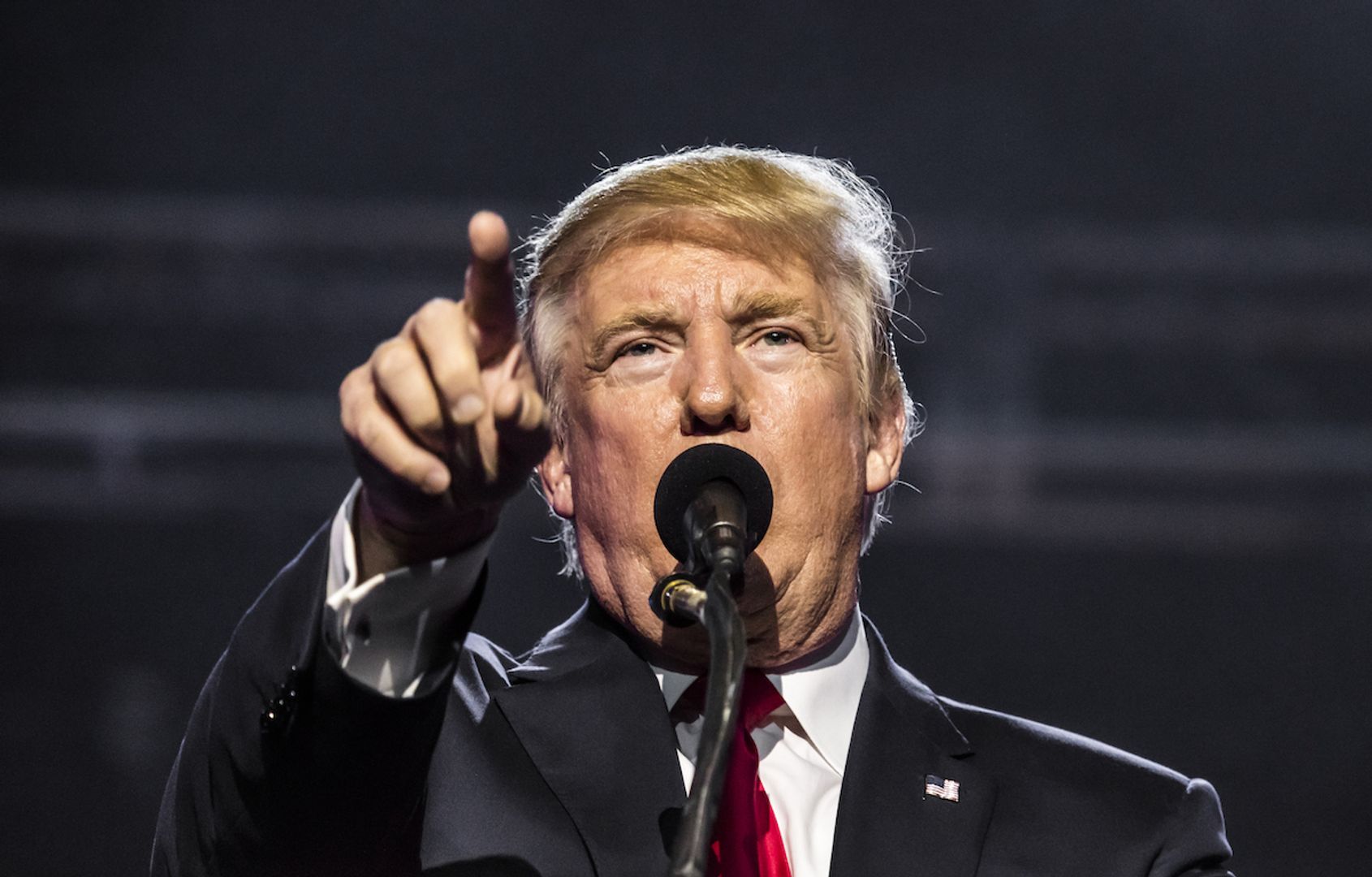

The last time Big Tech delivered earnings, Donald Trump had just started his term, stocks were soaring on expectations of a pro-growth government agenda and investors’ main worry was how long it would take companies to convert their artificial intelligence spending into profits.

Three months later, they are facing a far bleaker picture.

This week’s quarterly results from Microsoft Corp., Apple Inc., Meta Platforms Inc. and Amazon.com Inc will land in a market obsessed with every twist of a trade war that’s wiped $5.5 trillion from the S&P 500 Index. AI concerns have taken a back seat to angst over the possibility of a tariff-induced recession, while safe havens like gold have become the trade de jour for investors too rattled to buy stocks on the cheap.

Even with all the uncertainty, Wall Street isn’t giving the companies’ estimates much wiggle room. Analysts expect the so-called Magnificent Seven — which also includes Google-parent Alphabet, Tesla Inc. and Nvidia Corp. — to deliver an average of 15% profit growth in 2025, a forecast that’s barely budged since the start of March despite the flareup in trade tensions.

That raises the stakes for the four megacaps reporting this week, which collectively have a nearly 20% weighting in the S&P 500. Traders are unlikely to forgive earnings shortfalls in an already fearful market climate, despite steep declines in the stocks’ share prices and improved valuations. Dire outlooks from the industry behemoths would also be poorly received, especially if they bolster fears of muted corporate spending ahead.

“Any modicum of a weaker than expected number is going to cause a further selloff because of the concern around tariffs,” said Phil Blancato, chief market strategist at Osaic Wealth, who believes this year’s weakness in megacaps is a buying opportunity.

Markets got an early read on how Big Tech might be faring last week. Tesla reported its worst quarter in years, though traders cheered signs that chief executive Elon Musk intends to step away from his government work and focus more on the electric-vehicle maker. Alphabet beat expectations but offered little future guidance. The Bloomberg Magnificent 7 index jumped 9.1% last week amid a broader market rebound, though it’s still down 15% in 2025.

Profits and Spending

A deeper look comes during a two-day stretch that starts with results from Meta and Microsoft on Wednesday. While many executives have declined to predict how tariffs might impact their bottom lines, Wall Street has been doing its own math. Based on a 22% tariff rate modeled by Bloomberg Economics, lower gross margins could result in a net income contraction of about 7% in 2025 for the S&P 500, compared with the current consensus estimate of nearly 12% growth, wrote Bloomberg Intelligence chief equity strategist Gina Martin Adams.

Another key area of focus will be spending: The four biggest spenders — Microsoft, Alphabet, Amazon and Meta — are projected to pour roughly $300 billion into capital expenditures in their current fiscal years. While the companies have pledged to maintain that pace in 2025, Microsoft’s sudden decision to pause work on some data centers suggests cloud computing providers may be re-evaluating expenditures.

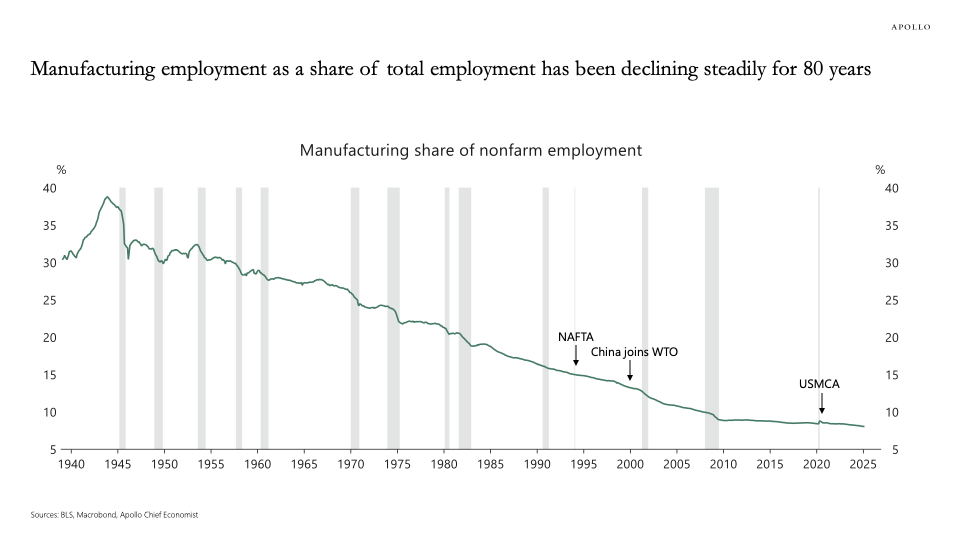

Apple, one of the companies most exposed to tariffs due to its supply chain reliance on China, may benefit from a pull-forward in demand from consumers seeking to avoid higher prices. However, those sales are seen as a one-off benefit, with tariffs sapping demand in future quarters. Amazon faces tariff risks to its e-commerce and advertising businesses, though a hit to profits could be cushioned by earnings in its high-margin web services unit, according to Jefferies analyst Brent Thill.

That said, there’s little expectation that executives will be able to give estimates with any degree of confidence, given the high level of macroeconomic uncertainty. American Airlines Group Inc. and Skechers USA Inc. are among companies that have abandoned forecasts this quarter.

Michael Shaoul, founder of the ION Macro Fund, said it will be difficult for executives to convince the market that they have a true view into financial performance in coming quarters.

“I think the more experienced management aren’t even going to try,” he said.

A bullish argument, of course, is that tech giants’ dominant industry positions and robust balance sheets make them better suited to withstand an economic downturn than other companies — even if the earnings picture is cloudy. The Magnificent Seven are also less richly valued following the recent selloff: Alphabet, for example, trades at 17 times profits estimated over the next 12 months, compared with an average over the past decade of 21 times, according to data compiled by Bloomberg.

That could boost the appeal of the Magnificent Seven to dip-buyers, especially if signs of easing in the global trade war emerge. A flash of that came last week, when stocks soared after Trump said a deal with Beijing would significantly reduce the tariffs he’s posted on Chinese goods.

But for Keith Lerner, co-chief investment officer and chief market strategist at Truist Advisory Services, it all comes down to the denominator in the price-to-earnings ratio.

“The valuations are getting more interesting down here, but we haven’t pulled the trigger yet,” he said. “There are a lot of questions on the E-side of the equation.”

This story was originally featured on Fortune.com