24 Surprising Facts About the National Debt

With so much news and misinformation about government spending, the government deficit, and the national debt in the media these days, it can be hard to remember exactly what it all really means and what impact it has on our actual lives. To make it easier, we put together a list of 24 quick facts […] The post 24 Surprising Facts About the National Debt appeared first on 24/7 Wall St..

With so much news and misinformation about government spending, the government deficit, and the national debt in the media these days, it can be hard to remember exactly what it all really means and what impact it has on our actual lives.

Key Points

-

Nobody actually knows how much debt the United States can afford to have. We might already be past our limit.

-

Military spending, tax cuts for the rich, and deregulation and tax breaks for companies are the biggest drivers of government debt.

-

Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; get started by clicking here here.(Sponsor)

To make it easier, we put together a list of 24 quick facts about the national debt that you can pull out at a party or in polite debate to show you actually know what you’re talking about the next time your uncle starts spreading conspiracy theories at Thanksgiving again.

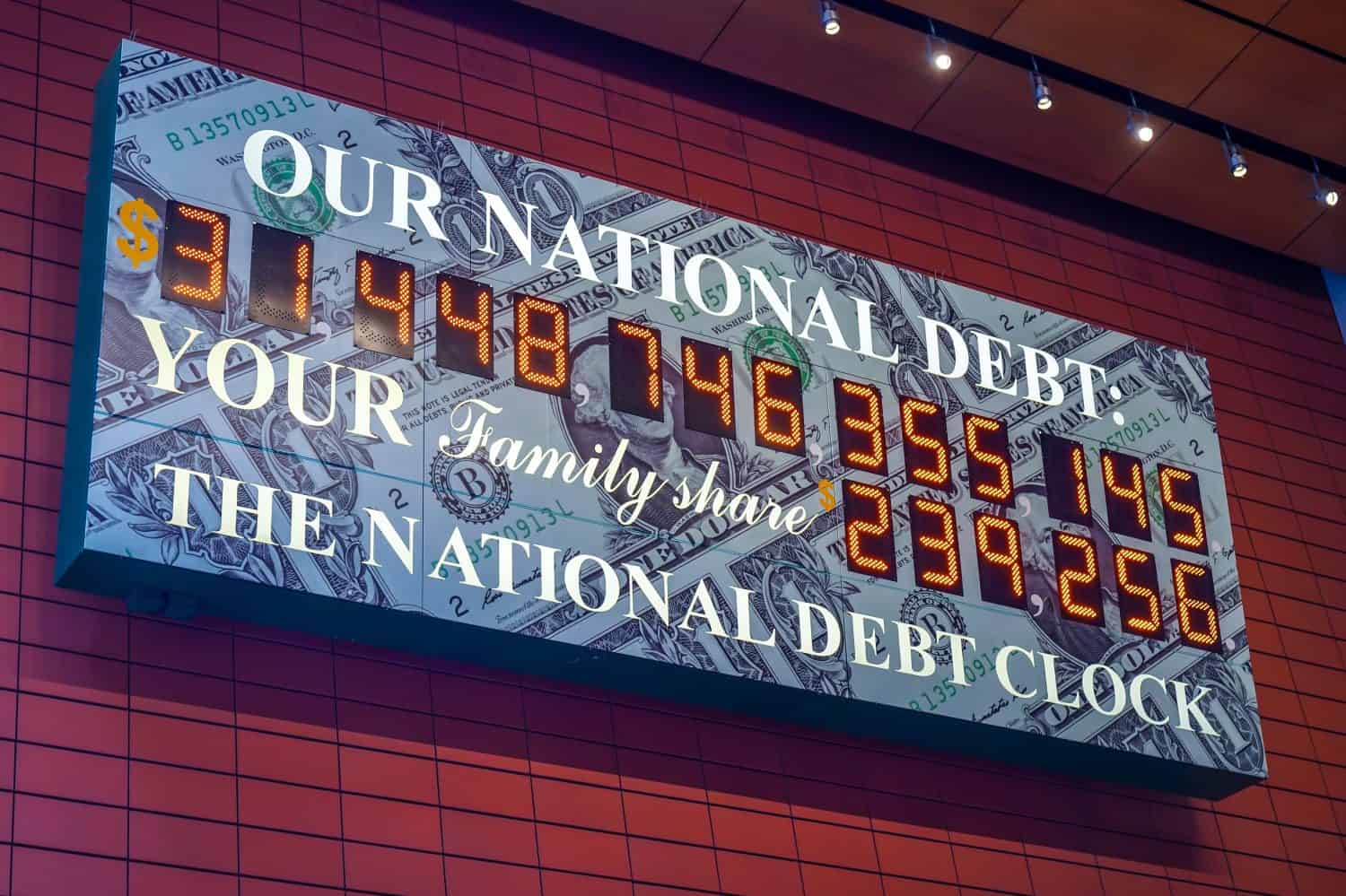

#1 It is Normal to have Government Debt

The fact that the government has debt isn’t unusual. Governments have been operating through loans and debt ever since humankind invented governments. As long as the government is able to pay off its debts, then it can continue to operate.

Yet, in our modern world of uncertainties, it seems that what was normal and what debt actually does has become increasingly confusing and mysterious.

#2 It is Different From the National Deficit

If the federal government spends more money in a year than it brings in through taxes, it will have a budget deficit that year. Since the government funds its operations through debt, the bigger the deficit is, the faster the overall debt for the government will grow. If the government brings in more money than it spends, it will run a budget surplus, and the overall debt will shrink as the government pays off its debts.

#3 Created by Selling Treasury Securities

The government sells Treasury Securities to investors, foreign governments, other government entities like the Federal Reserve, and corporations. Each year as the government passes a new budget, the Treasury will sell more securities to generate the money needed for the budget, and service that debt for as long as it exists, or buy back existing securities to reduce the debt.

#4 Limited by the Debt Ceiling

The federal government is limited in how much it is allowed to borrow. This is a control on how much the government can spend (funded through debt) without some brakes or process. Since Congress is in control of not only setting the budget but allocating those funds, it also controls how much debt the government is allowed to have, known as the debt ceiling.

#5 There are Two Parts of the National Debt

Officially there is “debt held by government accounts” and “debt held by the public”.

The debt held by government accounts is debt held in programs or accounts controlled by the government itself. This includes Social Security. The debt held by the public includes everything else. This includes state and local governments, the Federal Reserve, individuals, foreign governments, and more.

#6 The National Debt is More Than Our GDP

The GDP is the value or output of the entire economy of the United States. In essence, it shows how much money the United States is able to generate in a given year. For normal citizens, lenders will not give a loan to someone who is asking for more money than they can repay. In 2012, the total amount of government debt passed the debt-to-GDP ratio of 100%.

It remained roughly in that range until after the COVID-19 pandemic when it shot to about 132%. This means that if all the creditors for the U.S. debt came asking for their money back, the U.S. government would be forced to default as it would not be able to afford it.

#7 It is Only Going to Get Higher

The political success enjoyed by politicians over the last handful of decades means that there is little incentive for them to reduce the debt or pass a balanced budget. Experts and economists agree that the debt is only going to keep growing if current laws are not changed. They predict it will reach a GDP ratio of 172% before 2054.

#8 It Cost $726 Billion To Service the Debt

In July of 2023, it cost $726 billion to service the debt for one month. This was more than 14% of the entire federal budget. As the debt grows and the creditworthiness of the United States drops, this will only grow higher.

#9 The US has the Largest External Debt in the World

Companies, people, and governments outside the United States own more than $7.7 trillion of U.S. debt, out of a total of $33.1 trillion as of 2023.

#10 The Debt Is No Longer A Priority

Historically, the U.S. debt grew during wartime and shrank during peacetime. Additionally, presidents felt real pressure to pass a balanced budget and pay down the government’s debts.

Yet, despite what politicians might yell in Congress, they have consistently passed unbalanced budgets and increased spending without need and with little regard for the budget. Especially in our age of perpetual war, elected officials are hoping that later generations will be the ones to deal with it.

#11 It Reached $36 billion in March 2025

The pace of the growth of our national debt has sped up in recent years and grew by more than $1 trillion in just 100 days twice in 2024. As of March 2025, it has grown to $36.56 trillion. Most of this growth is due to the relief from COVID-19 and the recession that began under Donald Trump.

#12 The Debt Was Only Paid off Once

Andrew Jackson was the only president to even pay off all of the debts of the United States, for the years 1835–1836. This was part of his larger war against private banks and the control they had over the country.

#13 Before This Decade, Debt Reached its Highest GDP Ratio in WWII

Because the value of money changes over time, it is more useful to measure the debt as a percentage of GDP, which shows the balance between the debt and the money used to pay for it.

President Harry Truman needed significant amounts of money in order to effectively prepare the country and to engage in World War II. The presidents after the war had to deal with reducing the debt.

#14 Only Carter and Clinton Have Reduced the GDP Ratio Since WWII

The presidents after WWII were effective in creating a strong economy that was able to pay off the government’s debts, with significant progress made under Kennedy and Johnson. However, it began to grow steadily under President Nixon and has kept growing ever since except under President Carter and Bill Clinton.

Clinton is the only modern president to have achieved a government budget surplus.

#15 Republicans Cause the Largest Increases

Both Ronald Reagan and George W. Bush caused massive increases in government debt because of their bigger military budgets and tax cuts for corporations and the wealthy. Even though Reagan cut government benefits and welfare, his increases in military spending and tax cuts meant that the debt grew even faster. It also contributed to multiple recessions.

Bush passed some of the biggest tax breaks for the wealthy and deregulation that caused the 2008 financial crisis. Typically, Republican presidents have caused the biggest growth of government debt.

#16 Corporate and Wealthy Tax Cuts are the Biggest Debt Driver

Economists agree that because the government can only cut spending by so much, the biggest driver of the growth of government debt is actually the falling of tax rates for the rich and the elimination of corporate taxes.

These two areas of taxation generate, by far, the most revenue for the government, and a marginal tax rate of 91% on the rich allowed the United States to fund two world wars.

#17 The Debt Doesn’t Include Debt to Other Departments

This is just a fact about accounting, but only the debt is reported as a liability on the official financial statements produced by the government. When the government lends money to parts of itself, that money is reported as an asset on the balance sheets of those entities. This cancels out the liability on the balance sheet for the U.S. Treasury. So they cancel each other out.

#18 The National Debt Doesn’t Include Fannie Mae or Freddie Mac

Fannie Mae and Freddie Mac began as government-sponsored private companies that were traded on the stock market. However after the 2008 financial crisis, the government took over both entities in order to escape the crisis and prevent future similar events.

However, the massive amounts of debt and loans on the balance sheets of both entities mean that the government is reluctant to add so much extra debt to its own. This takeover was meant to be temporary, so this wasn’t an issue. However, as it seems the takeover might be permanent, this separation of debt can lead to problems.

#19 The Largest Foreign Holders are Japan, China, and the UK

In 2020, Japan held the most U.S. debt at $1.2 trillion (about 17.7% of the total foreign debt, China held $1.1 trillion, and the United Kingdom held $0.4 trillion. The rest is spread out across the entire planet.

#20 Foreign Governments Are Slowly Offloading US Debt

The share of the debt held by foreign governments has grown almost consistently ever since its creation. As the U.S. government was growing in value and was responsible for paying its debts, U.S. debt became a valuable asset to own.

However, since 2015, as presidents and elected officials have shown increasing disregard for the debt or government finances, foreign governments have begun offloading their debt. This includes the total money amount and as a share of debt overall. China began reducing its debt in 2011. Japan began offloading in 2012.

#21 The US Earns More From Assets Abroad

Currently, the United States actually makes more money from the assets it owns in other countries than it pays to service the debt owned by those countries. So, there is an uneasy stability between the U.S. and its creditors.

#22 Current Interest Rates Save Taxpayers Money

Ever since 2010, the U.S. government has actually operated with “negative real interest rates”. This means that the interest rates on the debt it issues are lower than inflation. Because inflation outpaces the growing interest, it actually saves the government money than paying down the debt.

This is only possible if there is “no alternative with sufficiently low risk” to secure debt. For now, it seems there is no alternative.

#23 We are On a Fiscally Unsustainable Path

The Government Accountability Office announced in 2009 that the U.S. was on a “fiscally unsustainable path” based on the then-projected increases in government spending and cuts to taxes. The tax cuts passed by Trump in 2017 led to the same jump in government debt as similar cuts made by Reagan and Bush. Without changes, the debt can strangle the government.

#24 We Don’t Know Where the Limit Is

Ben Bernanke, the chairman of the Federal Reserve during the 2008 financial crisis said that there is no known theory, no reliable data, nor experience that can tell us where the upper limit on government debt is. Nobody actually knows at what level the debt will begin to endanger the economy and the stability of the government. We could have already passed it and we wouldn’t know until it is too late.

The post 24 Surprising Facts About the National Debt appeared first on 24/7 Wall St..