3 Jim Cramer Stock Picks to Avoid in May

The charismatic host of CNBC’s Mad Money Jim Cramer has long been a polarizing figure in the investment world. Known for his high-energy delivery and bold market calls, Cramer’s stock recommendations attract a wide audience, from retail investors to seasoned traders. With a background as a hedge fund manager, Cramer leverages his experience to spotlight […] The post 3 Jim Cramer Stock Picks to Avoid in May appeared first on 24/7 Wall St..

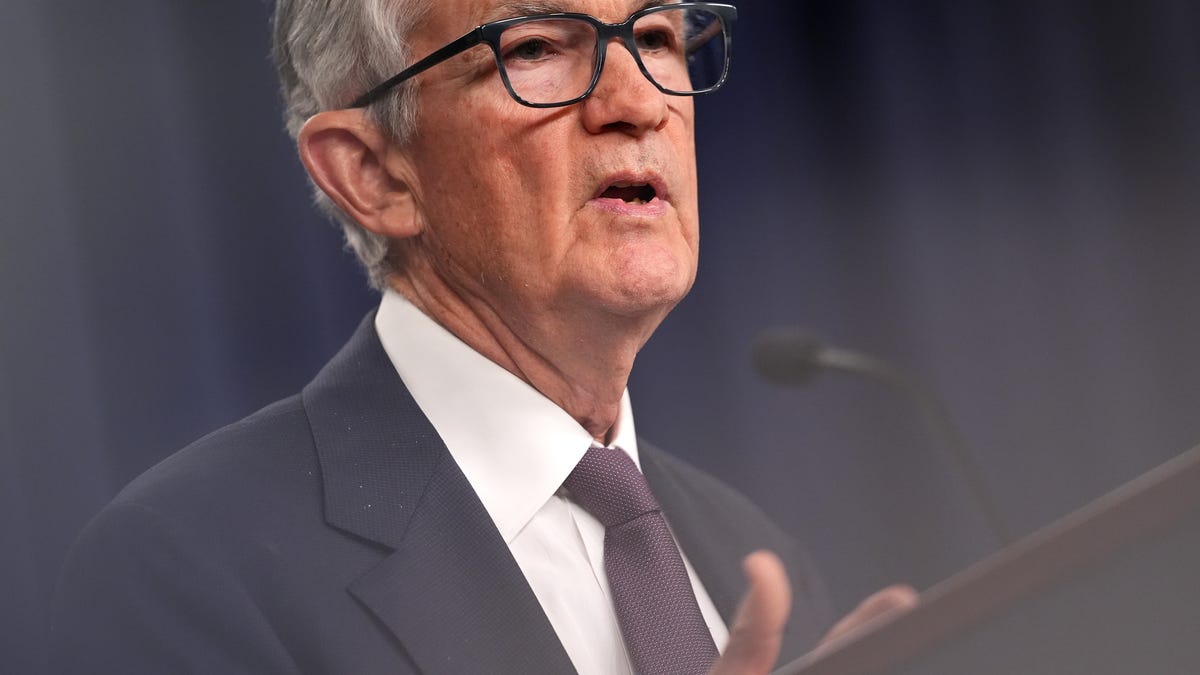

The charismatic host of CNBC’s Mad Money Jim Cramer has long been a polarizing figure in the investment world. Known for his high-energy delivery and bold market calls, Cramer’s stock recommendations attract a wide audience, from retail investors to seasoned traders.

With a background as a hedge fund manager, Cramer leverages his experience to spotlight stocks he believes are poised for growth, often emphasizing momentum, fundamentals, or sector trends. His nightly show and social media presence on X amplify his influence, making his picks a focal point for market chatter.

However, critics argue his rapid-fire approach and frequent changes in stance can lead to inconsistent outcomes, with some studies showing his recommendations underperform broader indices. As markets navigate extreme volatility, driven by tariffs and economic shifts, let’s look at three recent Cramer-endorsed buys that investors should avoid.

24/7 Wall St. Insights:

-

CNBC’s Jim Cramer is an entertaining and bombastic TV show host known for his rapid-fire stock picks.

-

Investors shouldn’t rely solely upon the former hedge fund manager’s stock picking advice because his stock calls can be wrong as often as they are right.

-

Nvidia made early investors rich, but there is a new class of ‘Next Nvidia Stocks’ that could be even better. Click here to learn more.

Affirm Holdings (AFRM)

Affirm Holdings (NASDAQ:AFRM) is a buy-now-pay-later (BNPL) fintech that Cramer says should continue delivering “some excellent results.” Shares are down 12% year-to-date, though up 70% over the last 12 months.

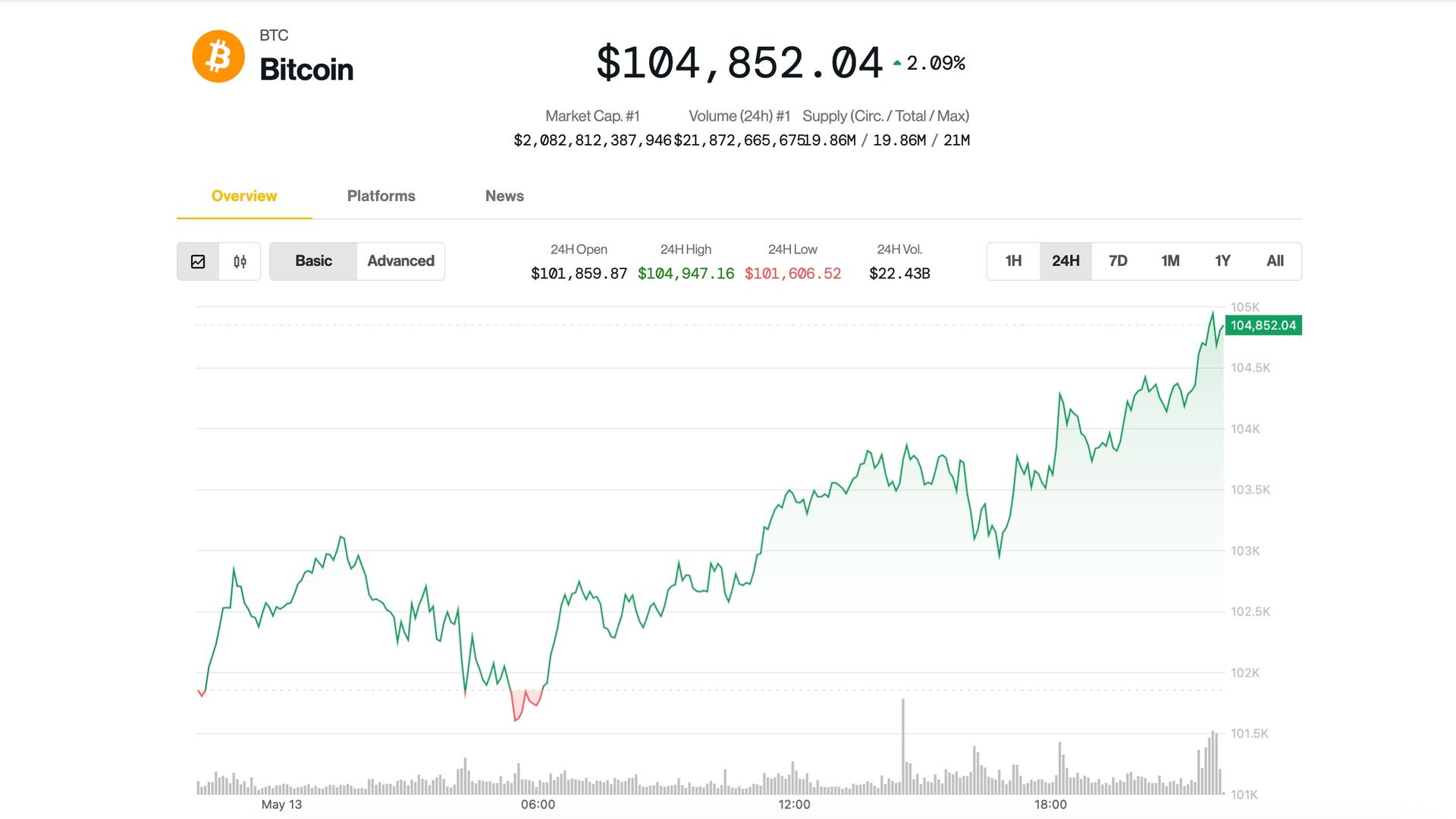

Despite the Mad Money host’s endorsement, investors should steer clear. AFRM is reliant on consumer spending, which remains under pressure from persistent inflation and its borrowing costs will remain high due to the Federal Reserve’s unwillingness to cut interest rates. While a trade deal framework with China will see most tariffs reduced for 90 days as the two sides hammer out the details, imported goods will still carry duties of 30%, making shopping more expensive.

Affirm’s shift to 0% interest loans, which grew 44% in the fiscal third quarter and now account for 13% of its gross merchandise value (GMV), sacrifices revenue for market share. Delinquencies also keep rising. Especially troubling is the 28% increase in those 91 to 119 days past due as Affirm writes them off after 120 days. Competition from PayPal (NASDAQ:PYPL), Block (NYSE:XYZ), and Apple‘s (NASDAQ:AAPL) Pay Later service further pressures margins. Because its risks outweigh its growth potential, AFRM is a stock to avoid.

Lululemon Athletica (LULU)

Premium athleisure brand Lululemon Athletica (NASDAQ: LULU) is the second Cramer stock to avoid. Although its stock jumped 9% yesterday due to the China trade negotiations, LULU stock remains a risky investment.

Lululemon’s high valuation, with a P/E ratio of 20.8 versus the industry’s 15.5, is unjustified amid slowing growth. Fiscal fourth-quarter results showed revenue rose 13% to $3.6 billion, but Americas sales were up 7% as comparable sales were flat, reflecting market saturation and weakening demand.

The athleisure apparel maker’s heavy reliance on China, which now represents 13% of revenue, exposes it to tariff risks and economic slowdowns. Competition from Athleta, Vuori, and Alo Yoga, along with Nike (NYSE:NKE) improving its competitiveness through its Skims partnership, erodes LULU’s pricing power, while inventory overhangs signal overproduction. Inventory rose 9% from last year, and Lululemon expects it will keep rising at a rate greater than its revenue growth this year.

Although Lululemon’s $1 billion share buyback offers some support, the athleisure leader doesn’t have the same cachet it once did, particularly with price-sensitive consumers. Facing risks from overvaluation, competition, and geopolitical exposure, LULU stock is another to avoid in 2025.

Reddit (RDDT)

On April 24, Cramer declared Reddit (NASDAQ:RDDT) “is a very good stock…I would be a buyer.” I wouldn’t. While shares are down 52% from their recent high, they can fall much further.

On the surface, the social media platform seems to be growing smartly. Revenue soared 61% in the first quarter to $392.4 million, and adjusted earnings of $0.13 per share easily beat analyst estimates of just $0.02 per share. Reddit generates over 90% of its revenue from digital advertising, having found success with its conversation ad placement format that allows advertisers to place ads in subreddits relevant to the marketer.

Daily active users also rose 31% to 108.1 million globally, with 21% growth in the U.S. However, the number of logged-in users only grew 23% versus a 38% increase in logged-out users. That is an important distinction because Reddit’s business relies upon user engagement. Without users logging in, they can’t comment on or create posts. That means 55% of all of Reddit’s daily active users are just skimming the site, up from 52% last year.

With the stock trading at 48 times next year’s earnings, 14 times sales, and 65 times free cash flow, RDDT is pricey and is the third Cramer stock to avoid.

The post 3 Jim Cramer Stock Picks to Avoid in May appeared first on 24/7 Wall St..