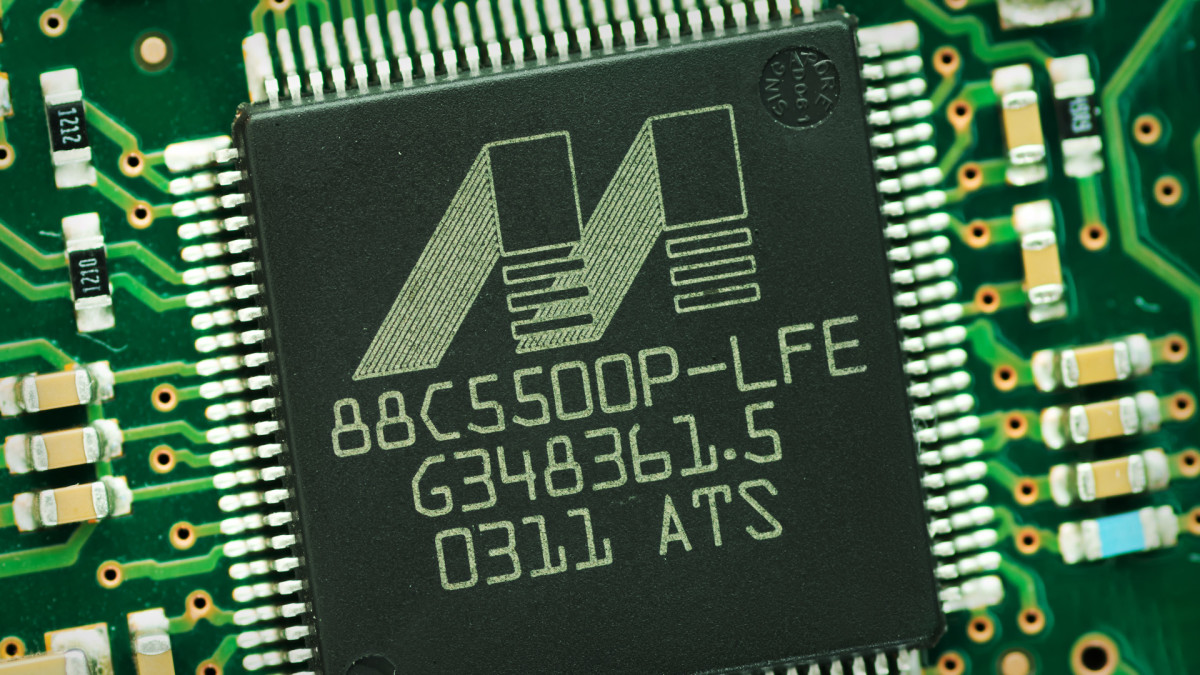

Analysts overhaul Marvell stock price targets after Q4 earnings

Marvell shares, a star performer in 2024, have fallen more than 20% so far this year.

Marvell Technology shares fell sharply lower in early Thursday trading following a solid, but unsurprising, set of fourth quarter earnings that arrived during a broader market slump tied to tariff and growth concerns.

Marvell (MRVL) has emerged, along with Broadcom AVGO and Advanced Micro Devices AMD, as one of the major U.S. chipmaking rivals to Nvidia (NVDA) , which holds a commanding lead in the market for new AI technologies but is running into supply chain constraints that have its major customers looking for backup relief.

Microsoft (MSFT) , Meta Platforms (META) , Google parent Alphabet (GOOGL) and Amazon (AMZN) are set to spend a collective total of $325 billion this year alone. Their three-year capex run rate, starting in 2023, is slated to increase nearly three-fold to around $690 billion.

The group scored a major victory on that front by signing a five-year cloud computing deal with Amazon Web Services in December that includes the supply of customer AI chips.

Marvell's ASIC chips, known as Trainium, help hyperscalers such as AWS, as well as other large providers of cloud services and infrastructure, move large amounts of data through integrated circuits and ultimately accelerate the speed and reliability with which they process information.

For the three months ending in January, Marvell saw data center revenues rise 78% from last year to $1.37 billion, with overall revenues rising 26% to $1.82 billion. Fourth quarter earnings of 60 cents per share topped Wall Street forecasts by a penny. Shutterstock

Heading into its current financial year, which ends in January of 2026, Marvell said its expects the ongoing surge in demand to power AI-related revenues past $2.5 billion.

Bullish AI revenue outlook

"We're definitely leaving this year open-ended in terms of what we can go do," CEO Matthew Murphy told investors on a conference call late Wednesday.

"Last year, we had talked about $1.5 billion," he added. "We blew through that this year and we anticipate being substantially above that I'm not putting a number on it just yet. I think that there's a lot to go here in terms of the momentum in the business and the opportunity set in front of us."

Looking into the current quarter, however, Marvell forecast overall revenues of just $1.88 billion, most of it from its data center business, a tally that was largely in-line with Wall Street forecasts.

Related: Analyst has surprising words on Nvidia's stock after drop

Cantor Fitzgerald analyst C.J. Muse said the conservative guidance, against the elevated expectations for the sector's biggest players, has likely put Marvell "in the penalty box until we gain further clarity."

"Management discussed AI revenues tracking significantly better than the prior guide of $2.5 billion in [fiscal 2026], with a clear path for continued growth into [fiscal 2027] and beyond," said Muse, who lowered his price target on the stock by $35 to $125 per share.

"As for perhaps even better and more important news, commentary from Management almost certainly confirms Marvel's win of Trainium3 with the company highlighting that Amazon custom silicon revenues are expected to grow on a year-on-year basis for both [fiscal 2026] and [fiscal 2027]," he added.

Amazon deal key to AI growth

Jefferies Blayne Curtis, who lowered his Marvell price target by $20 to $100 per share following last night's update, also noted the group's muted near-term guidance, but cited the longer-term potential of the group's ties with AWS.

"The modest upside to estimates is clearly a disappointment vs elevated expectations for Tranium 2 heading into the print, but we do think that Marvell took further steps to confirm they will not lose the next generation (3nm)," he said.

"Marvell reiterated that Amazon ASIC revenue would grow in [fiscal 2026] and [fiscal 2027] and inserted 'and beyond' into its commentary," he added "We still believe that they win [Trainium] 3nm if they deliver working silicon on time."

Marvell Technology shares were marked 17.9% lower in premarket trading to indicate an opening bell price of $74.01 each, a move that would extend the stock's year-to-date slump to around 35%.

More AI Stocks:

- Nvidia-backed startup could be hottest tech IPO of the year

- Apple blames name-calling glitch on its new AI feature

- Several AI leaders are considering a deal that could save Intel

"Shares are down sharply despite the good results, with some likely concerned about the magnitude of the beat, geopolitical pressures, and broader concerns about AI monetization." said CFRA analyst Angelo Zino, who kept his 'strong buy' rating in place following last night's update.

"We expect continued momentum in AI-related networking and custom silicon programs (e.g, Amazon partnership) ... while non-AI revenues showed signs of stabilization/improvement after inventory digestion."

Related: Veteran fund manager unveils eye-popping S&P 500 forecast