Baby Boomers, Don’t Let a Stock Market Crash Ruin Everything: 5 Ultra-Safe Dividend Stocks

For baby boomers, ultra-safe dividend stocks like these five that can add passive income streams to Social Security benefits. The post Baby Boomers, Don’t Let a Stock Market Crash Ruin Everything: 5 Ultra-Safe Dividend Stocks appeared first on 24/7 Wall St..

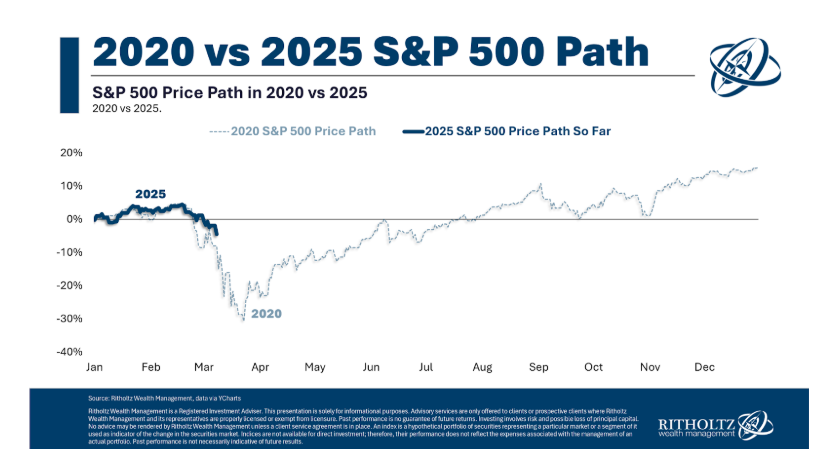

The “buy the dip” financial news teleprompter readers and the 35-year-old portfolio managers who have never seen a market crash are pounding the table that stocks are still going to the moon. Market veterans and “Hey Boomer” professionals have seen this show before. In 1987, the Dow Jones industrials plunged a stunning 22% in one day. Today, an equivalent drop in the venerable index would be almost 9,300 points.

24/7 Wall St. Insights:

-

The 2025 Social Security COLA was only 2.5%.

-

The COLA increase will equal about $50 per person each month.

-

Ultra-safe high-yield dividend stocks will hold up well during a big market sell-off.

-

Is your portfolio safe from a stock market crash? Why not meet with a qualified financial advisor near you today for a complete review? Click here to get started. (Sponsored)

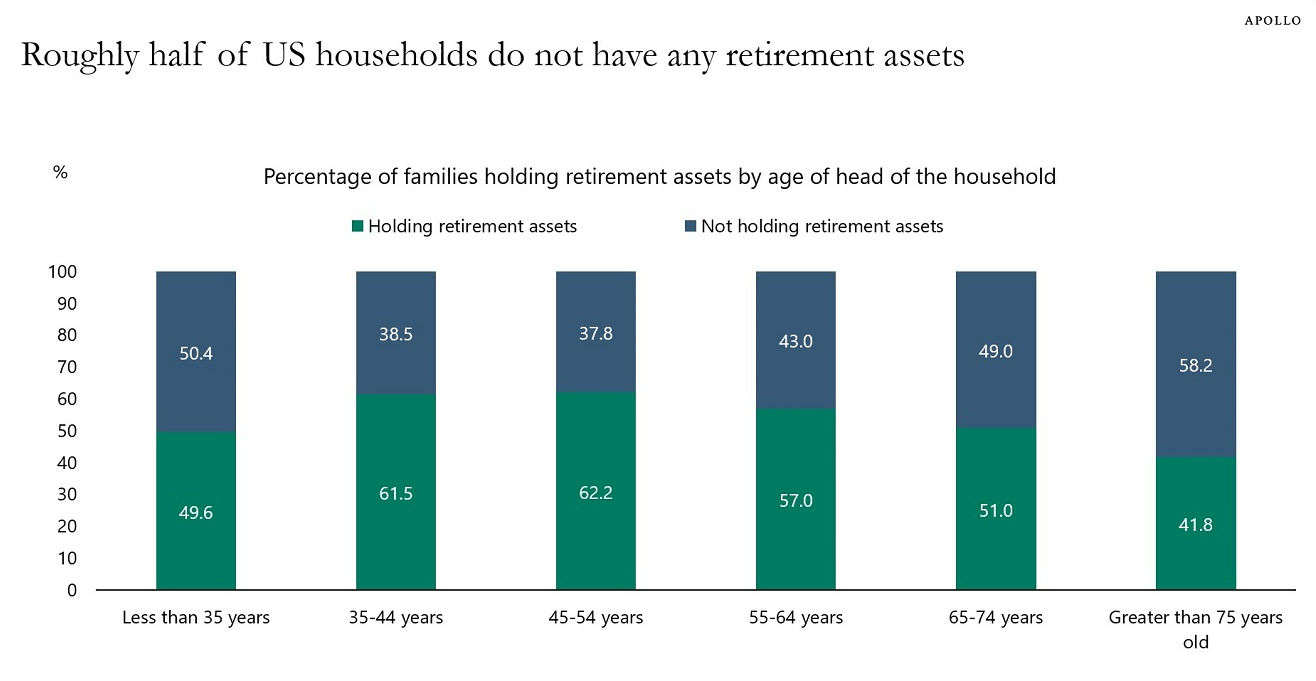

A market crash, though devastating, is workable if you are in your 40s and making peak money. However, for baby boomers who have enjoyed unprecedented gains over the past 35 years, being overweighted to the stock market now is like picking up nickels in front of a bulldozer, and it could be a fatal kill shot to their retirement savings. Look at this data we dug up on the internet on the effect of major market crashes. The recovery time can be much longer than recessions or regular bear markets, sometimes taking decades:

- The 1929 crash lasted until 1932, and the Dow did not fully recover until November 1954.

- The dot-com stock correction/crash in March 2000 took 13 years to recover fully.

- The Panic of 1907 took the stock market 20 years to return to its pre-crash level.

The youngest baby boomers turned 60 last year, while the oldest are closing in on 80 in 2026. It is essential to move out of S&P 500 index funds, put half of your cash in high-yield savings accounts that are SPIC insured, and concentrate on ultra-safe dividend stocks that can add passive income streams to Social Security benefits. We found five Wall Street favorites that have stood the test of time. All are Buy-rated at the top brokerage firms and banks we cover.

Why do we cover ultra-safe dividend stocks?

Ultra-safe dividend stocks provide investors with reliable streams of passive income. Passive income is characterized by its ability to generate revenue without requiring the earner’s continuous active effort. It is a desirable financial strategy for diversifying their income stream.

AT&T

The legacy telecommunications company has been undergoing a lengthy restructuring while lowering its dividend, which still stands at 4.11%. AT&T Inc. (NYSE: T) provides worldwide telecommunications, media, and technology services. Its Communications segment offers wireless voice and data communications services.

AT&T sells through its company-owned stores, agents, and third-party retail stores:

- Handsets

- Wireless data cards

- Wireless computing devices

- Carrying cases

- Hands-free devices

AT&T also provides:

- Data

- Voice

- Security

- Cloud solutions

- Outsourcing

- Managed and professional services

- Customer premises equipment for multinational corporations, small and mid-sized businesses, and governmental and wholesale customers.

In addition, this segment offers residential customers broadband fiber and legacy telephony voice communication services.

It markets its communications services and products under:

- AT&T

- Cricket

- AT&T PREPAID

- AT&T Fiber

The company’s Latin America segment provides wireless services in Mexico and video services in Latin America. This segment markets its services and products under the AT&T and Unefon brands.

Dominion Energy

Many of the Wall Street firms we cover are still very positive on utilities, and this company pays a strong 4.77% dividend. Dominion Energy Inc. (NYSE: D) operates through four segments:

- Dominion Energy Virginia

- Gas Distribution

- Dominion Energy South Carolina

- Contracted Assets

The Dominion Energy Virginia segment generates, transmits, and distributes regulated electricity to residential, commercial, industrial, and governmental customers in Virginia and North Carolina.

The Gas Distribution segment engages in:

- Regulated natural gas gathering

- Transportation

- Distribution and sales activities

- Distributes nonregulated renewable natural gas

- This segment serves residential, commercial, and industrial customers.

The Dominion Energy South Carolina segment generates, transmits, and distributes electricity and natural gas to residential, commercial, and industrial customers in South Carolina.

The company’s portfolio of assets included approximately:

- 30.2 gigawatts of electric generating capacity

- 10,500 miles of electric transmission lines

- 85,600 miles of electric distribution lines

- 94,200 miles of gas distribution lines

- Dominion serves approximately 7 million customers

Merck

Merck & Co. Inc. (NYSE: MRK) is not just a healthcare company, but a global force in the industry while paying a solid 2.75% dividend and offering investors the best entry point in over a year. The company operates through two segments.

The Pharmaceutical segment offers human health pharmaceutical products in:

- Oncology

- Hospital acute care

- Immunology

- Neuroscience

- Virology

- Cardiovascular

- Diabetes

- Vaccine products, such as preventive pediatric, adolescent, and adult vaccines

The Animal Health segment discovers, develops, manufactures, and markets veterinary pharmaceuticals, vaccines, health management solutions and services, and digitally connected identification, traceability, and monitoring products.

Merck serves:

- Drug wholesalers

- Retailers

- Hospitals

- Government agencies

- Managed healthcare providers, such as health maintenance organizations

- Pharmacy benefit managers and other institutions

- Physicians

- Physician distributors

- Veterinarians

- Animal producers

Merck’s growth is a result of its efforts and strategic collaborations. The company works with AstraZeneca, Bayer, Eisai, Ridgeback Biotherapeutics, and Gilead Sciences to jointly develop and commercialize long-acting treatments for HIV, demonstrating a commitment to innovation and growth.

Mondelez International

With a host of familiar brands and a solid 2.75% dividend, this company is always a safe bet for investors. Mondelēz International Inc.’s (NASDAQ: MDLZ) core business is making and selling chocolate, biscuits, and baked snacks.

The company also has additional businesses in adjacent, locally relevant categories including:

- Gum and candy

- Cheese and grocery

- Powdered beverages

Its portfolio includes global and local brands such as Oreo, Ritz, LU, Clif Bar, and Tate’s Bake Shop biscuits and baked snacks, as well as Cadbury Dairy Milk, Milka, and Toblerone chocolate.

The company’s segments include Latin America, AMEA, Europe, and North America. It sells its products in over 150 countries and operates in approximately 80 countries, including 147 principal manufacturing and processing facilities across 46 countries.

It sells its products to:

- Supermarket chains

- Wholesalers

- Supercenters

- Club stores

- Mass merchandisers

- Distributors

- Convenience stores

- Gasoline stations

- Drug stores

- Value stores

- Retail food outlets

Procter & Gamble

Procter & Gamble Co. (NYSE: PG) is one of the world’s largest consumer products companies. It offers a substantial 2.26% dividend and has very recognizable products.

Proctor & Gamble operates under five segments:

- Beauty

- Grooming

- Health Care

- Fabric & Home Care

- Baby & Family Care

The company’s brands include:

- Pampers

- Tide

- Bounty

- Charmin

- Gillette

- Oral B

- Crest

- Olay

- Pantene

- Head & Shoulders

- Ariel

- Gain

- Always

- Tampax

- Downy

- Dawn

P&G sells its products through mass merchandisers, e-commerce, grocery stores, membership club stores, drug stores, department stores, distributors, wholesalers, baby stores, specialty beauty stores, high-frequency stores, and pharmacies.

The company has been innovative in its product development process and uses that to help ensure future growth and cash flow. This should provide investors with years of steady growth and dividends.

The 5 Highest-Yielding Monthly Dividend Stocks Deliver Gigantic Passive Income Stream

The post Baby Boomers, Don’t Let a Stock Market Crash Ruin Everything: 5 Ultra-Safe Dividend Stocks appeared first on 24/7 Wall St..