Crowdstrike (CRWD) Price Prediction and Forecast 2025-2030 (March 2025)

Due to platform consolidation and cloud security, 24/7 Wall St. projects huge upside for CrowdStrike stock through the end of the decade. The post Crowdstrike (CRWD) Price Prediction and Forecast 2025-2030 (March 2025) appeared first on 24/7 Wall St..

CrowdStrike Holdings Inc.’s (NASDAQ: CRWD) 2025 Global Threat Report highlights the escalating cyber threats, particularly the rise in state-sponsored cyberattacks and weaponization of artificial intelligence. The company also recently posted a fourth-quarter and fiscal 2025 report that demonstrated strong revenue growth and cash flow.

The stock pulled back more than 20% following the earnings report but has mostly recovered. Since its initial public offering in June of 2019, the share price is over 445% higher. It hit an all-time high of $455.59 earlier this year.

24/7 Wall St. Key Points:

-

CrowdStrike Holdings Inc. (NASDAQ: CRWD) has become a leader in the global cybersecurity sector, thanks to high-profile hacking and cyber-espionage investigations.

-

Due to platform consolidation and cloud security, 24/7 Wall St. projects huge upside for the stock through the end of the decade.

-

If you’re looking for some stocks with huge potential, make sure to grab a free copy of our “The Next NVIDIA” report. It features a software stock we’re confident has 10X potential.

Investors are concerned with future stock performance over the next 1, 5, to 10 years. While most Wall Street analysts will calculate 12-month forward projections, it is clear that nobody has a consistent crystal ball, and plenty of unforeseen circumstances can render even near-term projections irrelevant. 24/7 Wall St. aims to present some further-looking insights based on CrowdStrike’s own numbers, along with business and market development information that may be of help with your own research.

A Global Cybersecurity Leader

With the advent of the digital age, tech-minded thieves, scammers, and hackers found a panoply of new prospective victims. As digital tools became routine within the government and industrial sectors, the inherent security vulnerabilities from skilled antagonists armed simply with a computer created the birth of the cybersecurity industry.

Founded in 2011, the Austin-based CrowdStrike has become a leader in the global cybersecurity industry, thanks to high-profile hacking and cyber-espionage investigations on both the corporate and government levels. Providing endpoint security, threat intelligence, and cyberattack response services. The company’s valuation has exploded, from $1 billion in 2017 to a 2025 market cap of $89.2 billion.

While CrowdStrike has strong ties to the U.S. government and multibillion-dollar conglomerates, its public reputation has been built on its identification of government-level military and espionage hacker groups.

To date, CrowdStrike’s biggest setback has been from July 2024. The company released an update to its Falcon detection and response software agent. Unfortunately, code flaws caused millions of Microsoft Windows OS-powered computers to crash all around the world. The downtime caused a widespread global impact, grounding commercial airline flights, temporarily taking Sky News and other broadcasters offline, and disrupting banking and healthcare services as well as 911 emergency call centers. Subsequent problems arose requiring multiple boots or other cumbersome, software key command fixes.

As a result, CrowdStrike stock dropped from a high of $398.00 per share to a low of $208.10 in only four trading sessions. The stock afterward clawed back from that loss.

CrowdStrike’s Performance Thus Far

CrowdStrike’s identification of highly publicized cybersecurity breach perpetrators is the bedrock of its reputation. The following events were all significant milestones:

- Sony Pictures’s data systems were hacked in 2014, compromising confidential business, employee, and communications data. CrowdStrike tracked down the hack to the North Korean government.

- That same year, CrowdStrike identified Chinese PLA military hackers and a 5-member team called Putter Panda (officially PLA Unit 61486) as responsible for a number of cyber espionage hacks that were executed to steal both military and trade secrets from the US government and several prominent billion-dollar corporations.

- CrowdStrike identified a Russian hacker group called Energetic Bear, which is affiliated with the Russian Federal Security Service, that had conducted hacks of US energy and utility companies and resources.

- In 2015, CrowdStrike identified and isolated VENOM, a flaw that opened a potential security breach for users of QEMU, Xen, KVM, and VirtualBox, and posted alert warnings for the cyber community.

- In 2016, CrowdStrike investigated the Democratic National Committee cyberattacks in coordination with the FBI.

- CrowdStrike also identified Russian cyber espionage group Fancy Bear as responsible for hacks into Ukrainian military apps as part of its assistance to Russia’s military conflict with Ukraine.

From 2020 on, CrowdStrike enacted a number of acquisitions that both grew the company’s valuation, as well as expanded its capabilities. These include:

- Preempt Security (zero trust and conditional access) in 2020

- Humio (log management) in 2021

- SecureCircle (zero trust extension for data) also in 2021

- Bionic.ai (cybersecurity) in 2023

- Flow Security (data security posture management) in 2024

- Adaptive Shield (SaaS security posture management) also in 2024

CrowdStrike went public in 2019. It finally became profitable in 2024, after years of losses as it built its cybersecurity business.

| Fiscal Year (Jan 31) | Price | Revenues | Net Income |

| 2015 | n/a | n/a | n/a |

| 2016 | n/a | n/a | n/a |

| 2017 | n/a | $52.70 M | ($91.30 M) |

| 2018 | n/a | $118.80 M | ($135.50 M) |

| 2019 | IPO: $334.00 | $249.80 M | ($140.01 M) |

| 2020 | $61.09 | $481.40 M | ($141.80 M) |

| 2021 | $215.80 | $874.40 M | ($92.60 M) |

| 2022 | $198.33 | $1.451 B | ($234.80 M) |

| 2023 | $105.90 | $2.241 B | ($183.20 M) |

| 2024 | $349.31 | $3.060 B | $53.70 M |

Key Drivers for Crowdstrike Stock in the Future

CrowdStrike’s future is driven by its ability to provide a comprehensive, cloud-native security platform that leverages advanced threat intelligence and AI to protect organizations from evolving cyber threats.

Platform Consolidation:

Driven by customer demand to simplify their security stacks, reduce costs, and improve overall security posture, CrowdStrike is pushing for cybersecurity platform consolidation by offering a broad suite of security services through its Falcon platform, reducing the need for organizations to manage numerous point solutions.

Crowdstrike announced three cybersecurity partnerships to further enhance the efficacy of its Falcon platform:

- The Cardinal Ops partnership will allow customers to seamlessly operationalize CrowdStrike threat intelligence into actionable detection content for any security information and event management, ensuring precise threat detection across diverse environments, and improving security efficacy and speed.

- Partnering with Nagomi will enable customers to proactively assess the impact of threat actor campaigns against their controls and security architecture. Nagomi transforms CrowdStrike threat intelligence into customized, actionable recommendations to optimize the security stack against real-world threats.

- A partnership with Veriti will give customers the ability to proactively monitor, prioritize and mobilize remediation efforts without business downtime. Veriti can automatically enrich and enforce CrowdStrike’s threat intelligence across all security controls, providing comprehensive protection.

Cloud Security Expansion:

CrowdStrike is heavily invested in expanding its cloud security capabilities, including securing cloud workloads, applications, and infrastructure. With cloud environments becoming more complex, the need for comprehensive cloud security solutions should continue to grow, providing a significant growth opportunity for the company.

Threat Intelligence and AI:

The growing sophistication of cyber threats demands advanced technologies like AI to proactively identify and mitigate risks. CrowdStrike leverages its vast threat intelligence data and artificial intelligence to enhance its detection and response capabilities. Furthermore, the need to protect against AI-driven threats is a significant driver as well.

Charlotte AI is CrowdStrike’s AI platform, which is expected to accelerate threat hunting and triaging up to 52% faster. Charlotte AI, launched in May 2023, automates and simplifies complex workflows through the use of natural language commands.

Stock Price Prediction for 2025

The consensus recommendation from 50 Wall Street analysts is to buy shares, 12 of them with Strong Buy ratings. Their average price target in 12 months is $409.01, which is 13.1% from a current price.

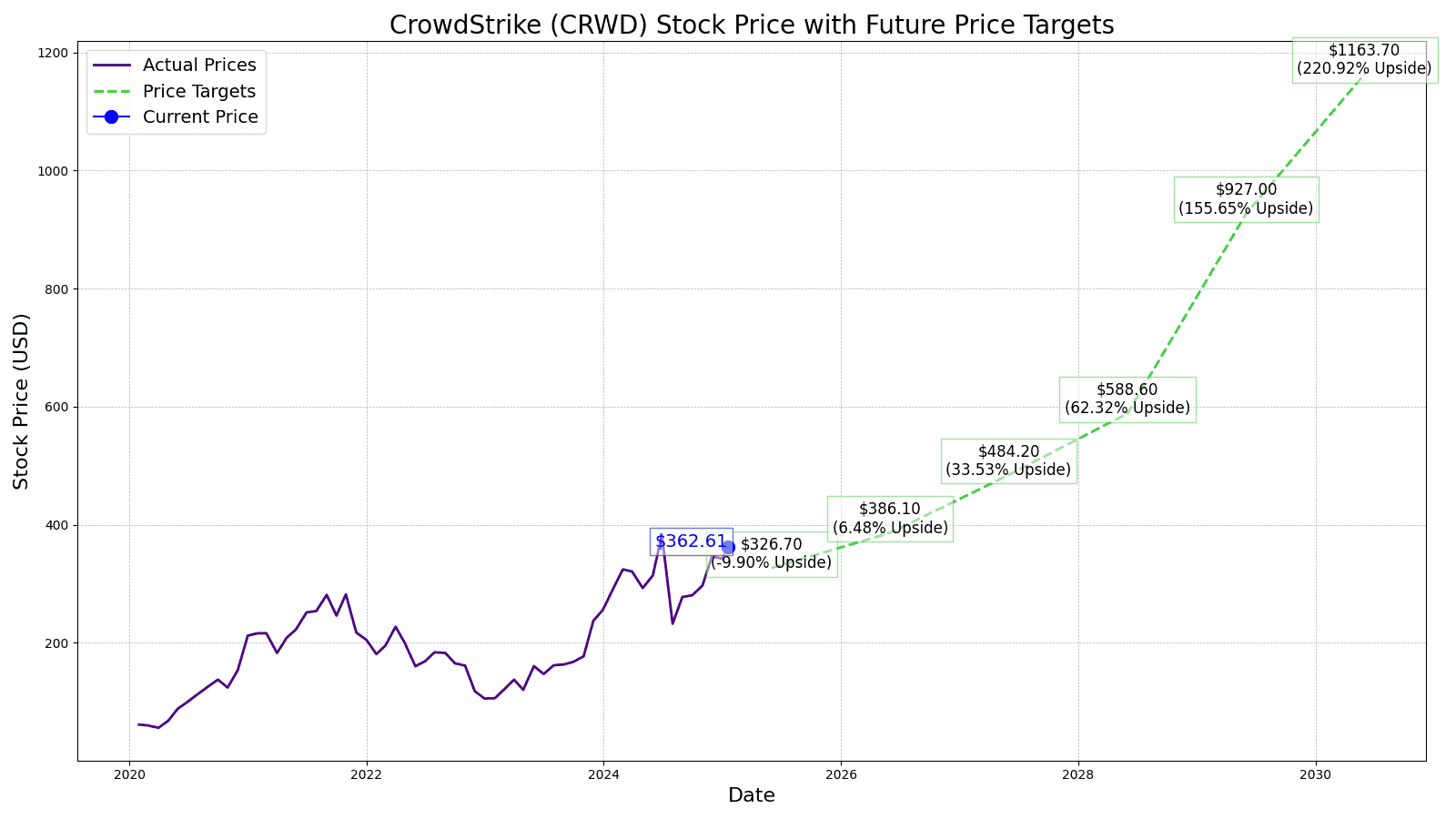

24/7 Wall St.’s 12-month projection for CrowdStrike’s price is just $326.70, which would be a loss of 9.7% from today’s price. Given that CrowdStrike only went into the black last year and after a near 40% drop in July, the measured regaining of lost ground is certainly not unexpected. The P/E ratio at the time of this writing is 102, but as profitability is so recent, we are using a P/E of 90 for our projections.

CrowdStrike’s Outlook for the Next Five Years

CrowdStrike Horizon cloud security solutions for Microsoft’s Azure will likely be customized and then adopted by Amazon and Google for their platforms. All three already use CrowdStrike Falcon for their conventional web business. We anticipate CrowdStrike’s 2026 price to hit $386.10.

As cyberattacks continue to proliferate and cyber blackmail schemes using viruses escalate, we think that Falcon improvements and enhancements from Cardinal Ops, Nagomi, and Veriti will drive more subscriptions for premium service packages. We project 2027 to see CrowdStrike’s price go to $484.20.

CrowdStrike’s debt-to-equity ratio was 0.79 as of 2024. Additional cash from operations used to redeem bonds and improve the company’s debt-to-earnings ratio to over 1.0 will broaden its appeal for conservative buy-and-hold institutional investor types, which will boost the stock in 2028 to a projected price of $588.60.

Identity Theft continues to attain greater sophistication, being able to now use some digital copies of biometric security protocols to breach security protection measures. Enhanced 2.0 version of Zero Trust protocols from the SecureCircle and Preempt Security acquisitions should address those issues to better protect systems. The 2029 Crowdstrike price is projected to be $927.00, a big jump that will be led by further Falcon subscription boosts.

Charlotte AI-driven security measures that learn about new threats and immediately update all of the details and successive defensive protocols deployed across the Falcon platform should greatly advance Crowdstrike’s cybersecurity capabilities. The machine learning aspects of Charlotte AI will allow for better anticipation of future threats. This will contribute to a huge jump in 2030 earnings and a commensurate projected price of $1,163.70.

| Year | EPS | P/E multiple | Price | Change |

| 2025 | $3.63 | 90 | $326.70 | −9.7% |

| 2026 | $4.29 | 90 | $386.10 | 6.8% |

| 2027 | $5.38 | 90 | $484.20 | 33.9% |

| 2028 | $6.54 | 90 | $588.60 | 62.7% |

| 2029 | $10.30 | 90 | $927.00 | 156.3% |

| 2030 | $12.93 | 90 | $1,163.70 | 221.7% |

The post Crowdstrike (CRWD) Price Prediction and Forecast 2025-2030 (March 2025) appeared first on 24/7 Wall St..