Baby Boomers Should Play It Very Safe in 2025 With These 5 Dividend Blue Chips

Here are five blue chip dividend research stocks that baby boomers can buy now and hold for solid passive income and a chance at inflation-fighting gains. The post Baby Boomers Should Play It Very Safe in 2025 With These 5 Dividend Blue Chips appeared first on 24/7 Wall St..

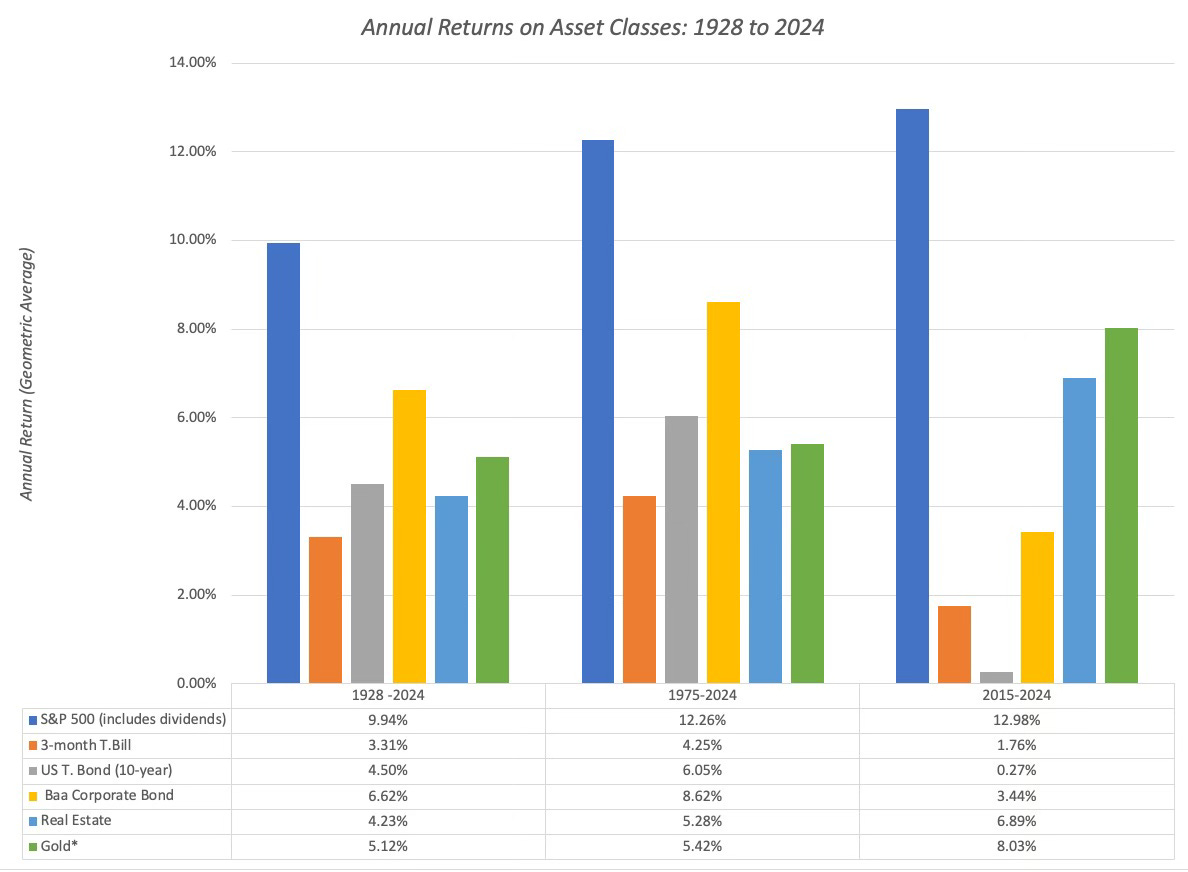

At 24/7 Wall St., we have followed dividend-paying stocks closely for over 15 years. With a growing audience of savvy baby boomers and retirees searching for safe income ideas that deliver more than the 10-year Treasury bonds’ 4.59% bi-annual dividend, we have closely screened hundreds of stocks looking for recurring, dependable dividend payouts and a degree of safety that allows for a good night’s sleep.

24/7 Wall St. Key Points:

-

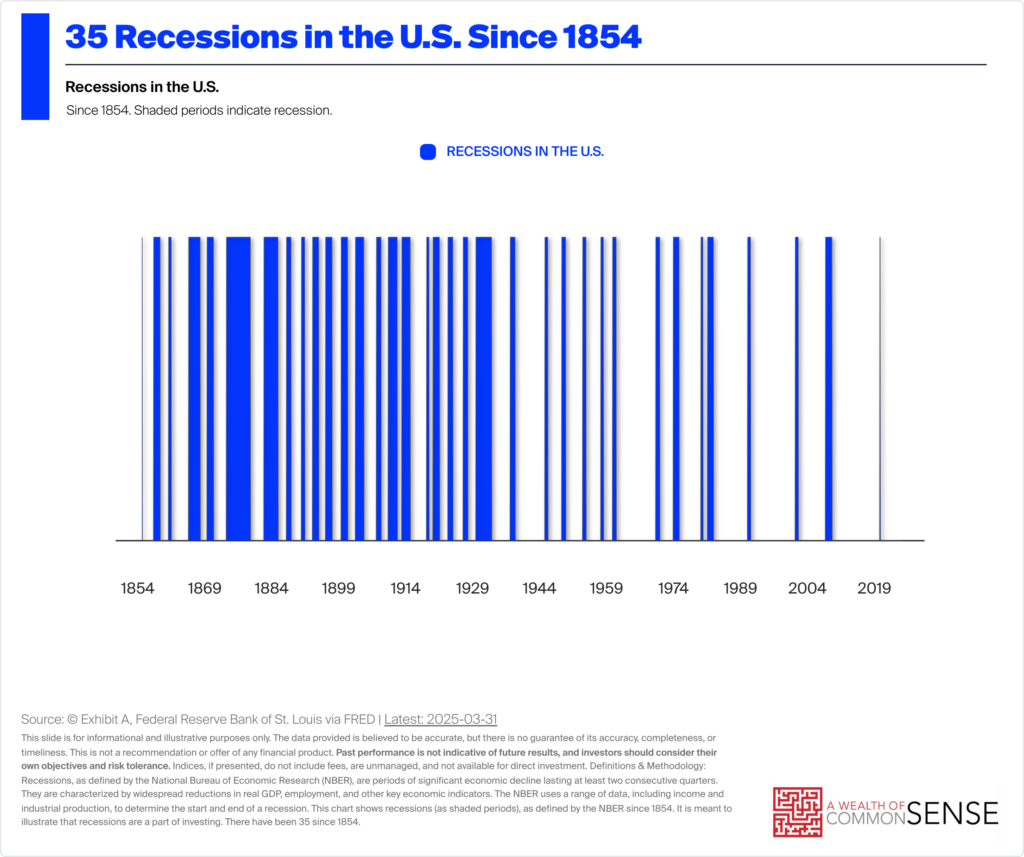

The stock market posted back-to-back monster years in 2023 and 2024.

-

There hasn’t been a bear market since 2022.

-

The possibility for a sizable correction in 2025 has grown.

-

Is your portfolio at risk if a big market sell-off occurs? Why not meet with a qualified financial advisor near you and find out? Click here to get started. (Sponsored)

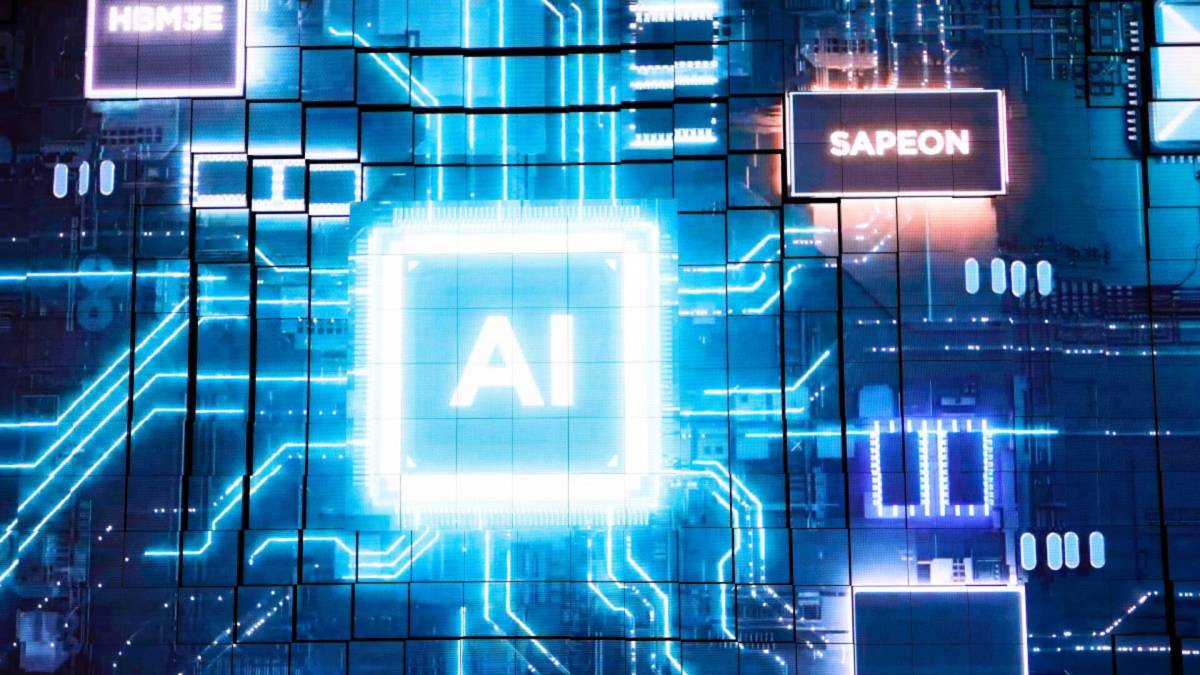

The past two years have been outstanding. The stock market has stampeded higher on the back of the Magnificent 7 technology stocks and excitement around the possibilities for an Artificial intelligence revolution. Many on Wall Street remain wildly optimistic for another strong year in 2025. This is what worries us here at 24/7 Wall St. the most. Very few top equity strategists see any storm clouds on the horizon, and when that’s the case, it’s usually a warning sign.

We screened our 24/7 Wall Street blue chip dividend research database, looking for safe stocks that baby boomers can buy now and hold for solid passive income and a chance at inflation-fighting gains. Five companies made the cut as some of our best ideas for 2025. All are buy-rated at top Wall Street firms.

Why do we cover blue-chip dividend stocks?

Blue chip dividend stocks are shares of large, well-established companies considered less risky and more financially stable than other stocks. They are often industry leaders with strong brand names and reputations and a history of consistent growth.

AT&T

The legacy telecommunications company has been undergoing a lengthy restructuring and has slashed its debt while lowering its dividend, which still stands at 4.88%. AT&T Inc. (NYSE: T) provides worldwide telecommunications, media, and technology services. Its Communications segment offers wireless voice and data communications services.

AT&T sells through its company-owned stores, agents, and third-party retail stores:

- Handsets

- Wireless data cards

- Wireless computing devices

- Carrying cases

- Hands-free devices

AT&T also provides:

- Data

- Voice

- Security

- Cloud solutions

- Outsourcing

- Managed and professional services

- Customer premises equipment for multinational corporations, small and mid-sized businesses, and governmental and wholesale customers.

In addition, this segment offers residential customers broadband fiber and legacy telephony voice communication services.

It markets its communications services and products under:

- AT&T

- Cricket

- AT&T PREPAID

- AT&T Fiber

The company’s Latin America segment provides wireless services in Mexico and video services in Latin America. This segment markets its services and products under the AT&T and Unefon brands.

Conagra Brands

This consumer packaged food giant is a safe idea, paying a stellar 5.09% dividend. Conagra Brands Inc. (NYSE: CAG) and its subsidiaries operate primarily in the United States as a consumer packaged goods company.

The company operates through four segments:

- Grocery & Snacks

- Refrigerated & Frozen

- International

- Foodservice

The Grocery & Snacks segment primarily offers shelf-stable food products through various retail channels.

The Refrigerated & Frozen segment provides temperature-controlled food products through various retail channels.

The International segment offers food products in various temperature states through retail and food service channels outside the United States.

The food service segment offers branded and customized food products, including meals, entrees, sauces, and various custom-manufactured culinary products packaged for restaurants and other food service establishments.

The company sells its products under these well-known brands:

- Birds Eye

- Marie Callender’s

- Duncan Hines

- Healthy Choice

- Slim Jim

- Reddi-Wip

- Angie’s

- BOOMCHICKAPOP

Dominion Energy

Many of the Wall Street firms we cover are very positive on utilities, and this company pays a strong 4.96% dividend. Dominion Energy Inc. (NYSE: D) operates through four segments:

- Dominion Energy Virginia

- Gas Distribution

- Dominion Energy South Carolina

- Contracted Assets.

The Dominion Energy Virginia segment generates, transmits, and distributes regulated electricity to residential, commercial, industrial, and governmental customers in Virginia and North Carolina.

The Gas Distribution segment engages in:

- Regulated natural gas gathering

- Transportation

- Distribution and sales activities

- Distributes nonregulated renewable natural gas

This segment serves residential, commercial, and industrial customers.

The Dominion Energy South Carolina segment generates, transmits, and distributes electricity and natural gas to residential, commercial, and industrial customers in South Carolina.

The company’s portfolio of assets included approximately:

- 30.2 gigawatts of electric generating capacity

- 10,500 miles of electric transmission lines

- 85,600 miles of electric distribution lines

- 94,200 miles of gas distribution lines

Dominion serves approximately 7 million customers.

Enterprise Products Partners

This is one of the biggest publicly traded partnerships.

This company is one of the largest publicly traded energy partnerships and pays a 6.84% dividend. Enterprise Products Partners L.P. (NYSE: EPD) provides various midstream energy services, including:

- Gathering

- Processing

- Transporting and storing natural gas, natural gas liquids (NGL) fractionation

- Import and export terminalling

- Offshore production platform services

The company has four reportable business segments:

- Natural Gas Pipelines and Services

- NGL Pipelines and Services

- Petrochemical Services

- Crude Oil Pipelines and Services

Many Wall Street analysts prefer the stock because of its distribution coverage ratio, which is well above 1x. This makes the company relatively less risky in the MLP sector.

Kraft Heinz

Even in bad times, everybody has to eat, and this company always stands to benefit while paying a tremendous 5.21% dividend. The Kraft Heinz Co. (NYSE: KHC) was formed via the merger of H.J. Heinz Company and Kraft Foods Group.

The company is a leading global food company with estimated annual revenues of $25 billion from well-known brands such as Kraft, Heinz, Oscar Meyer, and Maxwell House. Kraft Heinz is North America’s third-largest food and beverage manufacturer. It derives 76% of its revenues from that market and 24% from International.

Additional brands include:

- ABC

- Capri Sun

- Classico

- Jell-O

- Kool-Aid

- Lunchables

- Ore-Ida

- Philadelphia

- Planters

- Plasmon

- Quero

- Weight Watchers

- Smart Ones

- Velveeta

J.P. Morgan’s Best 2025 Stock Ideas Include 5 Blue-Chip Dividend Giants

The post Baby Boomers Should Play It Very Safe in 2025 With These 5 Dividend Blue Chips appeared first on 24/7 Wall St..