Bear Market Rally May Soon Be Over: 4 Dividend Aristocrats With 4%-5% Yields to Buy Now

These four safe-haven stocks are perfect for worried investors, as they should perform better than most companies in a recessionary economy. The post Bear Market Rally May Soon Be Over: 4 Dividend Aristocrats With 4%-5% Yields to Buy Now appeared first on 24/7 Wall St..

While it was fun while it lasted, as we have discussed before, inevitably, after vicious sell-offs like the one we saw from the market peak in February, which pushed the S&P 500 and the Nasdaq quickly into a brief bear market 20% decline territory, there is the potential for stunning bear market rallies like the one we have witnessed. Almost every time, the snapback rally is a hedge fund and algorithmic trader contingent covering short positions, not a slew of new, excited long-term investors. While stocks have cut almost all losses, the S&P 500 is down just 3.2%, but there could be more downside before we see a real volume-led turnaround.

24/7 Wall St. Key Points:

-

Investors should be careful reloading on the Magnificent 7 companies.

-

The Federal Reserve is likely to leave rates unchanged this summer.

-

Investors with big unrealized gains should consider taking some profits and resetting to safer, Dividend Aristocrats.

-

Are the Dividend Aristocrats a good idea for you? Why not meet with a financial advisor near you and find out? Click here to get started. (Sponsored)

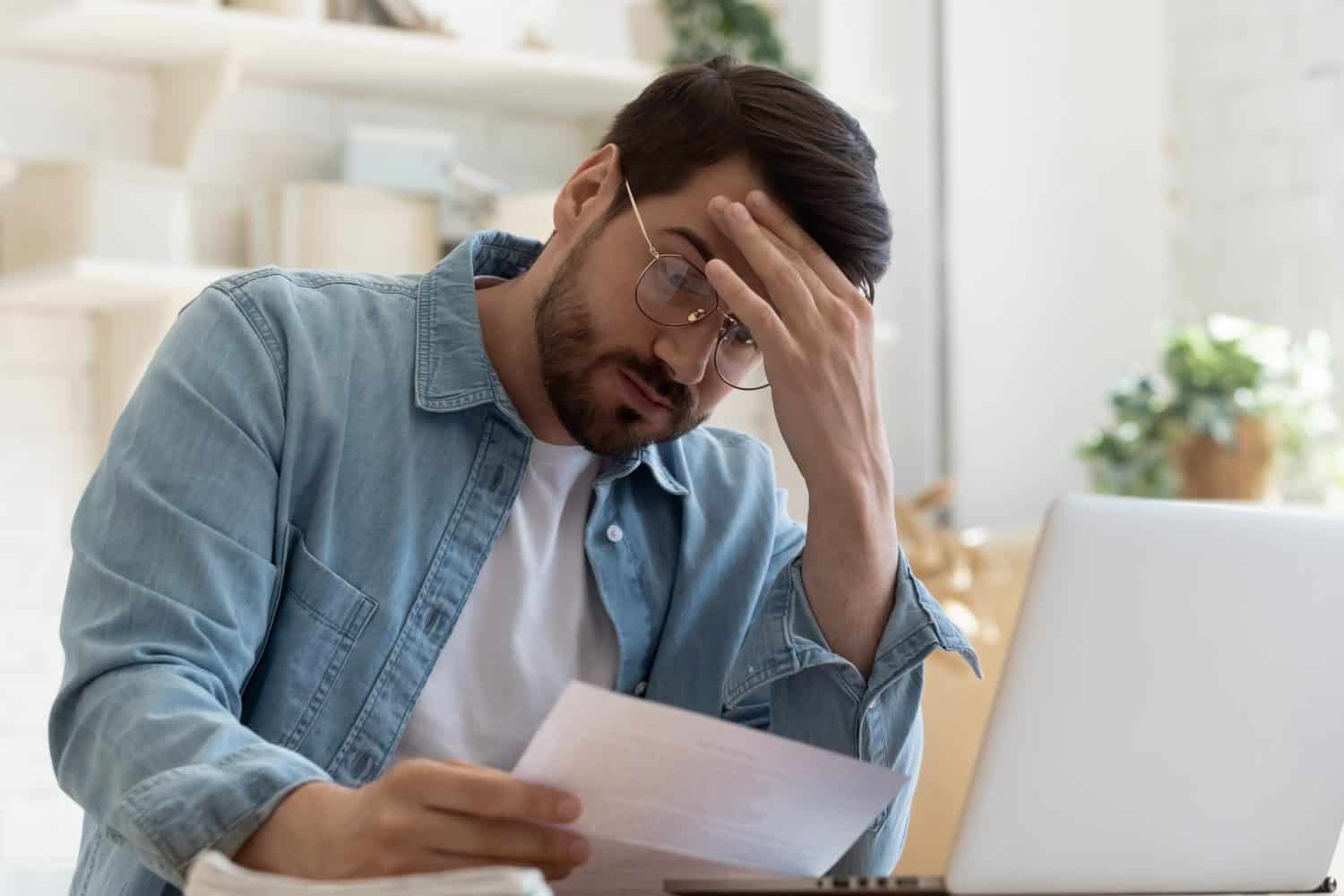

After a huge rally from the lows, one of the best and safest ways to stay invested now is to consider moving some capital to the Dividend Aristocrats. Investors seeking defensive companies that pay substantial dividends are drawn to the Dividend Aristocrats, and with good reason. The 66 companies that made the cut for the 2025 S&P 500 Dividend Aristocrats list have increased their dividends (not just maintained the same level) for 25 consecutive years. But the requirements go even further, with the following attributes also mandatory for membership on the aristocrats list:

- Companies must be worth at least $3 billion for each quarterly rebalancing.

- Average daily volume must be at least $5 million transactions for every trailing three-month period at every quarterly rebalancing date.

- They must be a member of the S&P 500.

We screened the 66 companies in the S&P Dividend Aristocrats index and found four perfect safe-haven stocks for worried investors. All of them could perform better than most companies in a recessionary economy.

Why do we cover the Dividend Aristocrats?

S&P 500 companies that have paid and raised their dividends for 25 years or longer are the types that growth and income investors want to buy and hold in their stock portfolios for the long term. These stocks are mostly conservative, and should we see a dramatic market correction, they will likely keep their ground much better than volatile technology names.

Chevron

This American multinational energy corporation specializes in oil and gas. The integrated giant is safer for investors looking to position themselves in the energy sector, and it pays a rich dividend. Chevron Corp. (NYSE: CVX) engages in integrated energy and chemicals operations worldwide through two segments.

The Upstream segment is involved in the following:

- Exploration, development, production, and transportation of crude oil and natural gas

- Processing, liquefaction, transportation, and regasification associated with liquefied natural gas

- Transportation of crude oil through pipelines

- Transportation, storage, and marketing of natural gas, as well as operating a gas-to-liquids plant

The Downstream segment engages in:

- Refining crude oil into petroleum products

- Marketing crude oil, refined products, and lubricants

- Manufacturing and marketing renewable fuels

- Transporting crude oil and advanced products by pipeline, marine vessel, motor equipment, and rail car

- Manufacturing and marketing of commodity petrochemicals, plastics for industrial uses, and fuel and lubricant additives

Chevron announced in the fall of 2023 that it had entered into a definitive agreement with Hess Corp. (NYSE: HES) to acquire all of the outstanding shares of Hess in an all-stock transaction valued at $53 billion, or $171 per share based on Chevron’s closing price on October 20, 2023. Under the terms of the agreement, Hess shareholders will receive 1.0250 shares of Chevron for each Hess share. The transaction’s total enterprise value, including debt, is $60 billion.

Eversource Energy

This smaller-cap utility is an energy provider serving customers in Connecticut, Massachusetts, and New Hampshire. This is a conservative stock idea that is off the radar and comes with a rich dividend. Eversource Energy (NYSE: ES) is a public utility holding company engaged in the energy delivery business.

The company operates through four segments:

- Electric Distribution

- Electric Transmission

- Natural Gas Distribution

- Water Distribution segments

It transmits and distributes electricity, solar power facilities, and natural gas.

The company also operates regulated water utilities that provide water services to approximately 241,000 customers and serves residential, commercial, industrial, municipal, and fire protection customers.

Federal Realty Investment Trust

While real estate has been hit some this year, hard assets are good in inflationary times, and this stock pays a solid and reliable dividend. Federal Realty Investment Trust (NYSE: FRT) is a recognized leader in the ownership, operation, and redevelopment of high-quality retail-based properties located primarily in major coastal markets, from the District of Columbia to Boston, San Francisco, and Los Angeles.

Federal Realty’s mission is to deliver long-term, sustainable growth through investing in densely populated, affluent communities where retail demand exceeds supply.

Its expertise includes creating urban, mixed-use neighborhoods like:

- Santana Row in San Jose, California

- Pike & Rose in North Bethesda, Maryland

- Assembly Row in Somerville, Massachusetts

Federal Realty’s 102 properties include approximately 3,500 tenants in 27 million commercial square feet and over 3,100 residential units. The REIT has increased its quarterly dividends to its shareholders for 56 consecutive years, the longest record in the industry.

Target

This stock remains a solid and safe retail total return play. Target Corp. (NYSE: TGT) is a general merchandise retailer in the United States. It offers apparel for women, men, boys, girls, toddlers, infants, and newborns, as well as jewelry, accessories, and shoes. The company also offers beauty and personal care products, baby gear, cleaning, paper, and pet supplies.

Target also provides:

- Dry grocery, dairy, frozen food, beverages, candy, snacks, deli, bakery, meat, and food service

- Electronics, which includes video game hardware and software

- Toys, entertainment, sporting goods, and luggage

- Furniture, lighting, storage, kitchenware, small appliances, home décor, bed, and bath

- Home Improvement

- School/office supplies

- Greeting cards, party supplies, and other seasonal merchandise

In addition, the company sells merchandise through periodic design and creative partnerships, shop-in-shop experiences, and in-store amenities. It also sells its products through its stores and digital channels, including Target.com.

Wall Street Loves 3 Strong Buy Dividend Stocks Spending Billions Buying Back Their Own Shares

The post Bear Market Rally May Soon Be Over: 4 Dividend Aristocrats With 4%-5% Yields to Buy Now appeared first on 24/7 Wall St..