3 Reasons SOFI Stock Is the Comeback Kid of 2025

There are traditional banks, and then there are neo-banks like SoFi Technologies (NASDAQ:SOFI) that seek to disrupt the world of personal finance. Like many other stocks in the financial space, SOFI got off to a rocky start in 2025; now, however, SoFi Technologies stock looks poised for a spectacular comeback. In a short time, SOFI […] The post 3 Reasons SOFI Stock Is the Comeback Kid of 2025 appeared first on 24/7 Wall St..

Key Points

-

SoFi Technologies demonstrated impressive member and product growth in Q1.

-

SoFi’s top- and bottom-line results indicate turnaround potential, especially in the company’s Lending segment.

-

Nvidia made early investors rich, but there is a new class of ‘Next Nvidia Stocks’ that could be even better. Click here to learn more.

There are traditional banks, and then there are neo-banks like SoFi Technologies (NASDAQ:SOFI) that seek to disrupt the world of personal finance. Like many other stocks in the financial space, SOFI got off to a rocky start in 2025; now, however, SoFi Technologies stock looks poised for a spectacular comeback.

In a short time, SOFI stock has gone from a troubled asset to a best buy now stock for 2025. Maybe you’re skeptical, though. That’s understandable, so here are three compelling reasons to consider buying SoFi Technologies shares as the turnaround trade of the year.

The Road to Recovery

As the old saying goes, every stock chart tells a story. As you can see, the price chart of SOFI stock tells the story of a rough start to 2025:

However, recent price action suggests that SoFi Technologies stock is curling up and coiled for a comeback. What changed here, though?

Actually, nothing fundamentally changed about SoFi Technologies. The company defied this year’s headline risk and had a great first quarter, though the public wasn’t aware of this until today.

That’s because SoFi just released its first-quarter 2025 results this morning. Prior to that, SoFi Technologies’ recent financial results were a mystery. Now, investors can see how well the company did in Q1.

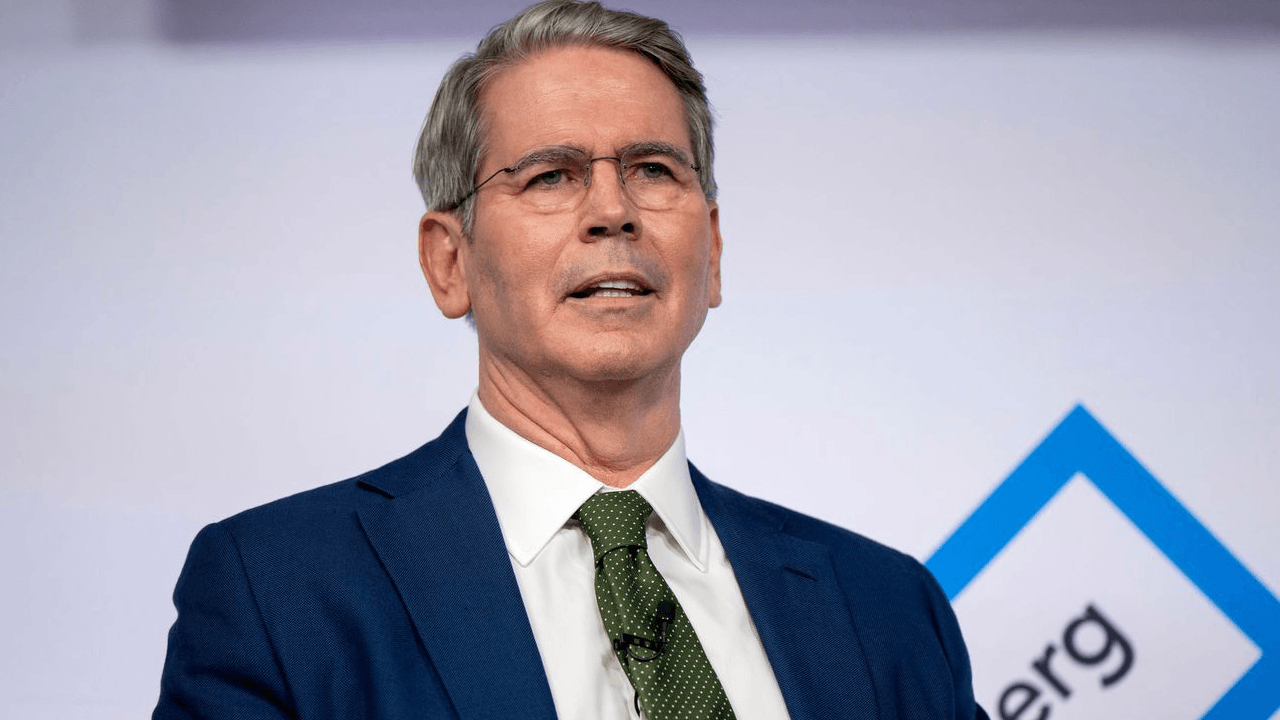

SoFi Technologies CEO Anthony Noto summed it up when he declared, “We are off to a tremendous start in 2025.” Investors evidently agree with this sentiment as SOFI stock jumped 7% this morning before paring those gains.

The company’s first-quarter results support the upturn in sentiment. In Q1 of 2025, SoFi Technologies managed to grow its adjusted (non-GAAP) net revenue 33% year over year to $770.72 million.

That dollar figure represents a quarterly record for SoFi. In addition, Noto observed that SoFi Technologies delivered its “highest revenue growth rate in five quarters.”

Turning to the bottom-line results, SoFi Technologies reported adjusted EBITDA of $210.337 million, marking a 46% year-on-year increase. Best of all, SoFi’s adjusted earnings (both GAAP and non-GAAP) improved 200% from $0.02 per share (diluted) in the year-earlier quarter to $0.06 in Q1 2025.

This wasn’t just a lucky fluke for SoFi Technologies, as the company has now recorded six consecutive quarters of GAAP-measured profitability. Thus, even though the headlines might point to economic issues in the banking sector, SoFi remains revenue-rich and income-positive in early 2025.

What will the rest of the year look like, though? The outlook is sunny, it seems, since SoFi Technologies raised its full-year 2025 adjusted net revenue range to $3.235 billion to $3.31 billion. Along with that, SoFi increased its full-year adjusted EBITDA guidance range to $875 million to $895 million, and its GAAP earnings outlook range to $0.27 to $0.28 per share.

Lending Segment Strength

The first reason to own SOFI stock now is that that the company showed overall improvement even while the financial headlines shocked and startled investors. Reason number two, however, focuses only on SoFi Technologies’ Lending segment.

This is crucial because SoFi Technologies can’t stage a powerful comeback if there’s a lack of lending and borrowing activity. After all, SoFi’s business model depends heavily on charging interest for loans.

The Federal Reserve isn’t expected to do much interest rate cutting this year. This may be problematic for SoFi Technologies as high interest rates can inhibit borrowing activity.

Yet, SoFi Technologies seems to have overcome this potential problem in 2025’s first quarter. As it turns out, the company’s Lending segment recorded $413.373 million in net revenue, up 25% year over year.

Moreover, SoFi Technologies’ Lending segment net interest income rose 35% to $360.261 million in Q1 2025. There’s no denying, then, that SoFi continues to collect plenty of income from loan interest payments.

A Growing Army of Members

Finally, we should now veer away from dollar figures and take a closer look at SoFi Technologies’ membership numbers. Remember, if SoFi’s membership dwindles, the top- and bottom-line results are likely to deteriorate.

In reality, there’s nothing to worry about since SoFi Technologies has a veritable army of members. As evidence of this, SoFi announced that its first-quarter 2025 membership grew by 800,000, representing record growth for the company, to 10.9 million members.

This signifies an increase of 34% on a year-over-year basis. Hence, not only does SoFi Technologies have an army of members for its app, but that army is expanding rapidly.

The company noted “continued demand for personal, student and home loan products,” so I suspect that many of SoFi Technologies’ new members are young borrowers. Evidently, SoFi is quickly becoming a go-to loan app for college students and first-time home buyers.

All of this bodes well for SoFi Technologies and its investors. Between the company’s financial results, Lending segment strength, and membership growth, there’s no disputing SoFi’s status as the comeback kid of 2025.

The post 3 Reasons SOFI Stock Is the Comeback Kid of 2025 appeared first on 24/7 Wall St..