Better Warren Buffett Stock: Visa vs. American Express

Here's an in-depth look at two longtime Berkshire Hathaway-held stocks.

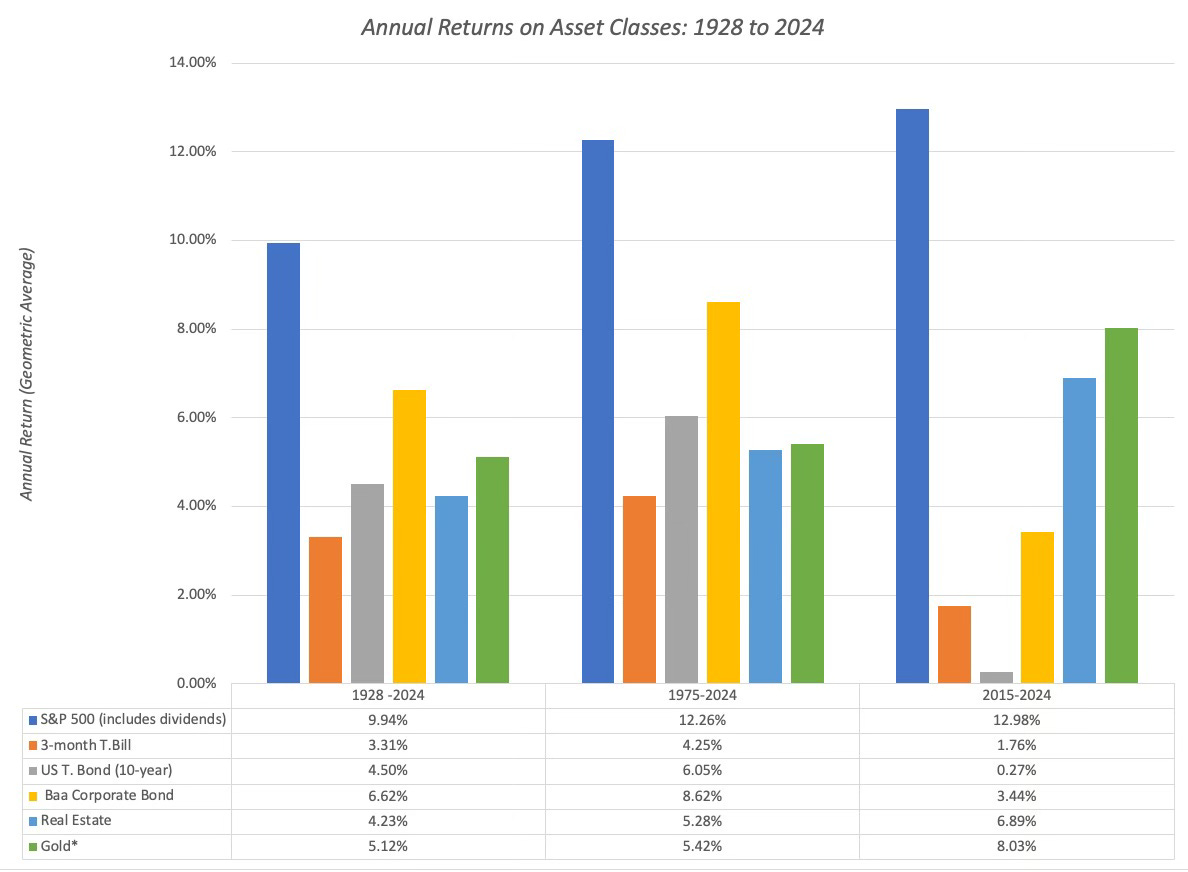

Warren Buffett is often hailed as one of the greatest investors of all time, having delivered exceptional returns for shareholders of Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B) over many decades. Under his leadership since 1965, the company's stock has achieved an impressive compound annual growth rate of 19.8% through 2023, nearly doubling the S&P 500, which saw a 10.2% return, including dividends.

Given Buffett's track record of market-beating success, it's worth examining Berkshire's $300 billion stock portfolio to identify potential investments that could help you surpass market performance. With that in mind, let's take a closer look at two of Berkshire's longest-held positions, American Express (NYSE: AXP) and Visa (NYSE: V), and explore which might be the better buy for investors today.

Berkshire Hathaway began building its initial $1.3 billion position in American Express in 1991, continuing its purchases through 1995. That investment in what was then a bank holding and payments company has since grown to $46.3 billion. Over time, Berkshire has increased its stake in American Express from nearly 10% to 21.6% -- without purchasing additional shares or reinvesting dividends.