8 Things to Do (and 6 Things Not to Do) When You Get a Raise

Getting a raise is a huge accomplishment, so congratulations! Once the additional money starts rolling in, you’ll want to make sure to use it in the best possible way. Here are some things you should and should not do when a raise comes your way. Should do Save for emergencies: If you don’t have enough […] The post 8 Things to Do (and 6 Things Not to Do) When You Get a Raise appeared first on 24/7 Wall St..

Getting a raise is a huge accomplishment, so congratulations! Once the additional money starts rolling in, you’ll want to make sure to use it in the best possible way. Here are some things you should and should not do when a raise comes your way.

Key Points

-

Lifestyle creep can make expenses that once felt like luxuries seem like necessities.

-

Earn up to 3.8% on your money today (and get a cash bonus); click here to see how. (Sponsored)

-

It’s vital to take your time before making new financial decisions.

-

A monthly budget can help you separate wants from needs.

Should do

- Save for emergencies: If you don’t have enough money to cover three to six months’ worth of expenses, now is the time to begin tucking it away in a safe place, like a money market account (MMA) or high-interest savings account. You’ll thank yourself if you become ill or your household suffers a loss of income.

- Pay off debt: If you’re carrying debt, do yourself a favor and focus on paying it off before you become accustomed to earning more money. Paying off a high-interest-rate credit card is like giving yourself a monthly bonus.

- Review your budget: A raise is a great excuse to revisit your household budget. Look for any areas of waste and identify areas you’d like to dedicate more money to.

- Invest in your future: Take a peek at your retirement account. How’s it looking? Are you on track for retirement? If not, there’s no better time to increase your contributions.

- Create a vacation fund: Life doesn’t have to be all work. Reward yourself by starting a vacation fund. For some people, planning and anticipation are half the fun of vacation.

- Give: As humans, we feel better about ourselves when we’re generous with others. Identify the causes you care about and decide how much you’d like to dedicate to keeping them afloat.

- Pay for home improvements: If you own your home, you know the role it plays in your net worth. You can increase the value of your home by focusing on repairs and upgrades that need to be made.

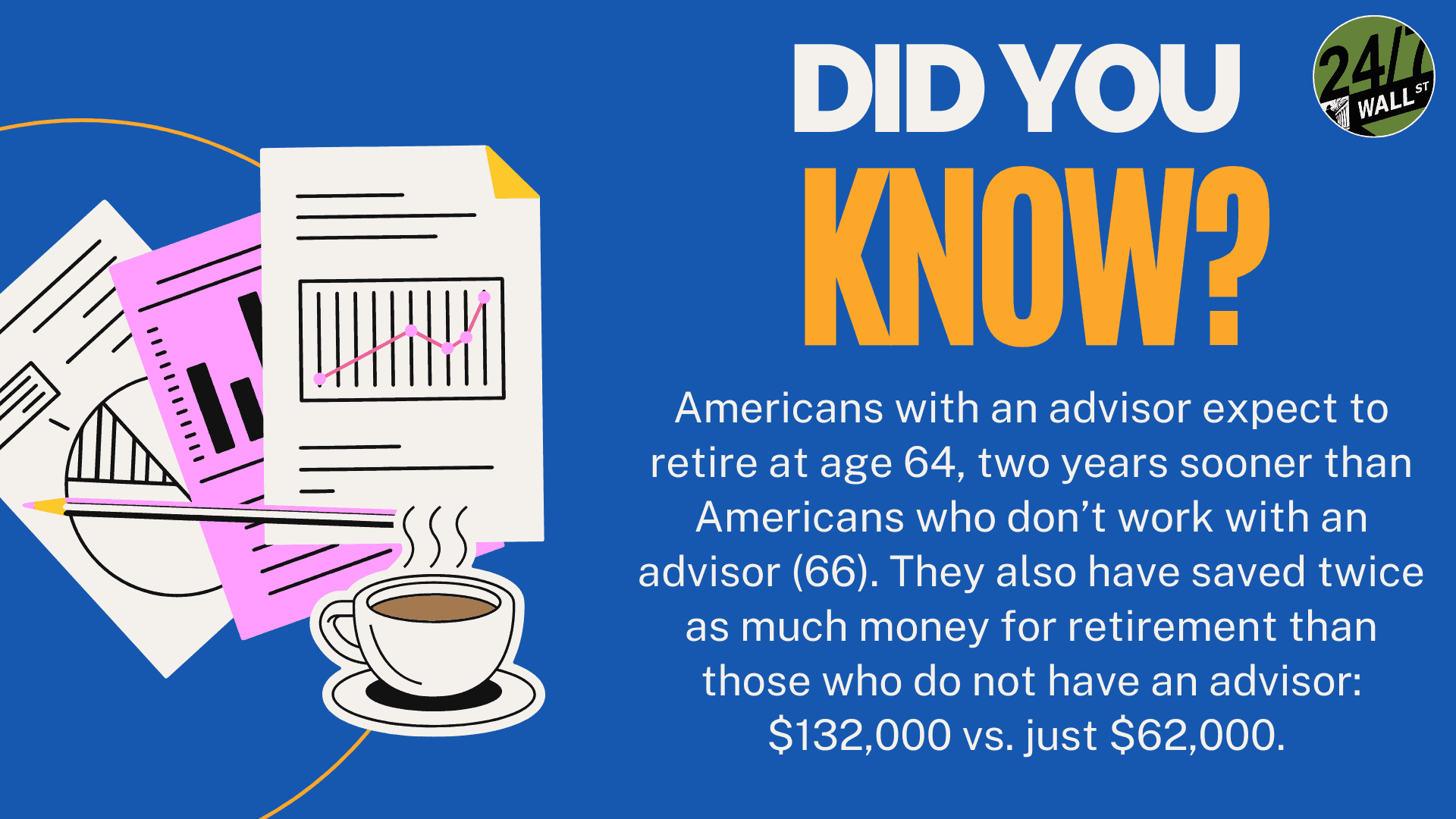

- Work with a financial advisor: If you’ve been going it alone, take the time to look for a financial advisor who’s a fiduciary. A fiduciary is legally bound to look out for your best interest.

Why we’re talking about this

It’s possible to become so accustomed to living on a certain amount of money that a new influx of cash feels overwhelming. That’s okay. The goal is to keep your cool and make slow and deliberate decisions. You want your money to work for you.

Should not do

- Splurge: There’s nothing wrong with celebrating your accomplishment. That’s to be expected. What you don’t want to do is make impulse splurges. For example, if you attend a home and garden show shortly after receiving your raise, you might want to take a beat before putting money down on a hot tub or new gazebo. Give yourself time to make measured financial moves.

- Allow lifestyle creep to sneak in: Lifestyle creep occurs when your lifestyle increases along with your income. Let’s say you receive a hefty raise and can suddenly afford that gold club membership or more extravagant vacations. While it’s your money, and you’re free to use it any way you want, allowing lifestyle creep to take over has a nasty habit of making you feel as though things you once considered luxuries are now necessities. Not only does this tie you down to new expenses, but it cuts into your ability to save and invest.

- Ignore debt: If you’ve just received a raise, you may feel like you’re walking on air. Don’t allow that feeling to deter you from taking care of critical financial issues, like paying off high-interest debt.

- Make impulse purchases: If you’ve spent years watching pennies, buying the things you want may feel great. Emotional and impulse purchases are usually only enjoyable until the bill comes. Remember, just because you’re making more money doesn’t mean you must spend it.

- Forget about your budget: Now that you have a little more breathing room, throwing the budget out the window may be tempting. Don’t do that. Instead, double down on your budget by deciding how your increased income can benefit you the most financially.

- Take unnecessary financial risks: If others learn that you have more money than usual, you should not be surprised if one or two of them have a “great investment idea” for you. Do yourself the favor of agreeing to nothing until you’ve had time to study the investment. Even then, your best bet is to speak with your financial advisor before making a move.

Again, congratulations on the raise. While you may need to make serious financial decisions soon, it’s a very good situation to find yourself in.

The post 8 Things to Do (and 6 Things Not to Do) When You Get a Raise appeared first on 24/7 Wall St..