Baby Boomers Used to Love Gifting Savings Bonds – Here’s Why No One Does It Anymore

For many baby boomers, receiving savings bonds as a gift was a rite of passage. Whether we’re talking about major life events like birth, graduations, weddings or other celebratory events, passing along a savings bond to a loved one (better than cash, since it pays a coupon!) may now be a thing of the past. […] The post Baby Boomers Used to Love Gifting Savings Bonds – Here’s Why No One Does It Anymore appeared first on 24/7 Wall St..

For many baby boomers, receiving savings bonds as a gift was a rite of passage. Whether we’re talking about major life events like birth, graduations, weddings or other celebratory events, passing along a savings bond to a loved one (better than cash, since it pays a coupon!) may now be a thing of the past.

I remember receiving a savings bond as a child as a gift from family, and I never really knew what to do with it (I eventually cashed it out when it came time for university). And while folks may not give savings bonds like they used to (with other 529 plans taking the place of such vehicles of late), thinking about how to save for loved ones’ long-term goals is something that will never get old.

Many baby boomers have lived through periods of time with greater volatility from an economic perspective, with savings bonds representing the sort of safe and reliable asset that can be aligned with long-term savings goals. However, for many young folks out there (who do not deal with anything that’s not digital or plastic), the idea of holding physical money or bonds that are less liquid than cash doesn’t make sense.

Let’s dive into what savings bonds are, and why no one seems to be using these savings vehicles anymore.

What Are Savings Bonds?

Savings bonds are government-issued debt instruments that allow individuals to invest in a low-risk, secure financial asset while lending money to the government. These bonds are designed to be accessible and reliable, making them particularly appealing to risk-averse investors.

Indeed, when I think about savings bonds, I think about the cash-like nature of these investments and how an investor who would prefer to stuff cash into their mattress would appreciate these offerings. Issued by the U.S. Treasury, savings bonds come in a number of different options. Series EE bonds and Series I bonds are among the options available to investors who have different goals.

Some investors may have heard the term “I Bonds” before, and that’s what the Series I bonds are – inflation-protected bonds. For those who still have concerns around where inflation is headed from here, I-Bonds can be the way to go.

In other countries like India, savings bonds offer fixed interest rates and pay out interest payments at different intervals (with lock-in periods as well). Thus, the varying options provided by the U.S. Treasury are appealing to long-term investors who may be particularly concerned about the impact of inflation over the coming years.

3 Reasons Why Savings Bonds Are Out

Once a staple gift among baby boomers, savings bonds have lost their appeal in today’s financial landscape. While they once symbolized a safe and reliable investment, changing economic conditions and evolving financial priorities have made them less attractive.

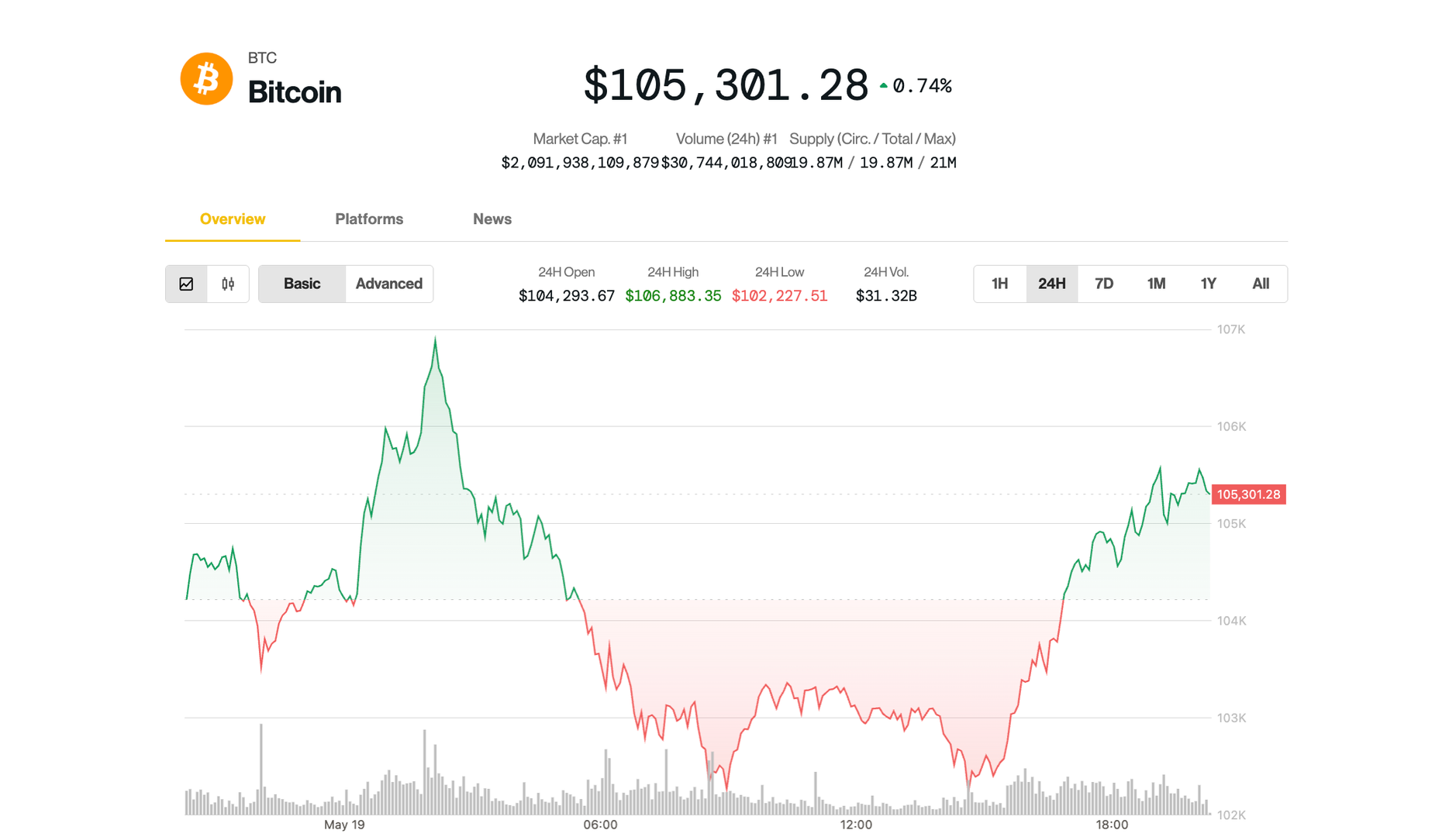

The first reason I think savings bonds have found themselves on the way out is the availability of more attractive investment options. The rise of ETFs and other low-cost diversification tools have really changed the game for investors who would have otherwise bought high-priced mutual funds from a shady financial advisor. Younger investors may also be more keen on adding more risk than previous generations (as the crypto boom and other metrics indicate). Thus, this sort of low-risk, low-upside offering doesn’t appeal to many in the younger investing cohort right now.

Secondly, interest rates continue to change drastically, making the ever-evolving landscape even more difficult for investors to traverse. If interest rates are held relatively steady, the competitive rates that various savings bonds can provide can be attractive to a wide swath of investors. However, with other competitive (and very liquid) products such as high-yield savings accounts and some CDs offering even better yields (in some cases) with greater liquidity, these interest rate changes may simply make savings bonds too risky relative to the alternatives.

Finally, investors today have different financial priorities than investors of the past. While the dollar did indeed used to go further than it does today (by a wide margin), I think the overall sentiment shift of younger Gen Z and Millennial investors toward higher-risk, lottery-ticket like investments is really what’s driving most of the shift away from vehicles like savings bonds. Investors simply don’t want “good,” they demand “great.” In such an environment, savings bonds don’t really have a chance.

Are Savings Bonds Still Worth Considering?

When comparing savings bonds to other investment options like mutual funds and ETFs, it’s essential to consider their risk levels, return potential, and liquidity. Savings bonds are government-backed securities that offer fixed interest rates and virtually no risk, making them an appealing choice for conservative investors.

However, their lower returns and liquidity constraints (such as penalties for early withdrawal) make them less attractive for long-term wealth growth. In contrast, exchange traded funds and other diversified (and risk-controlled) investing vehicles may be better for those looking to compound their wealth over the long-term.

Savings bonds may indeed be out, at least in terms of popularity. But investors looking to put some capital away for retirement do have other options to consider (and I-Bonds aren’t a bad option for those who are more concerned than most about another leg higher in inflation in the future).

The post Baby Boomers Used to Love Gifting Savings Bonds – Here’s Why No One Does It Anymore appeared first on 24/7 Wall St..